At the beginning of the new week, the Japanese yen against the US dollar is consolidating but looks quite weak yet. USD/JPY buyers are not gone: they are lying low, waiting for a good time to resume action. Market players are saying that the devaluation of the yen has become one of the main trading ideas in the currency market this year. The Japanese yen has lost more than 16% and can lose more but investors are ready to change the trend. The reason isthat the Bank of Japan will most probably have to correct its monetary policy to catch up with other regulators.

This viewpoint is based on certain livening up of inflation, while the BoJ had been fighting its low rates for decades. The situation has changed, hence, foundation for changing the monetary policy has appeared.

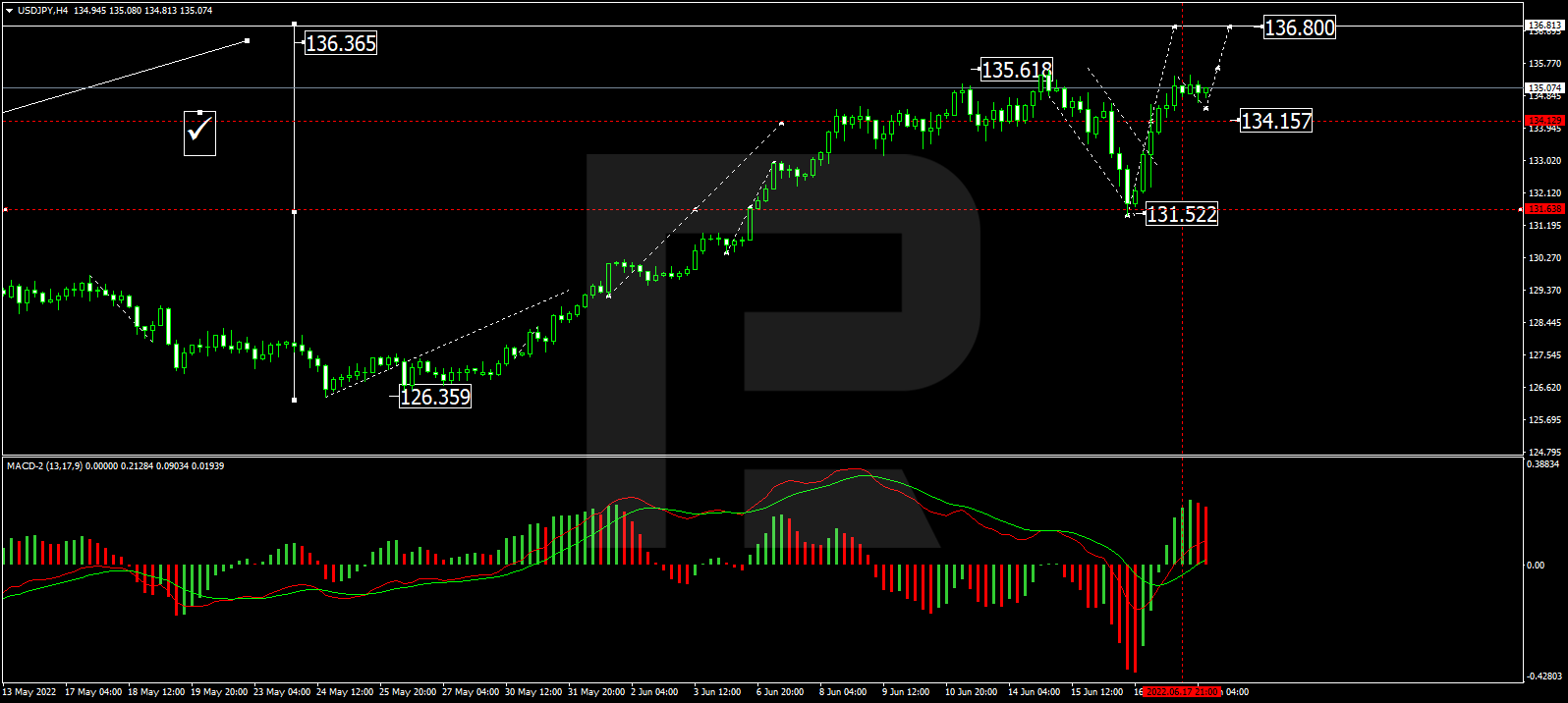

On H4, USD/JPY has corrected to 131.50. At the moment, the market continues developing a growing wave to 136.80 (at least). Currently, there is a consolidation range forming around 134.40. We expect an escape upwards and growth to 136.80, followed by a decline to 131.50. This tech picture is confirmed by the MACD. Its signal line is trading above zero. So, we expect growth to new highs.

