Bitcoin fell 6.9% last week to close at $26,900, while Ethereum lost 6.2% to $1800. Top-10 leading altcoins lost between 3.1% (Cardano) and 12.2% (Polygon). The total capitalisation of the crypto market fell by 5.5% over the week to $1.13 trillion, according to CoinMarketCap. One of the main reasons was issues at Binance, where BTC withdrawals were suspended twice.

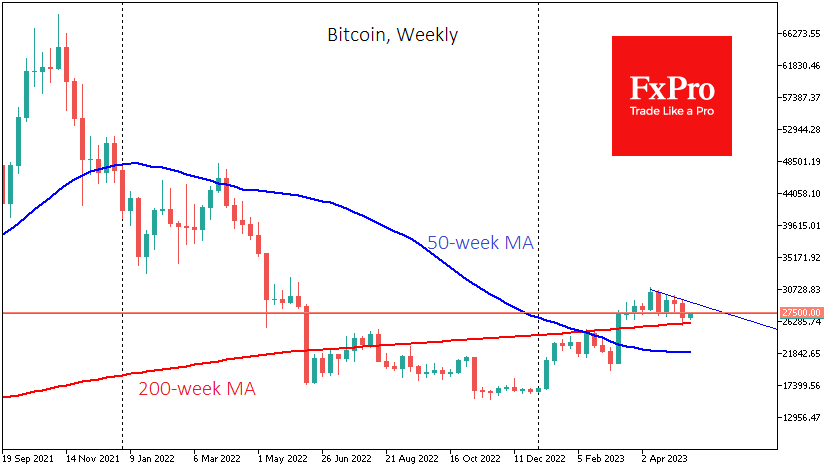

Bitcoin proved interesting for sellers as it touched the 200-week average, passing close to $26,000 last Friday. By defending this key average, the bulls seem to have convinced the market of the sustainability of the long-term bullish trend. On Saturday and Sunday, the Bulls defended the $26.8K level. On Monday, investors switched to active buying and pushed the price to $27.5K. However, cautious buyers will likely want to see a $28-28.5K takedown as confirmation of the break of last month's downtrend.

The Ethereum core network experienced two massive outages that prevented transactions from being completed for some time. Blocks were created, and transactions were completed but could be altered. The developers of the Ethereum client Prysm released an emergency update.

News background

CryptoQuant believes that institutional investors will start buying Bitcoin in late 2023 when the Fed starts to cut interest rates. MicroStrategy founder Michael Saylor described Bitcoin as a solution to growing financial problems and a tool that gives hope to eight billion people to hold their savings. According to him, BTC is a commodity of necessity and traditional money in its current form is already "dying".

The US Chamber of Commerce issued a brief report on the case of trading platform Coinbase and the US Securities and Exchange Commission (SEC), criticising the agency for illegal actions against cryptocurrencies.

The European Banking Authority (EBA) believes central banks should ban large stablecoins if they threaten certain countries' monetary policies. EU lawmakers plan to require companies involved in digital asset storage, trading and investment to report their clients' balance sheets to tax authorities.