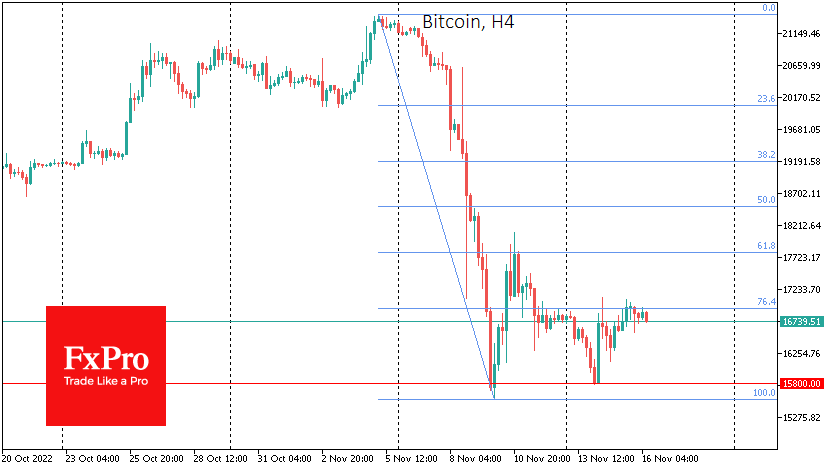

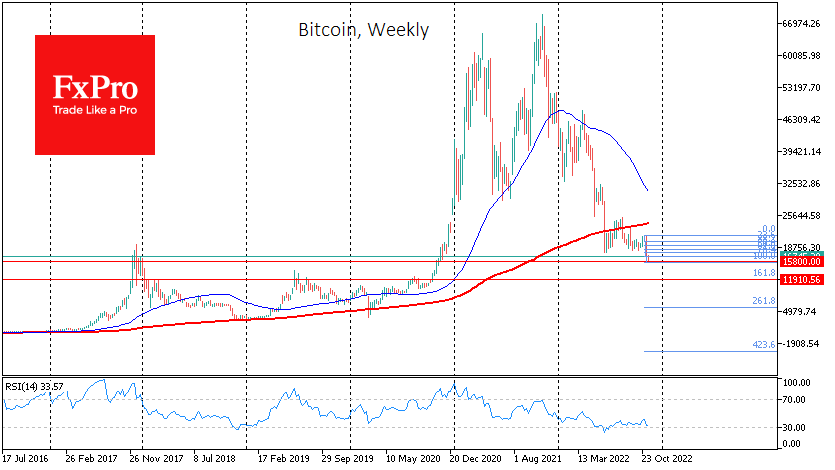

Bitcoin is trading at around $16.8K with no significant changes overnight and in the consolidation area of the last five days. The panic sell-off appears to be over, with key stablecoins regaining their pegs. The market capitalisation stands at $847 billion (+0.2% overnight). Bitcoin is consolidating near the 23.6% retracement of the 5-10 November collapse.

Failure to go higher indicates heavy selling pressure, suggesting a higher chance of losing 1k in value than going up by the same amount. This pattern suggests that if it fails under $15.6K (the low of the drop), the next target for the bears will be the 12K area. This is also where the 2019 cyclical highs and the August 2020 pivot area are located.

News background

The decline in HODLer balances does not indicate a widespread loss of confidence in bitcoin's prospects, Glassnode notes. However, miners have sold off almost 10% of their bitcoin holdings amid the collapse of FTX. Initial estimates by Crypto Fund Research suggest that cryptocurrency funds' losses due to the FTX bankruptcy could be as much as $5 billion, but final estimates could be much higher. The FTX bankruptcy led to a panic among crypto investors and a massive withdrawal of assets from centralised exchanges. Collectively, exchanges have lost more than $5bn in the past week.

Binance CEO Changpeng Zhao and MicroStrategy founder Michael Saylor urged users to keep assets in cold wallets, especially during "market turbulence". Cryptocurrency holders are predominantly doing so, with hardware crypto-wallet providers Trezor and Ledger reporting multiple growths on their products. According to Citigroup, trading volume on decentralised exchanges soared 30% in November.

Changpeng Zhao, head of Binance, proposed an association to bring together major players in the crypto industry to work with policymakers and regulators. He announced six critical requirements for centralised exchanges.

The Bank for International Settlements (BIS) conducted a study on the motives of cryptocurrency investors. As it turned out, the main reason for investing in digital assets was lust for profit rather than distrust of traditional banks and government institutions.