Stocks grow due to increases in companies’ profits. Crypto is mainly due to a change in the supply-demand balance. Currencies move as countries solve some issues and create others. Among these assets, there are metals affected by all of that, plus some extra. Our new article is all about trading precious metals, pros, cons, tips, and tricks!

In the next several entertaining minutes we will uncover the fundamental factors affecting precious metals prices. You will learn when to buy gold and why sometimes silver is better. What’s the difference between economic uncertainty and recession and does rising rates affect gold negatively? All answers are here!

Key takeaways

- Precious metals are rare, high-valued commodities used in jewelry, manufacturing, and investments. They include gold, silver, platinum, and palladium.

- Base metals, also known as industrial metals, are typically used as raw materials in the production of various goods and products. They are less valuable and rare than precious metals.

- The price of precious metals depends on supply and demand, including economic uncertainty, industrial output, and macroeconomic events.

- Gold is one of the most popular and valued assets in the world, and has a negative correlation with the US dollar.

- Platinum and palladium are both critical for the car manufacturing industry and tend to slide lower as global demand for cars decreases.

What are the different types of metals?

In general terms, metals can be divided into two categories: precious and base metals. They differ on a variety of factors, including resistance to corrosion, rarity, and use cases. Among precious metals, there are gold, silver, platinum, and palladium. Base metals are represented by copper, zinc, lead, nickel, and others.

What are precious metals?

Precious metals are rare, naturally occurring elements that have a high economic value due to their scarcity and unique physical and chemical properties. They include gold, silver, platinum, and palladium, and are widely used as investments, currency, and in various industries due to their perceived value and stability.

Precious metals don’t oxidize and are not exposed to corrosion, they look shiny, and most of them were used as money a long time ago. With FBS, you can trade every famous precious metal.

What are base metals?

Base metals, also known as industrial metals, are typically used as raw materials in the production of various goods and products. They include copper, aluminum, nickel, lead, and zinc, and are less valuable and less rare than precious metals. These metals are widely used due to their low cost and widespread availability. Still, they may influence the economy of the country greatly. For example, Indonesia is home to 22% of the world's nickel reserves, making the country way more economically powerful than before nickel was found there.

What are the different precious metals to trade?

With FBS, you can trade all four metals from this list. However, there are even more trading pairs for all your needs, so you can find a suitable precious metal to trade at any moment.

- Gold. Who doesn’t love trading gold? It’s so far one of the most popular assets in the world, also, one of the most valued, with over $12 trillion capitalization. Usually, gold and the USD have a negative correlation. It means the metal moves down when the greenback rises, and vice versa. Used as currency before, now gold can be found in chips for millions of devices. You can choose from a variety of gold pairs, from classic XAUUSD (gold vs. the US dollar) to alternative XAUEUR, XAUGBP, or XAUAUD.

- Silver. It’s a white metal that has a wide range of uses in various industries, including electronics, jewelry, and coins. Silver is widely traded on various exchanges and is popular among investors for its relatively low price and higher volatility compared to gold. Silver is often considered undervalued because it grows slower than gold. Factors such as industrial demand and macroeconomic events influence its price.

- Platinum. Platinum is a rare and valuable metal that is used in various applications, including jewelry and catalytic converters, which account for 50% of demand and help companies emit less toxic fumes in the air. It’s one of the rarest metals on earth and is often traded at a higher price point than other precious metals.

- Palladium. It’s used primarily in the automotive and electronics industries. This lustrous silvery-white metal comes from mines located in the United States, Russia, South Africa, and Canada. It’s 30 times rarer than gold and used a lot in green energy production. Usually, the price of palladium is most affected by the auto industry because along with platinum this metal is used in catalytic converters.

What affects the price of precious metals?

In a nutshell, every asset’s price depends on supply and demand. If some country found massive platinum deposits, the price may decline because the market starts to price in the rise in supply. On the other hand, the global recession may lower the demand for cars and catalytic converters, creating price pressure on platinum and palladium prices. Here’s what else drives prices:

Economic uncertainty

To better understand the dynamics of metal in crisis times, it’s good to know that the USD is moving against gold. When the USD rises, gold falls, and vice versa. Silver is like a more volatile version of gold.

Correlation of gold and. the Fed Funds Rate

Platinum and palladium are both critical for car manufacturers, thus, they tend to slide lower as global demand for cars decreases.

