MT4 is considered the most popular platform among forex traders. Its success can be explained by at least 2 reasons:

Flexible terminal settings allow you to adapt it to any trading conditions of brokers. It is through the MetaTrader platforms that intermediary companies are able to provide target audiences with services using the A-book or B-book model.

For users, this software is no less attractive, since the developers have provided a unique set of tools for effective technical and computer analysis. In addition, the mql editor is integrated into MetaTrader, which allows enthusiasts to develop their own analytical tools and even automated trading systems. By the way, the author's support tools can be placed in the "Market" section on the official website of the company-developer. It is worth mentioning that the price of really high-quality and efficient tools for trading on the over-the-counter market reaches 20,000 USD.

Despite all the advantages of a standard set of analytical tools, most novice traders pay attention exclusively to custom indicators. It is now appropriate to dispel the myth that these analytical tools are superior to the standard ones in quality of trading signals. In fact, most custom indicators are designed exclusively for commercial purposes. The algorithm is almost entirely based on standard trend indicators and oscillators, while the developers have provided a history of quotes, that is, when testing indicators on the historical data of the terminal it seems really impressive, but when trading online, the number of false signals exceeds 50%. The entry point to the market is displayed correctly after the signal has been processed.

Of course, there are custom indicators that are not redrawn and they all deserve special attention. The most effective of them are the Chaikin oscillator and the adaptive moving average. We will talk about them later. Now it is more important to pay attention to the standard analytical tools of the MetaTrader platforms and try to understand: should it be used in practice? After all, most of them were developed at the end of the last century, and since then the principle of pricing liquid assets has changed significantly.

Moving average

The simplest and most effective trend indicator based on which several oscillators and trading strategies are developed. By the way, Bill Williams himself used this tool when creating the Profitunity TS.

The indicator algorithm is quite simple: the program calculates the average price for a certain period, which is set by the trader in the input parameters. Average prices as well as open / close, high / low levels can be used for the calculation. Despite the simplicity of the algorithm, moving averages are still effective. To see this, it is enough to pay attention to the performance of some trading strategies, which are based on moving averages.

MA + Fractals

For trading, you will need to transfer 3 indicators to the chart of the selected financial instrument:

- An exponential moving average with a period of 25, applied to Hight.

- Another exponential MA with a period of 25, applied to Low prices.

- Bill Williams fractals, which will be used to filter false signals, which is especially important when working with assets with high volatility.

Important! Recently, the cryptocurrency market is gaining increasing popularity, and many traders begin trading Alt-Coins on specialized exchanges or CFDs on cryptocurrencies through Forex brokers. In the latter case, by the way, the profit potential is significantly higher, since the maximum value of leverage on crypto exchanges does not exceed 1: 5. Forex brokers are ready to offer the target audience a more tangible level of financial support - 1:50. Of course, this is associated with higher trading risks, but it does not matter when identifying accurate entry points. That is why it will be necessary to use the MA + Fractals strategy when trading CFDs on cryptocurrencies with high leverage.

You need to open a Sell order only if the signal candlestick has crossed 2 slipping from top to bottom, and the confirmation candle is fully formed below the price channel. An additional signal will be the formation of a bearish fractal. For opening Buy orders, the rules are mirrored. Setting Stop loss on the opposite local level is mandatory. Order for profit taking is not required. The transaction will be closed manually after the formation of a fractal in the opposite direction.

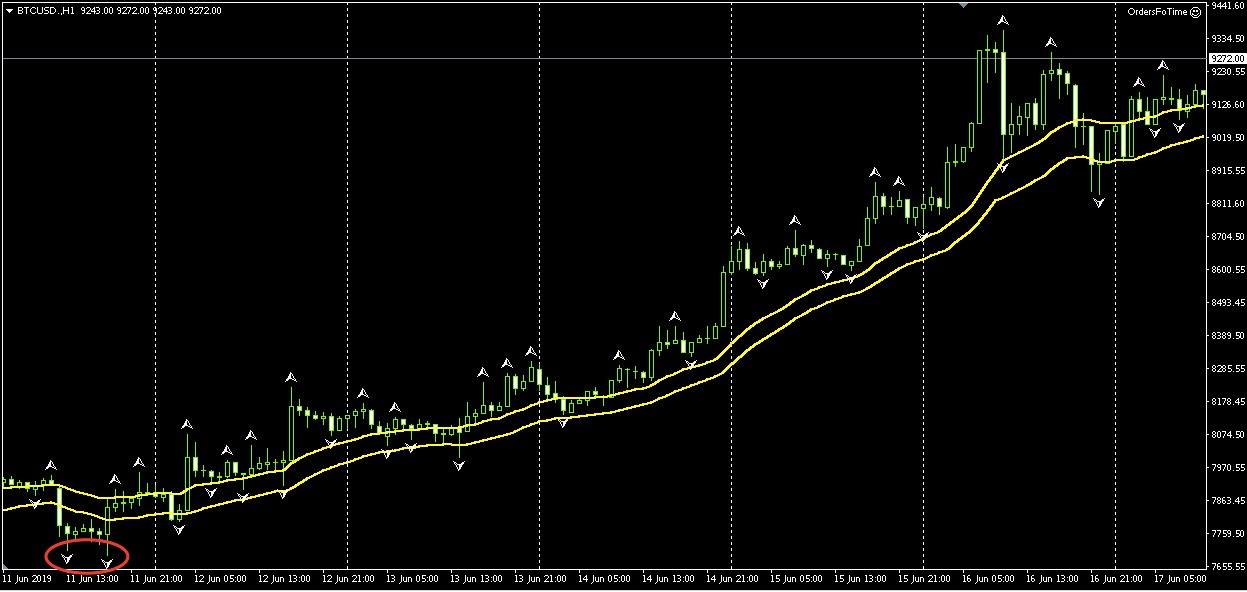

Important! It is believed that cryptocurrency assets are practically not amenable to standard methods of analysis. This is partly true, but to ensure the effectiveness of standard moving averages, trading examples will be considered on the BTC / USD graph:

