Big news from the world of crypto. A successful upgrade of major scale has been carried out on the Ethereum network, which could prove to be a pivotal point for the entire industry. Anyone who’s even remotely familiar with the crypto industry agrees that the Ethereum Merge is the event of paramount importance that is going to have a lasting impact on this niche of the global financial market. But while many recognize its importance, not many people can explain it to others in understandable terms, the task that we’ll undertake in this article. It will offer you insight into the following topics:

- What is the Ethereum Merge and how is it bound to influence the underlying blockchain network?

- What are the economic implications of this event on the crypto industry and the price of Ether (ETH)?

- What are the main concerns and risks associated with the Merge?

The reasons why the Ethereum Merge took place: the move from Work to Stake

One of the most important events of the past couple of years, which will have serious long-term implications for the cryptocurrency industry, occurred late at night on 15 September. The transition named the Merge represents the first stage in several future network upgrades aimed at resolving issues that have been plaguing the Ethereum blockchain for years, most notably the problems of energy consumption, scalability, and network fees. Prior to the actual Merge, the Ethereum team had carried out three trial runs on public Ethereum test nets: Ropsten, Sepolia, and Goerli.

The core reason behind the Merge lies in the desire of the devs team to switch the consensus mechanism (the protocol responsible for validating transactions within the Ethereum blockchain) from the initial Proof-of-Work (PoW) to the one called Proof-of-Stake (PoS).

PoW is the algorithm that requires high-end hardware (ASIC miners or GPU-based mining farms) to solve complex cryptographic problems to validate and hash transactions, place them in the blocks and add those blocks to the blockchain in exchange for rewards in an underlying cryptocurrency. Bitcoin is the most significant blockchain network that still (after the Merge) utilizes the PoW algo.

PoW vs. PoS consensus mechanisms: why the transition was necessary

The main problem with Proof-of-Work, and the reason for the Merge to have taken place, is the volume of electricity consumed that has been growing exponentially with the expansion of corresponding blockchain networks. A significant portion of this electricity is produced from fossil fuels with high carbon emission that damages the environment. This created a stigma against the PoW-mined cryptos and significantly slowed their adoption and integration in the global economy.

Scalability was another problem that plagued the Ethereum network during its PoW era. Practically since its offset, Ethereum was the building ground for decentralized applications (dApps) and later accommodated an entire sector of decentralized finance (DeFi) and the niche for non-fungible tokens (NFTs), with both being the driving force behind the 2020/2021 bull market. The enormous influx of users who tried to capitalize on the hype around these two crypto phenomena had constantly clogged the network and made transaction fees go up in the skies. The solution was badly needed and the devs had taken the only right path there was - the transition to the Proof-of-Stake model.

The PoS system replaces miners with validators and mining farms with server nodes also called stake pools. As the name suggests, Proof-of-Stake requires network participants to commit funds to the systems (the stake) in order to be given a chance to validate transactions, add blocks, and receive rewards.

