Oil is a commodity asset of high volatility. This is a key energy carrier with stable and high demand. Also, oil can be safely called one of the most promising exchange-traded assets, and here's why:

- the medium-term value of black gold is fairly easily predicted through analysis of fundamental factors;

- dependence of prices on geopolitical factors;

- private traders rarely turn to commodity assets, as a result of which there is practically no market noise.

It’s worth mentioning right away that actually there is no real, or physical, commodity trading in the OTC Forex market. Traders are solely interested in making a profit through CFDs pricing of the asset provided by forex brokers. Quite not all trustworthy intermediary companies are ready to offer clients earnings on commodity assets. Most people prefer to limit themselves to familiar currency pairs, cryptocurrencies and precious metals, therefore, for trading CFDs on oil, it is recommended to pay attention to the following verified brokers:

These companies are licensed by competent major international regulators, which guarantees the protection of private traders from non-trading risks. Also, to make money on oil CFD trading, you can consider working with stock brokers who are ready to provide traders with access to the New York and London exchanges. These sites for 2019 are leaders in terms of oil futures trading volumes.

In this article, we will overview the key features of oil as an exchange asset, and also talk about the most effective trading methods that even a novice trader can put into practice.

How much money does it take to start making money on oil pricing?

Important! Cooperation with stock brokers for trading commodity assets eliminates non-trading risks due to tighter regulation of intermediary companies, however, in this case, the trader will need to open transactions without leverage. Forex brokers are ready to provide leverage to customers up to 1:1000, which will not only allow you to start trading with minimal investment, but also significantly increase the profit potential.

In other words, the minimum transaction volume for oil CFD trading is 1 lot, which is 10 barrels of crude oil. At the time of writing, the cost of a barrel of Brent crude oil is 60 USD, that is, to open a transaction through stock brokers, a trader will need to have an amount of 600-650 USD. In cooperation with Forex brokers, it will be enough to indicate the leverage at the level of 1:100 during registration. This will be enough for comfortable trading CFD contracts on black gold. In this case, to open a transaction it will be enough to deposit from the account from 10 USD.

The optimal deposit amount is 300 USD, as this provides an adequate supply of available funds to maintain the margin. In other words, when using a leverage of 1:100 with a deposit of 10 USD, the probability of investment loss is about 99%, since even a small movement of the chart in the opposite direction from the forecast will cause the Stop Out order to be closed. With a deposit of 250-300 USD, this probability is minimal. It is this amount that allows for comfortable trading of CFDs for oil, and at the same time to comply with the standards of money management.

What affects the price of oil?

When analyzing black gold prices, it is perfectly acceptable to use both computer and technical analysis. However, the use of fundamental analysis is more effective. Geopolitical and macroeconomic factors are able to tell much more about the dynamics of oil pricing, which will allow you to make the right trading decision in a timely manner.

What specific factors are important to consider?

- Weather. No matter how strange this may sound, global warming can significantly affect the cost of fossil hydrocarbons amid reduced demand and an oversupply of the offer. Climate forecasts should be considered only if long-term trading in black gold is planned.

- Geopolitical. Arrangements between the heads of oil producing countries have a direct impact on the price of oil. For example, in 2014-2015, Saudi Arabia significantly increased the volume of black gold mining. As a result, an excess of hydrocarbons formed on the market, which led to a reduction in cost by almost 50%. It is important to understand that the ratio of supply and demand has a key influence on the value of any product. In 2019, a steady overabundance of hydrocarbons was formed on the world market. In other words, supply confidently exceeds demand. This state of affairs is forcing heads of oil and gas companies and heads of state to regulate oil production to stabilize prices. Thus, to determine the medium-term trend, it will be necessary to wait for an increase or decrease in production volumes. 20% of the current value is enough to open a deal (increase in volume is a downtrend, decrease is an upward one). The necessary information can be obtained from the news or official reports of specialized enterprises, but it is best to visit the official websites of large oil and gas companies and get acquainted with the documentation published in the public domain. Information on the planned volumes of oil production is not a commercial secret and is always available for public viewing.

- Changes in crude oil reserves. The United States and Russia regularly publish relevant reports. This factor is not so much fundamental as market. Since oil is a stock exchange asset, large investment companies monitor the publication of information on black gold reserves. The news of a significant decrease in this indicator may become a reason for a change in the trend against the backdrop of a change in the mood of large bidders.

- Volatility. It is important for proponents of short- and medium-term trading that changes in the cost of oil during the day can range from 1-4%.

