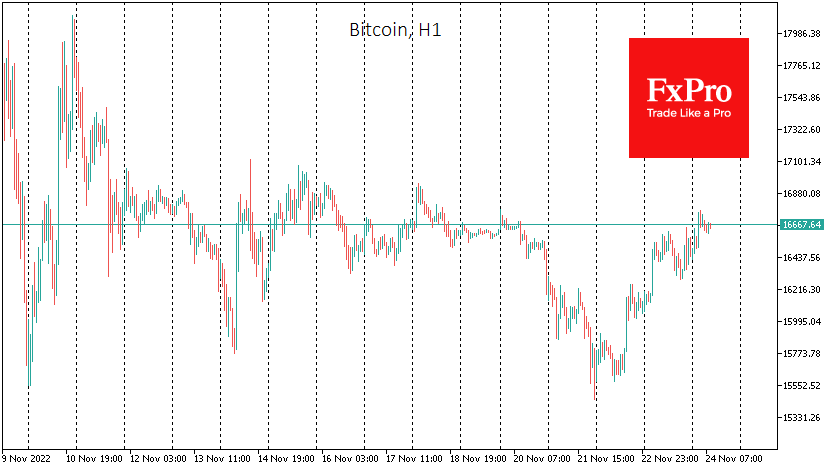

Bitcoin is adding 1.2% over the past 24 hours to $16.7K by the start of trading on Thursday. Ethereum is rising more briskly, gaining 4.3% to $1200. Crypto market capitalisation rose 2% to $837B, rebounding from the latest setback at the start of this week. On the short-term charts, Bitcoin has formed an inverted head-and-shoulders pattern, suggesting an upside potential growth to $17.8K, as suggested by classic targets for this figure. In turn, this would be a move out of consolidation in almost two weeks, which could further boost buyers' optimism.

Taking a step back to the larger timeframes, however, strength remains on the bears’ side as the former cryptocurrency trades below previous consolidation levels at $18.0K.

News background

According to Coinbase research, many investors are increasing the number of coins in their wallets despite the decline in the crypto market. Over the past year, 62% of institutional investors surveyed have increased their investments. According to a Harvard University study, central banks in sanctioned countries could use bitcoin, as well as gold, as a risk hedge. Diversifying central bank reserves could eventually boost the value of cryptocurrency and gold.

Elizabeth Warren, a US Senate Banking Committee member, also called for stronger regulation of the cryptocurrency industry in her article for The Wall Street Journal. She said the Sam Bankman-Fried empire incident is a "wake-up call" for the authorities. New York state authorities have imposed a two-year ban on the non-environmental mining of cryptocurrencies on the Proof-of-Work (PoW) algorithm.