The use of technical analysis is very important in Forex trading. And indicators are one of its main components. Each trader wants to have in their arsenal a high-precision tool with minimal data delay.

Indicators without redrawing are very popular and attract the attention of many traders. However, many newcomers do not know anything about this tool and do not have enough information about the real benefits that could be received from the usage of these indicators.

The practical advantage of indicators without redrawing

Unfortunately, some Forex indicators with redrawing can lead to the deposit draining. A change of signals for entering a transaction during trading is the reason for this, sometimes it can even be quite abrupt.

After a signal, indicating a convenient moment for buying or selling an asset, has arrived from the tool with redrawing, the trader opens a position in this direction. Literally after a minimum period of time, the indicator changes the previous signal to the opposite. Since the order is already open, the trader suffers losses. Alas, after such an incident, it is unrealistic to call a broker and report what happened. It will look ridiculous.

The reason for this “inconsistency” is that these tools give signals with delay, using averaged values ​​in the calculations. And the market is rapidly changing its environment due to increasing volumes. Therefore, signals on opening a trading position in the previous direction are no longer relevant.

To avoid such situations, you need to use accurate indicators without redrawing. They give more correct signals. There are no errors in the operation of such indicators. They are considered more effective, and therefore - the most profitable. The undoubted advantages of these tools are the correct verification and full analysis of price indications on the historical data of any asset. Do not be afraid that they may change. This is the fact that will significantly help the trader make the right decision.

Kwan NRP Indicator

An example of a good indicator without redrawing is the Kwan NRP tool. This algorithm is a more advanced modification of the old Kwan. As a result of optimization, the new instrument generates more accurate signals to enter the market. The previous flaw (redrawing) is now fixed.

Kwan NRP clearly defines the extremes of price movement. Moreover, it changes the color of the indicator line depending on the direction of price movement. The indicator has much in common with classical oscillators, but the movements formed by it remain unchanged during price fluctuations. When Kwan NRP gives a signal to buy, for example, this signal does not change on the chart of the traded asset.

The operation of the tool is quite simple to understand. Located at the very bottom and starting to move up, the indicator line turns blue. This is a buy signal. Accordingly, moving from the very top down, the line turns red, signaling the trader to sell.

The lack of lag in signal generation makes Kwan NRP a very profitable tool. Some traders use it as an additional filter in their trading strategy. The indicator is able to identify certain features and patterns in price dynamics that are not visible to the eye. Given this circumstance, the trader can adjust the trading strategy already used by him and increase his earnings, minimizing possible losses.

ZigZag Larsen Algorithm

The tool refers to direction indicators without redrawing. This is a modified version of ZigZag Larsen with eliminated lag and redraw. It quickly determines the trend reversal. Traders using this tool have every chance to enter the market in a timely manner without missing a favorable moment.

The indicator has proven itself on the Renko charts. It works on any timeframes, but the best results were seen at large time intervals. Some experienced traders recommend to ensure with an additional confirmation signal during a reversal of the trend. Stochastic or RSI is ideal for this.

The price reversal on the chart of the asset ZigZag Larsen marks with arrows of different directions and colors. The tool has one feature - on the zero bar the signal may not be displayed, but it will already be clearly visible on the next candle. Zig Zag Larsen contains a built-in sound and text alert. If desired, a message about entering the transaction can be sent to the trader’s email.

PZ_SwingTrading indicator

One of the popular indicators without redrawing for MT4 is the PZ_SwingTrading algorithm. It was created for swing trading. It’s based on price fluctuations with a periodicity of one week. Using several price vectors, the tool reveals the moments of overbought and oversold in a certain direction of the trend, and the possibility of a correctional impulse.

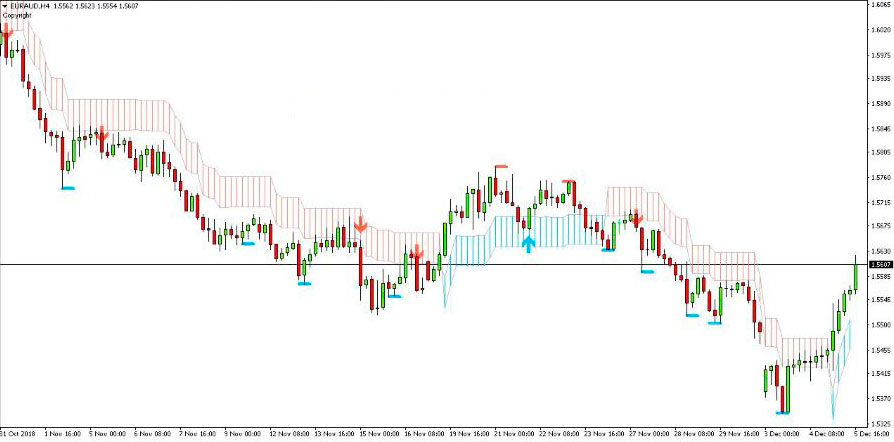

On the graph you can observe the full potential of the instrument:

- Colored stripes - tool features;

- Arrows of different colors show the pivot points of the trend, the direction of the swing;

- Dotted lines show probable swings in the opposite direction;

- The timeframe can be changed if desired;

- Alert system implemented;

- Redrawing is excluded.

Experts advise to keep positions open for no more than 4 days. This is an approximate swing time. Such is the cyclical trend movement.