Industrial output

It is the output of industrial establishments and covers sectors such as mining, manufacturing, electricity, gas, steam, and air-conditioning. To put it simply, the more industrial output the better. Bigger production doesn’t always mean bigger demand for goods. However, when these two things come together, prices almost always rise. Still, greater output (due to cheaper production) may overflow the market, making the demand side weaker, and pushing prices lower. Gold doesn’t get affected by industrial output changes too much because it’s mainly used as a store of value. Not so much gold goes into chips.

Palladium and platinum are under a heavier influence, as they are both mainly used for goods production.

Strength of the dollar

Why does USD soar? Because when the Fed rises rates, money becomes more expensive. To put it simply, higher interest rates increase deposit yields and loan interest. Thus, people and companies slow down spending and try to save more money for the future. The economy slows, and currency becomes more expensive, rising against other currencies. All that creates price pressure for gold, making it lower when the Fed fights inflation.

Here’s how it works:

- US treasury yield rises → USD demand rises → USD rises.

- When the USD rises, gold (XAU) plunges (this has come from the times of the Gold Standard and remained even after it).

- Gold supply doesn’t increase as fast as demand. Moreover, inflation doesn’t go to zero, making the USD weaker with time.

- Thus, even if gold falls for years, it will continue to rise in the long term.

As for other metals, the situation is somewhat different. Platinum and palladium don’t get affected so much by the USD, so their movements are driven by other factors.

Interest rates

Here’s an example for you to get the idea quickly. November 2, 2022: US Federal Reserve increased the interest rate by 75 basis points, creating a huge uptrend movement for the USD. Gold slid 4000 points over the next few hours. When the Fed is hawkish, it pushes the USD up, making gold weaker. Silver usually goes into a rally when Fed keeps the interest rate near zero, making it somewhat similar to gold.

Correlation of silver and the Fed Funds Rate

What’s for palladium and platinum, these metals don’t get affected so much, but the overall economic fluctuations still get to them.

Quantitative easing

If we want to rephrase “Quantitative easing” we would get simple “Money printing”. The Fed creates more money on the market, making it easier for companies to raise capital. On the contrary, this monetary policy speeds up inflation. Precious metals surge when the demand for them rises. Also, they tend to love inflation and go up when prices increase. Gold and silver are true inflation fans, and platinum and palladium are more of an industrial production type of precious metals. Quantitative easing has a bullish impact on all risky markets, including stocks, cryptocurrencies, and metals.

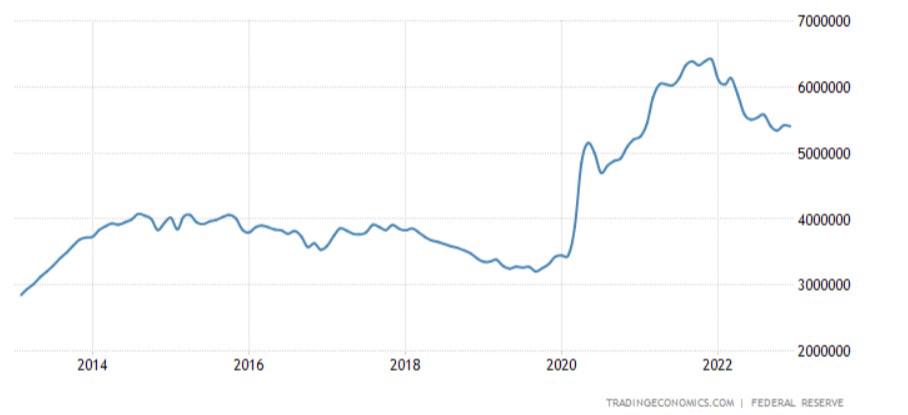

The US monetary supply M0. Gold rose 41% when the printing machine started working in 2023

Trading precious metals summed up

We told you pretty much everything you need to know about trading precious metals. Now, you know factors affecting the price of precious metals including economic uncertainty, industrial output, the USD movements, interest rates, and dovish monetary policy. Precious metals offer a unique trading opportunity for those seeking certain types of price action. By understanding the reasons behind metals' rises and falls, traders can make informed decisions about their future movements.

Turn knowledge into success with FBS by creating an account and trading every precious metal from this article. You can even choose alternative gold and silver pairs like XAUGBP (gold-British pound) and XAGEUR (silver-euro). We hope this article was helpful and informative, thank you!