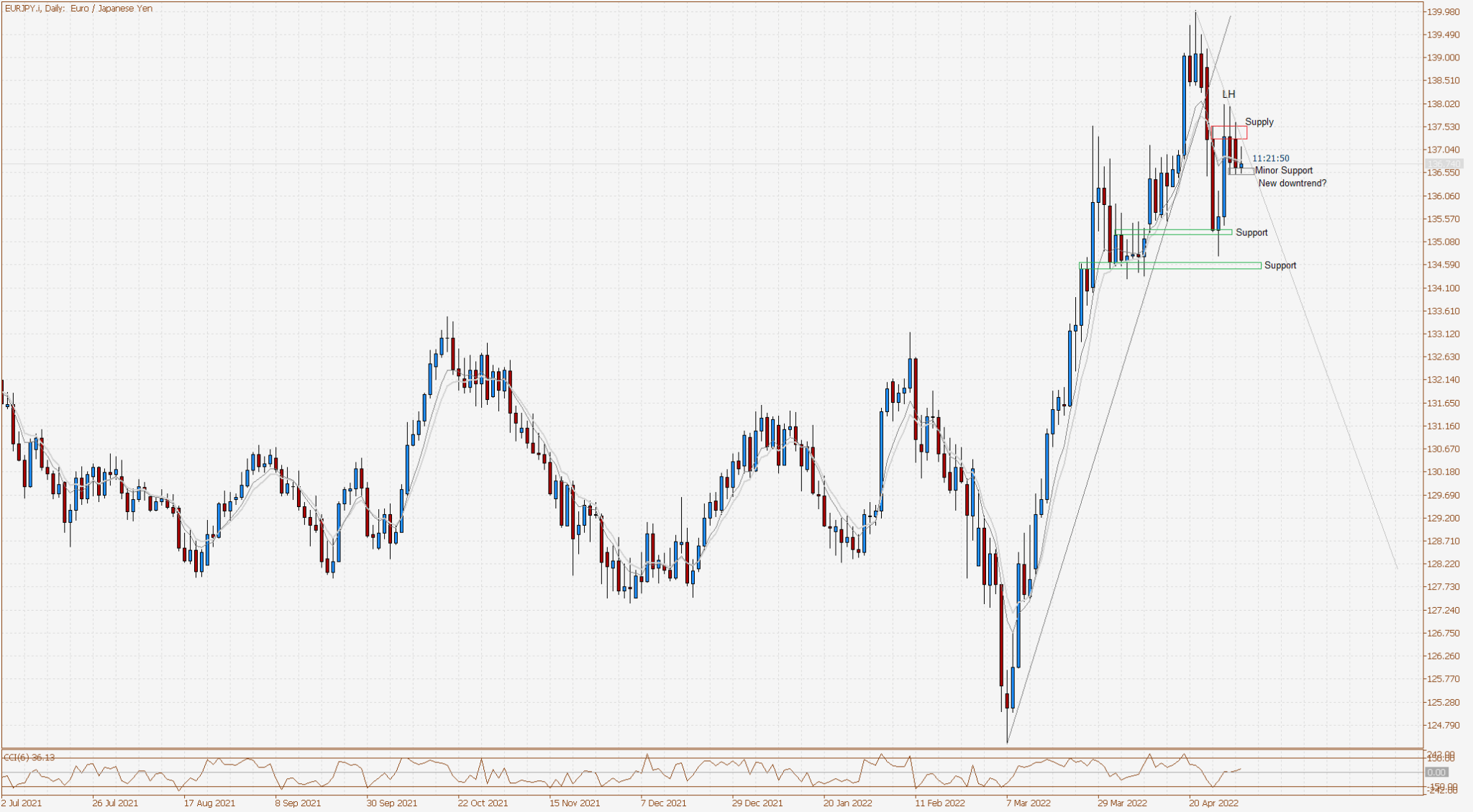

Today’s focus is on the EURJPY, and for now, it’s from the sell-side. That might sound a bit strange based on the amazing buying we have been seeing in recent weeks but like everything, nothing lasts forever. Please note that we’re not calling it a trend change, but in the short term, some signs have started to stack up on the seller side.

The first sign we can see is the break of the medium-term to the long-term trend. After that break, we saw a short steep counter that is typical of counter-rallies after a break lower. Currently, we can see a build-up of indecision that has formed an LH after the trend break. From 137.50 we can see plenty of supply from sellers halting any new attempt by buyers.

These are, for now, all pointing to a possible push lower by sellers, but they have a few things to do before we can start thinking confirmed. First, we need to see minor support beaten to see a resumption of seller control. We would then look lower at 135.28 support and 134.60 support if that happens. If sellers can move below both of those levels, we could have a new downtrend on our hands.

EURJPY D1 Chart

We have put in the forming downtrend abut we would like to see price remain inside that trend if it moved back to the support areas. If we see buyers maintain minor support and push to or through the new downtrend line, we would start thinking possible fail, and we would then move back to the drawing board with new focus on a possible retest of the April high if new HLs and HHs are formed.

The BOJ and the Jen will also be a focus as they drove the recent rally, and it was primarily policy-driven. Any updates from the BOJ that resume JPY weakness could also be a factor in candling out the current seller price action.