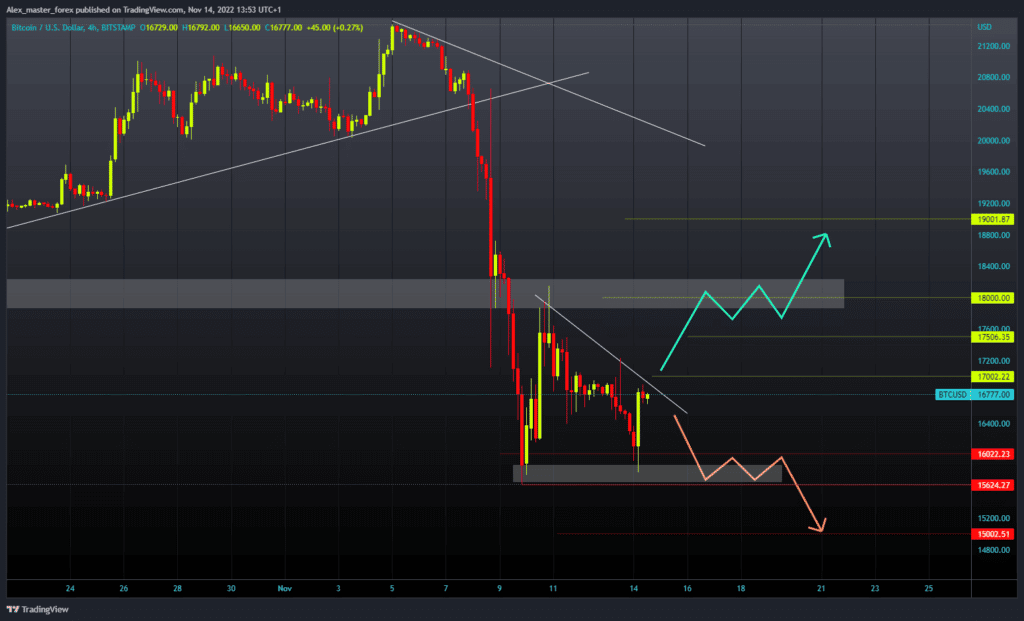

Over the weekend, the price of Bitcoin continued to be in a critical zone. This morning the price of Ethereum has fallen below the $1200 level again. Over the weekend, the price of Bitcoin continued to be in a critical zone. This morning, the price of Bitcoin once again fell below the $16,000 level. Today’s low was at the $15790 level. After that, we saw a strong bullish impulse that pushed the price to the $16900 level, and for now, we managed to stay in that zone.

We need a little more in order to reach the $17,000 level. To continue the bullish option, we need a positive consolidation and a break above the $17000 level.

After that, it is necessary to hold above and with a new bullish impulse to start a further recovery of the price of bitcoin. Potential higher targets are $17500 and $18000 levels. For a bearish option, we need a negative consolidation and a drop to the $16000 support level. After that, we could see a retest of last week’s low at the $15625 level. A breakout below could further bring down the price of Bitcoin. A potential lower target is the $15,000 level.

This morning the price of Ethereum has fallen below the $1200 level again. The price formed a new low at the $1170 level. After this, we see a strong bullish impulse that took the Ethereum price up to the $1250 level. Now we have consolidation at that level. For a bullish option, we need a continuation of positive consolidation and a move toward the $1300 level.

A break above would greatly benefit us for further price recovery. Potential higher targets are $1350 and $1400 levels. For a bearish option, we need a negative consolidation and a new drop below the $1200 level. Thus, we would again reach the critical support zone, which could lead to a continuation of the price drop to even lower levels. Potential lower targets are $1150 and $1100 levels.