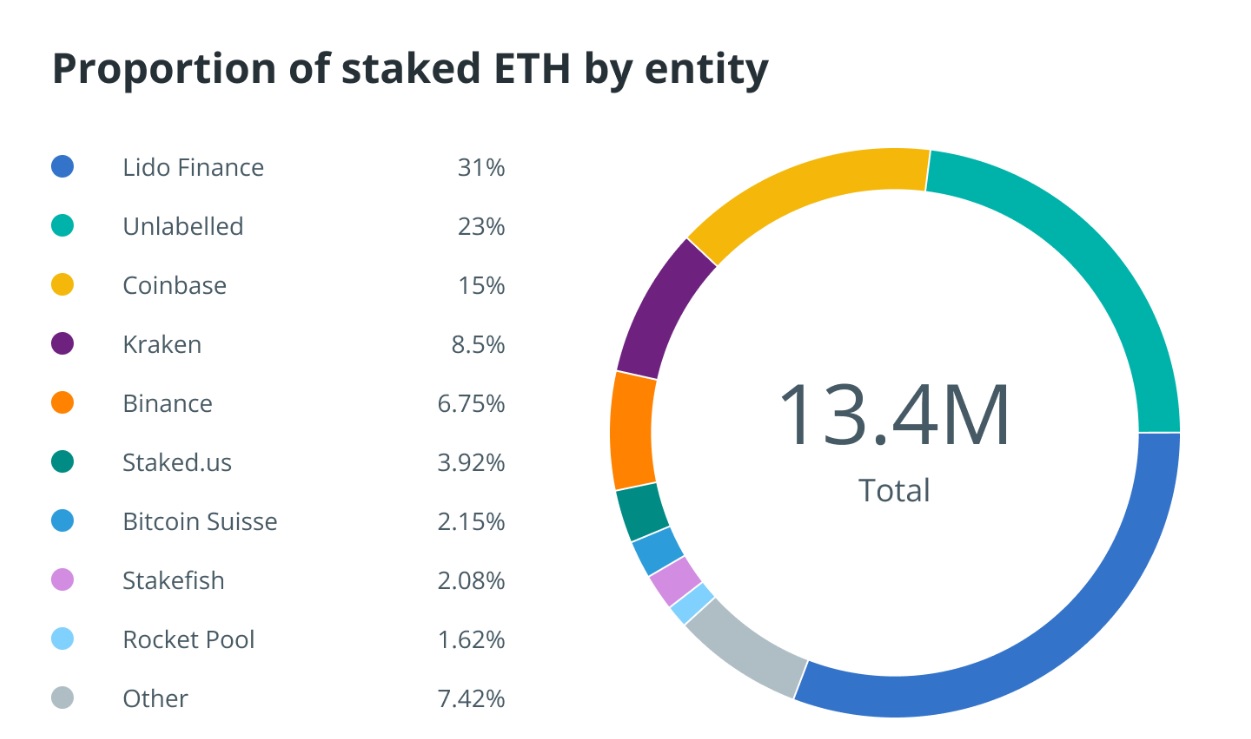

In the case of Ethereum, the initial stake was established at 32 ETH, which is a hefty sum for retail investors but feasible for large companies that now form the core of Ethereum’s stakeholders, an issue upon which we’ll touch later in the article. Right now, there are over 400,000 validators in the network that chooses at random those that validate transactions, though the preference is being given to those with higher stakes. Should the validator attempt a malicious act, he or she may lose it indefinitely. This system requires far less energy to be properly operational - the PoS Ethereum network should consume 99.95% less electricity than before. Plus, it makes scalability much easier to achieve thanks to a substantially lower transaction validation time and the integration of the solution called sharding that separates a transaction into small “shards” consequently increasing the network’s throughput. However, all these improvements won’t be achieved by a means of Merge alone. As already mentioned, the Merge is an important stepping stone towards the full transition to PoW, so still, a lot of work needs to be done by Vitalik Buterin and the devs team.

The concerns associated with the Merge: the conflict with cryptocurrency miners

However, the switch to the new consensus mechanism also entails certain risks both in terms of fundamentals and price action. It’s important to consider those risks before deciding whether to invest in ETH or add to your existing position. The first concern has to do with the arising conflict between the Ethereum team and PoW miners. The miners are obviously threatened by the Merge that deprives them of profits by triggering the Terminal Total Difficulty (TTD) threshold that is rendering the PoW chain unprofitable; consequently, brute forcing the Merge. Those interested in nuances of the Ethereum network may know TTD under another term, the Difficulty Bomb, the mechanism designed to encourage the network participants to switch to PoS by increasing the mining difficulty. The miners were, understandably, unhappy about the developments and even threatened to perform the fork to be able to carry on with PoW mining, which had actually taken place and resulted in the emergence of the hard fork dubbed EthereumPoW.

But the odds seem not to be in miners’ favor as the issuers of the two largest stablecoins: Circle (USDC) and Tether (USDT), declared their support of the Merge and the transition to the PoS chain. Given how dependent the entire sector of decentralized finance (DeFi) is on stablecoins, the stance of Circle and Tether could prove decisive in this dispute, and make the task of forking insurmountable.

Censorship concern stirs the crypto community

Another thing about the Merge that worries the blockchain community has to do with transaction censorship. That takes up back to the beginning of August when the Office of Foreign Assets Control (OFAC), which is the financial intelligence arm of the Treasury Department, had slapped sanctions on the virtual currency mixer called Tornado Cash. The mixer, which is literally a piece of code, was found guilty of facilitating the laundering of over $455 million, including more than $90 million that had been stolen by the notorious group of hackers, collectively known as the Lazarus Group, which allegedly has close ties with the government of North Korea. The regulators have put the smart contract of Tornado Cash on the sanctioned list, which also reflected negatively on the Ethereum network. The threat to Ethereum comes from the fact that many of its existing stakeholders had interacted with Tornado Cash, which made them potential targets for the regulators.

