Filling up the car at the pump is more expensive than any other time in history, which is affecting the quality of life for hundreds of millions of people, but retail investors have a strategy to offset the cost of rising crude oil prices and fuel prices. Let’s take a quick look at oil technicals and then consider one very good reason for trading oil in 2022 and beyond.

Technical analysis of oil

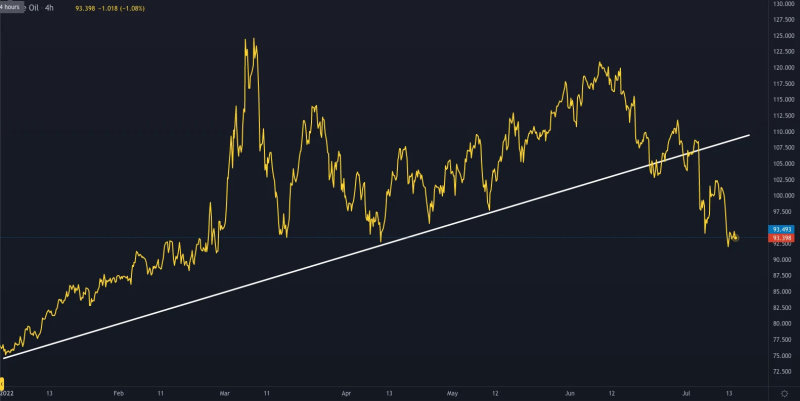

Technical analysis shows that US Oil broke the uptrend at the price of $106.25, retested, then declined again to below $100.

Crude oil 2022 price history with trend break line

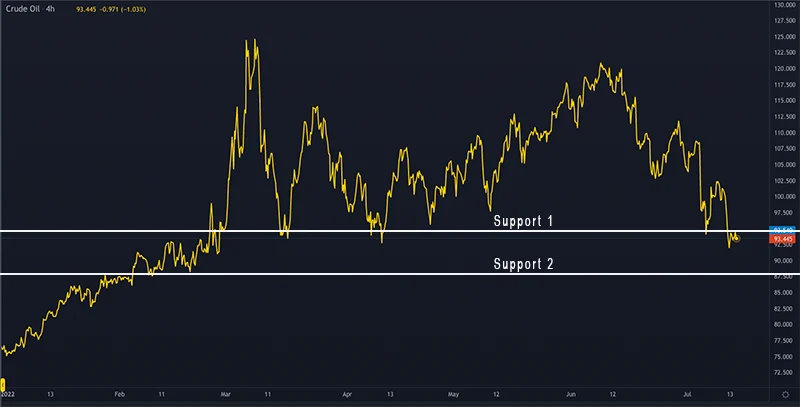

Now moving around $94.50 - $102 price range, US Oil is bouncing between the Fibonacci retracement range of 50% - 38.2%, and facing strong resistance by the 38.2% mark. If this recent fall continues, we could see oil prices going as low as support 2.

Crude oil 2022 price history with Fibonacci retracement

So oil might be overbought and over priced, making it seem like a shorting opportunity, but the long term trend suggests otherwise. Trading oil might be a risky proposition right now considering current price action.

The fundamentals of oil trading

Outside of the usual hedge fund pumps and dumps, corporate profit is the biggest influence on the price of oil today. The supply and demand dynamic remains volatile with no signs of easing or stability on the horizon. Adding to that uncertainty, global oil producers have significantly slowed production over the last 12 months causing a false scarcity. The order to reduce oil extraction came from the top of the big oil companies themselves. More than one oil refinery has scaled down pumping volumes without good cause, much to the frustration of the United States, major countries and drivers everywhere.

Last week, US President, Joe Biden, demanded that big oil companies explain why they are not increasing production volumes to stabilize the market, despite everyone knowing the answer is nothing more than inflated short-term profit. But it’s not just the American people feeling the pinch at the pumps.

The whole world has seen fuel prices double, which is adding to rising unemployment and a decline in global retail sales. While oil companies celebrate huge profits, the world struggles to avoid another recession. There’s doom and gloom all over the financial world, but perhaps retail traders have a way to soften the blow of inflation.

Trading oil futures contracts to offset fuel costs

It’s called fuel hedging and it’s commonly used by large fuel consuming industries such as airlines, shipping, and haulage companies. They’ve been doing it for years, but the same price mechanics can be used by individuals, not just companies. If you open a buy position on oil and the price rises, fuel prices will likely rise too. You’ll lose at the pumps, but profit on your trading platform. Likewise, if oil and petrol prices fall, your trades will yield negative results, but you’ll win at the pumps - saving money the next time you fill up.

5-year comparison of crude oil and fuel prices

To start hedging fuel prices, first calculate your average weekly fuel usage. If fuel prices rise by $0.10, how much additional cost does that generate for you? Now go to your trading platform and calculate how much US Oil you’d need to buy to generate profit that would offset a fuel price increase.

Take into account a brief price delay, since gas stations set their fuel prices based on what they paid for the tankers, not the current markets. You might prefer to open and close orders on a regular basis, but if you do occasionally keep orders open overnight, Exness won’t charge swap fees.

Is this a foolproof strategy? No… definitely not. The markets are always unpredictable, although, if you’ve done your calculations right, only a divergence between oil and pump prices may spell trouble for you, and that hasn’t happened in the last 30 years.

The bottom line

Keeping in mind that past performance offers no guarantee of future results, technicals don’t indicate a buying or selling opportunity right now. As always, the markets follow predictable routines… until they don’t. No matter which assets you trade, there’s going to be a surprise eventually, so trade responsibly and manage your funds with caution. Hedging fuel prices might work for now, but if everyone does it, we might see the first price divergence of oil prices and fuel prices in history.

Remember to set your Stop Loss close to the active price range, especially if you’re taking advantage of Exness’ high leverage.