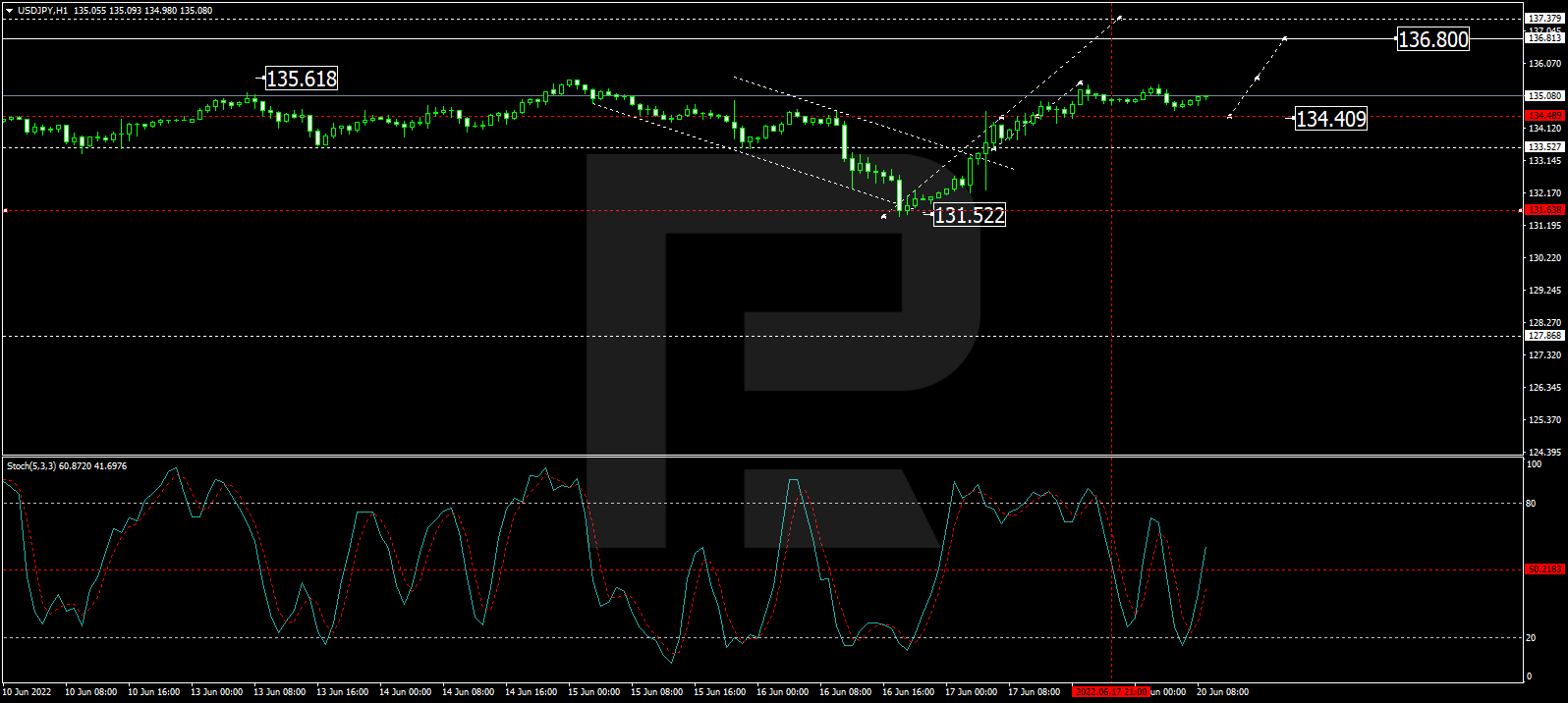

On H1, USD/JPY has completed a correction to 131.51. Today the market continues developing another growing wave. Currently, there is a consolidation range forming around 134.40. We expect a test of the range from above, followed by growth to 135.10. If this level is broken away, a pathway for growth to 136.80 might open. Technically, this scenario is supported by the Stochastic oscillator. Its signal line is forming a structure of growth to 50. And as soon as it is broken away, a pathway to 80 will open.