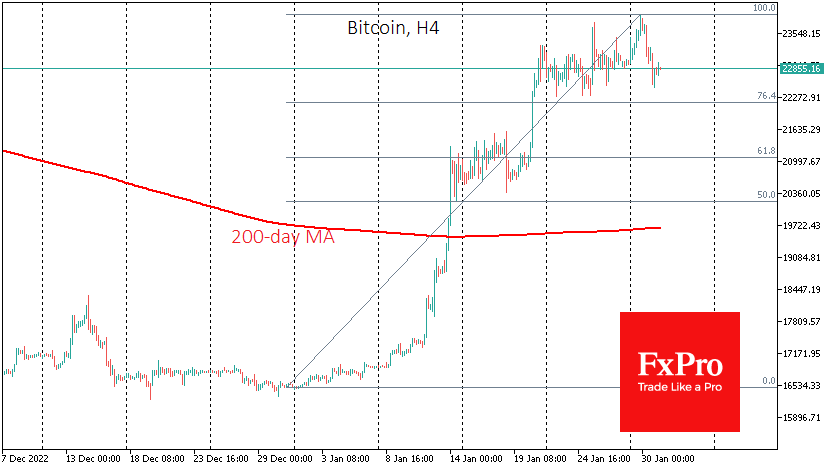

Bitcoin lost ground throughout Monday, falling to $22.5K in early trading on Tuesday, down 6% from its Sunday peak. Total cryptocurrency market capitalisation fell 1.1% overnight to $1.04 trillion, with altcoins easy to find with positive overnight trends. While institutional selloffs pressured bitcoin, it is still trying to swim against the tide, gaining 0.7% today to $22.8K. On the technical side, the latest pullback is too small to be considered a full-blown correction capable of attracting new buyers to the downside.

Bitcoin now has a much higher chance of continuing its slide on profit-taking from the rally since the beginning of the year. These can be as low as $22.1K or even $21.0K. The pull into defensive assets intensified ahead of the FOMC's decision when market expectations and Fed rhetoric diverged dramatically.

According to CoinShares, investments in cryptocurrency funds rose by $117m last week, the highest in six months, with investors focusing on bitcoin. Investments in bitcoin-related funds increased by $116 million, Ethereum by $2 million, and inflows in funds allowing short bitcoin to rise by $4 million.

News Background

Vailshire founder Jeff Ross suggests that bitcoin is likely to rise to $25,000 in the short term. According to him, the strength of BTC on the 4-hour chart remains impressive. South Korea will introduce a cryptocurrency transaction tracking system in 2023 to combat money laundering and recover illegally obtained funds.

The value of bitcoin on Nigeria's popular NairaEX exchange jumped to nearly $39,000 in local currency terms, 65% higher than the BTC price on the global market. The discrepancy is due to the country's central bank's ATM withdrawal limit. The central bank is trying to reduce the proportion of cash in circulation to increase the acceptance of digital naira (eNaira).