Proven Oil Trading Strategy

During the preparation of the material, a thorough study of black gold quotes was conducted, as a result of which it was possible to develop 2 effective strategies that even novice traders can use in their trading. Only macroeconomic factors will be required to operate.

In the short-term trading of CFDs for crude oil or commodity futures for hydrocarbons, you should pay attention to the publication of information on crude oil reserves in the United States. Similar news comes out weekly. If the hydrocarbon reserves in the US storages decreased, then this indicates an increase in demand, if increased, then to decrease. In other words, if the published information turned out to be higher than forecasts, then we should expect a short-term downtrend and consider opening a Sell order upon the news release. If the stock turned out to be less than experts' expectations, then with a probability of up to 90% this will lead to the development of a short-term upward trend. Check out a few examples:

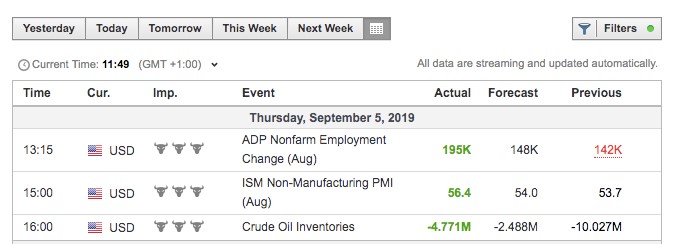

September 5 at 4:00 p.m. GMT published information on US crude oil inventories. As you can see, the actual information exceeded analysts' expectations by almost 2 times, which indicates a high probability of the formation of a short-term downtrend:

As you can see, the forecast was fully justified and at exactly 4:00 p.m. GMT, upon the news release, you can open a Sell order.

Important! A snapshot of the trading platform is presented, whose server time is 2 hours ahead of GMT!

Stop Loss will need to be set at the nearest local level. By the way, the pin bar formed in front of the signal candle is a reliable confirmation of the correct entry. There is no need to establish an order for taking profit. The transaction will need to be closed at market value in 12 hours (before the start of the next European trading session).

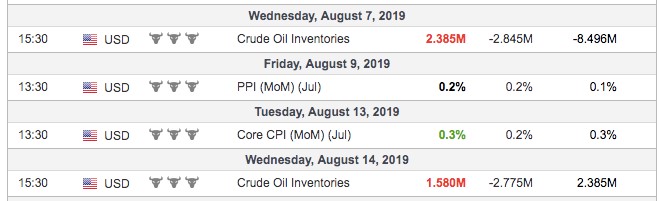

Now let's pay attention to the information on changes in US crude oil reserves published on August 7 and 14, 2019. In both cases, the actual news turned out to be lower than experts' forecasts, which indicates the formation of upward corrections in the mentioned periods. It remains to verify this data on the price chart:

As you can see, the trading forecast was fully justified and with the timely opening of a transaction under the CFD contract could bring a good profit.

Important! One of the key advantages of oil CFD trading on the news, in comparison with currency pairs, is the insignificant expansion of the spread. For example, during the publication of important macroeconomic data on the GBP/USD pair, an increase between Bit and Ask prices up to 20 points may be observed, while the spread for commodity futures does not increase by more than 3-5 points.

Under the influence of news on crude oil reserves in the United States, an upward correction was formed on August 14. Such statistics fully justify the possibility of trading according to the considered strategy by real means.

Additional rules:

- The risk for each transaction should not exceed 10% of capital.

- When working with CFD contracts through Forex brokers, it is not recommended to set a leverage of more than 1:100. Otherwise, the risk of losing a substantial part of the deposit with a slight correction against an open order will be significantly higher.

- A Stop Loss order is required.

- The complex use of indicators in order to filter out false signals in this case is unacceptable due to frequent delays. It is more advisable to pay attention to Price Action patterns.

- For oil trading, it is important that the base currency of the account is US dollars. Otherwise, you should be prepared for the additional costs of conversion (applies to clients of stock brokers).

Conclusion

The considered strategy of trading the black gold CFDs will allow beginners to start earning money. You can verify the high efficiency of the method yourself by analyzing the history of quotes.

Additional information: supporters of medium-term trading are advised to pay attention to seasonality in oil pricing. In the winter months, the price of black gold rises amid rising demand and decreases in the spring and summer. Successful implementation of this trading plan is possible only if there are no changes in the volume of hydrocarbon production, so you will have to study the reports of large oil producers.