Moreover, all decentralized applications (dApps) that accepted funds from the said cryptocurrency mixer also came under scrutiny for potentially helping cyber criminals and rogue governments to circumvent sanctions. Even the miners that produced the blocks that included transactions that had interacted with Tornado Cash also felt worried about the prospects of becoming collateral damage to Washington’s economic warfare. Blockchain firms and services (Uniswap, Aave, dYdX, Alchemy, and Circle) responded by curbing the support for the addresses that had dealt with Tornado Cash and even blacklisting many if not all such addresses. But the real concern has arisen after the community learned that big mining pools like Ethermine had been directly censoring Tornado Cash router transactions by rejecting them at the protocol level, starting right after the sanctions had been rolled out.

However, the most worrisome thing about the post-Merge state of the Ethereum network is the prospect of validator centralization. A validator is an entity that runs the node (one had to contribute 32 ETH to become a validator in the Beacon Chain) that maintains the network by validating transactions, storing data, and supplementing blocks of data to the blockchain. Right now, the list of largest validators is topped by Binance, Coinbase, Kraken, and Lido Finance. No need to explain that in order to avoid being targeted by regulators, these big companies would be forced to heed their demands, including OFAC sanctions.

In mid-August, Brian Armstrong, the CEO of Coinbase, promised to abide by the law despite being opposed to sanctions against technology (smart contract). Add to that the case of Flashbots, the middleware for Ethereum validators that helps them extract additional income via the MEV-Boost option. Its devs team announced the intention to comply with OFAC sanctions by censoring the default relay.

Technicalities aside, this case alone significantly undermines the integrity of the PoS Ethereum network and makes it far less censorship resistant and much more prone to regulatory scrutiny. This has already produced a lot of heated debates not only within the community but also within Ethereum’s core developers team. One of its members, Marius Van Der Wijden, said that allowing censorship would mean that they would have failed to fulfill the true purpose of Ethereum, and threatened to leave the team.

The proposed solutions include social slashing (taking away staked tokens from bad validators), which is morally and technically questionable, and even a user-activated soft fork (UASF), also with doubtful feasibility and effect. The Ethereum community seems to be in favor of social slashing as the resolution to the problem that may cripple the network, the team, and the entire concept. However, with Coin Center, the leading non-profit crypto advocacy group, and a small group of U.S. politicians preparing to push back against the Treasury and its sanctions against an autonomous code, it becomes clear that this whole story only begins to pick up steam, whereas its resolution - that way or another - will have deep and long-lasting implications for the Ethereum network, the price of ETH, and the cryptocurrency market in general.

The reasons why ETH dropped after the Merge

While many expected the price of ETH to rally after the successful Merge - which indeed was a success - the price had actually dropped by as much as 15% to $1,420 in the first hours after the event. As of the time of writing, the price of ETH keeps going downhill. Many crypto trading experts, including us, reckon that a price drop was almost inevitable since it was a classic “sell the news” scheme. As it often happens with the price action prior to affairs of such magnitude, the success of the Merge had already been “priced in” during the rally that preceded it. As data from Glassnode and major crypto trading platforms suggests, the savvy derivatives traders had been using hedging tactics like buying call options, expecting ETH to sink after the completion of the Merge - and it did just that.

On top of that, there is plenty of evidence that people had been actively borrowing funds on DeFi platforms like Aave in anticipation of the Merge, hoping they would be able to increase their crypto positions in ETH from the PoW network that was expected to decrease in value by dozens of percent. For instance, a group of PoW miners had exercised the hard fork of Ethereum - EthereumPoW - which resulted in the emergence of a new token called ETHW that performed a massive rally from $35 to nearly $61 on the eve of the Merge only to plummet by more than 70% after the event, contributing tremendously to the overall selling pressure.

The present and the future of ETH post Merge

The post-Merge drop of ETH can also be explained by the fact that the Ethereum funding rates had dropped into the negative territory (to -0.6%) and ultimately to the 14-month low even before the Merge took place, which is an indication that bearish sentiment prevails over the market.