The screenshot shows a segment of the BTC / USD with a period of H1, which reflects the dynamics of altcoin pricing against the US dollar within 7 trading days. There is a pronounced uptrend, so you should consider only opening Buy orders. The marker indicates a false breakout of the moving ones, but a bull fractal protects against the opening of a Sell order.

Within 7 trading days, more than 20 trading signals were generated. The fact is that the strategy is designed for effective short-term intraday trading, so it is recommended to adopt it to scalpers. Fractals are a reliable filter of trading signals of trend indicators. If the rules of money management are observed, the potential profitability of the strategy will be about 70% per month. If we consider Forex currency pairs as a financial instrument, then the profit potential will not exceed 30-35%. This is due to more moderate volatility.

The obvious advantages of the MA + Fractals strategy include high profitability and accuracy of trading signals, which are mainly provided by Bill Williams' fractals. Of the significant drawbacks, it is worth highlighting only one: for a successful trade, a trader will take a lot of time and undivided attention. If trading is not your main occupation, it is recommended to pay attention to the following strategy.

Puria method

The basis of the trading strategy (TS) are 3 moving averages, and the standard MACD oscillator will be used as the filter of the trading signals. Before you begin, you will need to transfer indicators with correct input parameters to the price chart:

Exponential moving averages with periods of 5.75 and 85. For a comfortable visual perception it is recommended to paint the indicators in different colors. All slips should be applied to closing prices.

For the MACD oscillator to work correctly, you will need to enter the following settings:

- Fast EMA = 15;

- Slow EMA = 26;

- MACD SMA = 1;

- Apply to Close (to closing prices).

Signals for opening a Sell order:

- Sliding with period 5 in the chart window should cross 2 MA with periods 75-85 from top to bottom.

- The graph should be built under slow gliders.

- The breakout candle should close below MA with periods of 75 and 85.

- The MACD oscillator should cross the zero level from top to bottom. The histogram must be built below level 0.

To open Buy orders trading rules are mirrored. Stop Loss is set at the opposite local level forecast, and the Take profit value should be fixed. The potential profit from each open transaction should not be less than 15% of the average volatility of the selected financial instrument for trading within the day.

The Puria method is a scalping trading strategy, but if we talk about Forex, then it is permissible to consider it as a medium-term method of earnings.

Important! The “Puria Method” strategy was developed for trading stock assets, but the use of this method shows quite good financial results when managing capital in the over-the-counter market. To ensure the effectiveness of the TS reviewed, trading examples will be presented on the BTC / USD chart:

The screenshot below shows the BTC / USD graph with a period of H1. The dynamics of changes in the cost of altcoin for 7 trading days is displayed. During this period, the indicators formed 3 trading signals, 2 of which closed with a fixed profit, and 3 needed to close on their own after the price failed to overcome the local maximum twice. In accordance with the rules of technical analysis, this indicates the beginning of a correction, and sometimes a reversal of the global trend.

Since the average daily volatility of the BTC / USD pair is 35,000 points, the minimum Take Profit must be at least 5000 points for the risk to be justified. In order for the strategy to bring profit in the long term, it is extremely important that the Stop Loss exceeds Take Profit by no more than 2 times. It is strongly recommended to carefully study the history of quotations before applying the TS “Puria method” at BTC / USD. It is important to choose the optimal values ​​of safety orders before trading with real money and achieve a Stop Loss and Take Profit ratio of 1: 1.

Bollinger Envelope

Standard trend indicator based on moving averages. For the practical application of this tool for analyzing currency pair charts, the following optimal parameters are optimal:

Bollinger bands should be interpreted as adaptive trend lines. Trading is carried out in accordance with the classical rules of technical analysis – breakdown of support / resistance levels or rebound from these levels.

Bollinger envelope generates the most accurate trading signals during consolidation periods that are observed on most liquid currency pairs during the Asian session. Since the cryptocurrency market is decentralized and unregulated, altcoins are characterized by consolidation with a very wide range, trading within the boundaries of which is associated with high trading risks. Therefore it is strongly recommended to use the Bollinger envelope when working with currency pairs or stock assets. An example of effective application of this indicator will be considered on GBP / USD with a period of M15:

In the period of the Asian session, a clear trend corridor is almost always formed on the GBP / USD pair. When the price touches the lower border of the channel, you will need to consider opening a Buy order, and when you touch the top, Sell. During the Asian session, an average of 2-4 trading signals are formed, 80% of which meet the expectations. This proves the effectiveness of the use of the Bollinger envelope when working with currency pairs and stock assets. The use of this indicator when working with cryptocurrencies is extremely risky due to the nature of the pricing of altcoins.

Conclusion

As you can see, the standard indicators are still quite effectively coping with the tasks. The main thing is to specify the correct settings and correctly interpret the signals.