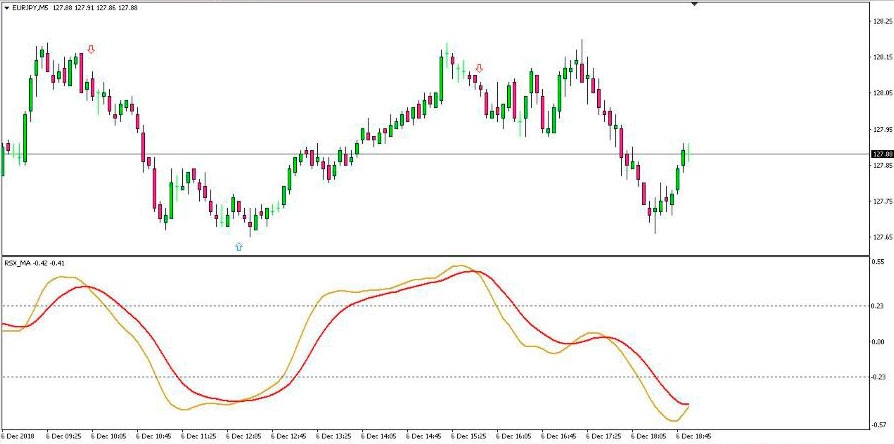

RSX MA – arrows indicator

This is a well-known and effective indicator for MT4 trading platform without redrawing. The signals from the RSX MA-arrows are pretty high quality. They contribute to a good profit on short time frames.

Signals are based on the intersection of the RSI indicator and the moving average. The trader should only consider intersections beyond the established boundaries of the levels displayed on the screen. There are not many signals to enter the transaction, but they are correct. The tool does not redraw them.

By default, its settings are most effective for EURJPY pair, timeframe - 5 minutes. For other currency pairs, RSX MA-arrows settings should be selected empirically.

Trend Master Indicator

Trend Master is a representative of arrow indicators without redrawing. The tool can perfectly fit into the framework of many trading systems. Its competent use will allow the trader to make good profits.

Trend Master is suitable for all assets at all time intervals. However, the algorithm can best be applied on time frames from 5 to 15 minutes. When switching to higher timeframes, you should set up large stops, and this is already an increased risk. Trading should be in the direction of the global trend, since during a flat Trend Master will constantly change readings, misleading the trader.

The tool is a line that changes color depending on price growth or decline. Green arrows that appear on the chart indicate a purchase, and red arrows indicate a sale. After choosing a specific asset for trading, it is advisable to test the instrument on a demo account, and only then switch to trading with real funds.

Trend Focus Tool

The next algorithm, which is an indicator without redrawing, can be called Trend Focus. It, like its predecessor, is based on simple moving averages. The instrument looks like a line following the trend. Depending on the price increase or fall, the line changes color. Blue is an upward trend, pink is a downward trend.

Signals without redrawing in the form of blue arrows indicate purchases, red ones indicate sales. In the settings, the most important element is Period1. It is recommended to set the value to 20. If this parameter is increased, say, to 50, then the signals will be delayed. Too small a value will contribute to the appearance of false signals.

Trend Focus can also be used as support and resistance lines. This circumstance will make it possible to set the price range for trading. The indicator perfectly senses market changes. But it should not be taken as a Grail that can solve all financial problems. The market is constantly changing, and relying entirely on tool readings would be unreasonable. However, it is perfect as an additional filter for an existing trading strategy.

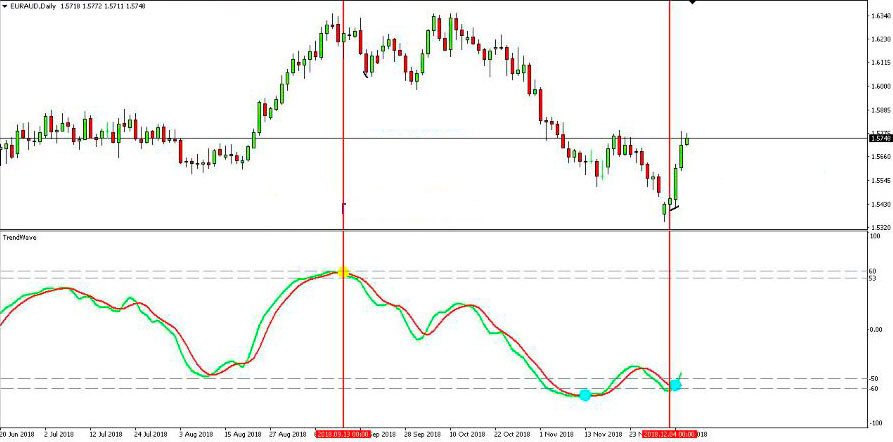

Trend Wave Algorithm

This is another indicator of levels without redrawing which is popular with traders. The algorithm works great on the basis of overbought and oversold zones. As a basement tool, it shows trend reversal points on a chart. Trend Wave is free to download and installs easily in MetaTrader4.

Trading with the tool is not difficult, as it is intuitive even for a beginner. When the indicator forms a blue dot, this is a buy entry. At this time, the indicator line leaves the oversold zone. The appearance of a yellow dot means that the time has come for a sale. This is the time the line exits the overbought zone.

Traders who have already tested the algorithm in their trading, argue that it works well both in an upward or downward trend and in a flat. However, in order to avoid a large number of false signals, it is better not to use Trend Wave in a flat.