This, in turn, points to the possibility of ETH sliding further down, possibly below $1,000. However, this opens a possibility of a short squeeze that would help ETH escape the so-called “$1,500 trap.”

Weekly ETH/USDT chart

Now, let’s take a look at the actual weekly ETH chart to see how things unfold here after the price drop. The drop might even be called a crash, given that ETH has shrunk by 25% in a matter of days. Since Stochastic indicates that the momentum has switched to the bearish side after the oscillator had briefly touched the overbought area, the downward slide of ETH is likely to continue in the consolidation channel between $1,000 and $1,400, formed on the basis of its historic price action.

Also note that ETH had failed to even make an attempt to disrupt the downtrend, which suggests the presence of an insurmountable selling pressure that is likely to persist throughout the fall season and leave ETH consolidating all the way toward the year’s end. But if the said pressure turns out to be too strong, the second cryptocurrency by market capitalization could drop into the triple-figure territory and find ground near $800.

In our opinion, the mid-term scenario for ETH is bearish-to-consolidatory. Given the overall situation on stock and other markets, and the global economy in general, there’s hardly a way for ETH to go past $2,000 in the coming months - there’s simply not enough free capital floating around to support such a move. Yet in the long run, our expectations regarding ETH are quite the opposite.

Latest Update: ETH’s bearish predisposition has worsened after the biggest interest rate hike (which is likely to be made by the time of publication) the United States Federal Reserve has made in the past 40 years. In fact, it was the latest of four interest rate raises during the year - totaling 2.25 percentage points - in an attempt to tame soaring inflation. This move will translate to an increase in credit card rates, a decrease in demand for mortgages, and the growth of annual percentage rates for car and student loans in the United States.

As for the cryptocurrency industry, and ETH, in particular, the community has already come up with a rather ominous description of Fed’s actions - the sledgehammer. Mike McGlone, a senior commodity strategist for Bloomberg Intelligence, described this situation quite comprehensively: “We have to turn over to the macro big picture and what’s been pressuring cryptos this year and that is the Fed sledgehammer.”

In his opinion, which largely coincides with ours, the consequences of the said interest rate hike will force ETH and the rest of the crypto market deeper into bearish territory in 2022 before the trend consolidates and begins reversing. We forecast that ETH will make new all-time highs by 2025 on the backdrop of growing institutional adoptions and the reasons explained in the next paragraph.

The future of ETH: it definitely looks bright

Our overall bullish stance on ETH is explained by the changes in the underlying tokenomics that will no doubt have a positive effect on the price in the long run. It has a lot to do with the so-called “triple halving” which is a huge-scale inflation reduction that will eventually occur on the Ethereum network due to its transition to PoS. Among the factors that will contribute to the inflation drop is the reduction of ETH issuance to 584,000 coins per year which would put the inflation rate at 0.49% instead of the current 4.13%. That will ultimately cut the inflation rate by 90% which roughly equates to the inflation cut of three Bitcoin halvings, hence the name.

As market history has shown, each BTC halving turned out to be price-positive, meaning that it had always led to the commencement of the bull market. ETH won’t necessarily rally three times as strong, but there’s a basic law of economics that states that a sharp reduction of supply coupled with increasing demand always results in price appreciation.

Add to that the impact the burns of base fees - mandatory in the Ethereum network after the London upgrade - will have on the supply, ETH might well become a deflationary cryptocurrency. Given that inflation is likely to plague the global economy for at least three more years, the demand for an anti-inflationary asset will undoubtedly surge, coming from both retail and institutional investors. And as the most basic rule of the economy dictates, high demand combined with increased scarcity results in price growth, an enormous one in the case of ETH.

Bottom line

Whereas the notion of cryptocurrencies being “the future of money” is a bit far-fetched, at least in current circumstances, Ethereum is undoubtedly the future of blockchain or even the entire technology sector if Buterin and Co manage to resolve the aforementioned issues. Given that the Merge has been a success, the demand for ETH will explode over the coming year. And if its price does fall under $1,000 and to $800, this cryptocurrency would be severely underpriced, which means - well, we don’t offer financial advice, but it goes without saying.

Since crypto went mainstream, there have always been talks going around about ETH throwing BTC off the throne. It seemed unlikely before but with its advancements in the department of fundamentals, which is a prerequisite for future demand, the coup in the crypto palace might pan out after all.