Bitcoin rose 2.4% to $30.5K in the past 24 hours. Ethereum added 0.2% to $1820. Ether was unexpectedly among the laggards. Altcoins from the top 10 rose from 1.5% (BNB) to 4.1% (Solana). Total crypto market capitalisation, according to CoinMarketCap, rose 1.8% overnight to $1.26 trillion. Bitcoin’s dominance index added 0.2% to 46.3%. The cryptocurrency fear and greed index was down 3 points to 10 by Friday and remains in “extreme fear”.

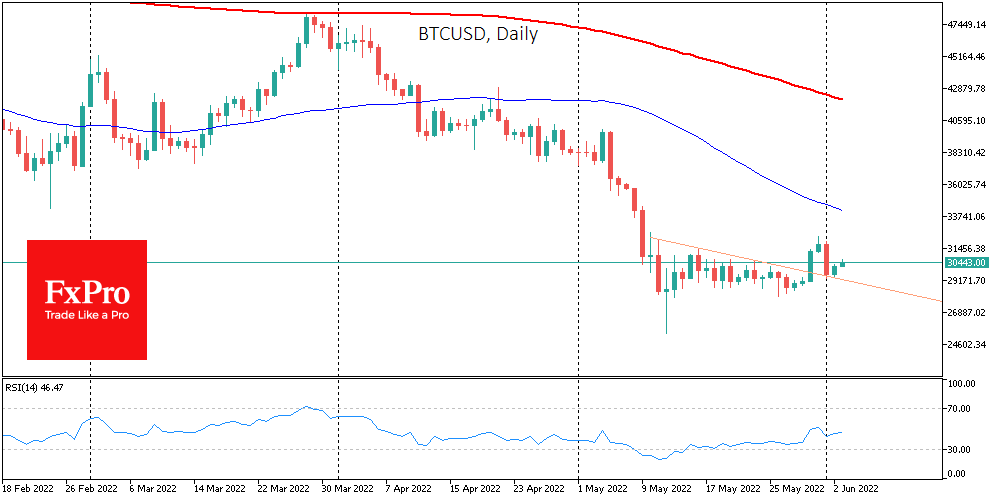

Bitcoin rebounded on Thursday after falling sharply the day before. The strengthening was helped by a weaker dollar and positive stock indexes. The local downtrend (former consolidation triangle from May 10) turned into a support line. For the short term, this is good news. However, it is worth remembering that this is a fragile structure that could be broken by both a stronger dollar and a market reaction to labour market news.

Bitcoin has already reached the “bottom” in the current cycle of decline and will not fall below $25,000, said former BitMEX cryptocurrency exchange CEO, Arthur Hayes. However, a market trend reversal should be expected when the Fed stops raising rates.

According to BTC.TOP CEO Jiang Zhuoer, the bearish phase will end in six months. A possible driver for this could be the Ethereum update, which should occur between October and December. Another bullish factor will be the US Federal Reserve’s refusal to hike rates. According to a Goldman Sachs survey, 6% of global insurance companies have invested or want to invest in cryptocurrencies. According to the Economist Impact survey, a growing number of investors see digital currencies as a useful tool for portfolio diversification.