Secrets of successful trading during the Asian session

Practically every trader knows that the particular dynamics of the pricing of financial instruments depends not only on the selected asset, but also on the trading period. On many specialized sites, beginner traders may encounter such recommendations:

- work should be from 06-00 to 14-00 GMT, since at this time there is a peak in the volatility of liquid assets;

- high volatility opens up promising opportunities for traders.

Such statements are quite reliable, since it is precisely the instability of financial markets that creates all the conditions for obtaining high profits. But is it easy for novice traders to manage capital in such conditions?

Trading in conditions of high volatility is associated with high risks. Therefore, in the early stages of trading with real money, newcomers are advised to pay attention to more affordable earning methods that differ from classical trading methods not only in moderate risks, but also in their attractive profit potential. Such methods of trading we are going to discuss in this article.

Features of the Asian trading session

The Asian Session is the over-the-counter trading period in which primarily Asian traders operate. The largest trading participants in this period are banks of Japan, Singapore and Hong Kong. The Asian session lasts from 00:00 to 09:00 GMT. A consolidation period is observed on liquid financial instruments at this time - the price chart moves sideways within a narrow price corridor, the range of which rarely exceeds 10% of the value of the average daily volatility of an asset. For trading, it is recommended to consider such currency pairs as EUR/USD and GBP/USD.

Before starting work, it is important to make sure that no major announcements from political or financial figures are scheduled for the Asian session, as well as the np publication of important macroeconomic data that could affect the dynamics of asset pricing. It is enough to pay attention to the economic calendar before trading.

It is this period that should be considered by novice traders to develop basic trading experience.

Novice traders are strongly advised to pay attention to personally tested trading strategies, with a yield potential of 10 to 75% per month. The presented methods of earning are quite simple, but very effective. They can be used by novice traders to boost a deposit. After studying the material, everyone can start applying them in practice and get the first profit.

Bollinger Cover

It was mentioned earlier that during the Asian trading session, price charts of currency pairs, which do not include AUD, JPY, NZD currencies, move within a narrow corridor. Trade will be carried out in accordance with the classical rules of technical analysis, but for this you will need to accurately determine the channel boundaries. This can be done in two ways:

Draw trend lines. To implement this idea, you will need to wait for the formation of at least 2 local levels. However, one should not forget that the market is chaotic and the borders of the channel should not be taken literally.

Use trend indicators. There are enough effective trading systems based on moving averages. This is a simple and reliable analytical tool, the use of which is still relevant. Based on the moving average algorithm, the Bollinger Envelope indicator was developed. This tool is strongly recommended to use when trading during the Asian session.

Indicator features

The Bollinger envelope is included in the standard set of analytical tools in all popular trading platforms. There are custom, modified versions of this indicator, but the developers did not make any significant changes to the original algorithm. For efficient trading, the standard version is enough.

The Bollinger envelope is based on moving averages and responds to changes in volatility. The boundaries of the indicator should be interpreted as support and resistance levels, which are constantly adjusted to price changes, which allows the trader to accurately determine the direction of the local trend.

Trading Rules

During the Asian session, EUR/USD and GBP/USD currency pairs will need to be covered with a Bollinger envelope on the price chart with a period of M15. Transactions will need to be opened when the price touches the extreme border of the indicator.

Important! When choosing an asset, it is recommended to give preference to the GBP/USD pair due to the greater profit potential, which is provided by a wider range of the price channel.

To open a Sell order, you need to wait for the price to touch the resistance level. For setting the Buy order the rules are the opposite. The use of safety warrants is required. Stop loss should be located at the last local level of the M15 chart, while its value should not exceed 10 points. Take profit is set on the opposite border of the price channel. The profit potential directly depends on the market volatility and on average varies from 7 to 12 points of net profit. Since we are talking about short-term trading, the risk per transaction should not exceed 2% of the deposit.

To understand the principle of trading, it is recommended to familiarize yourself with several examples:

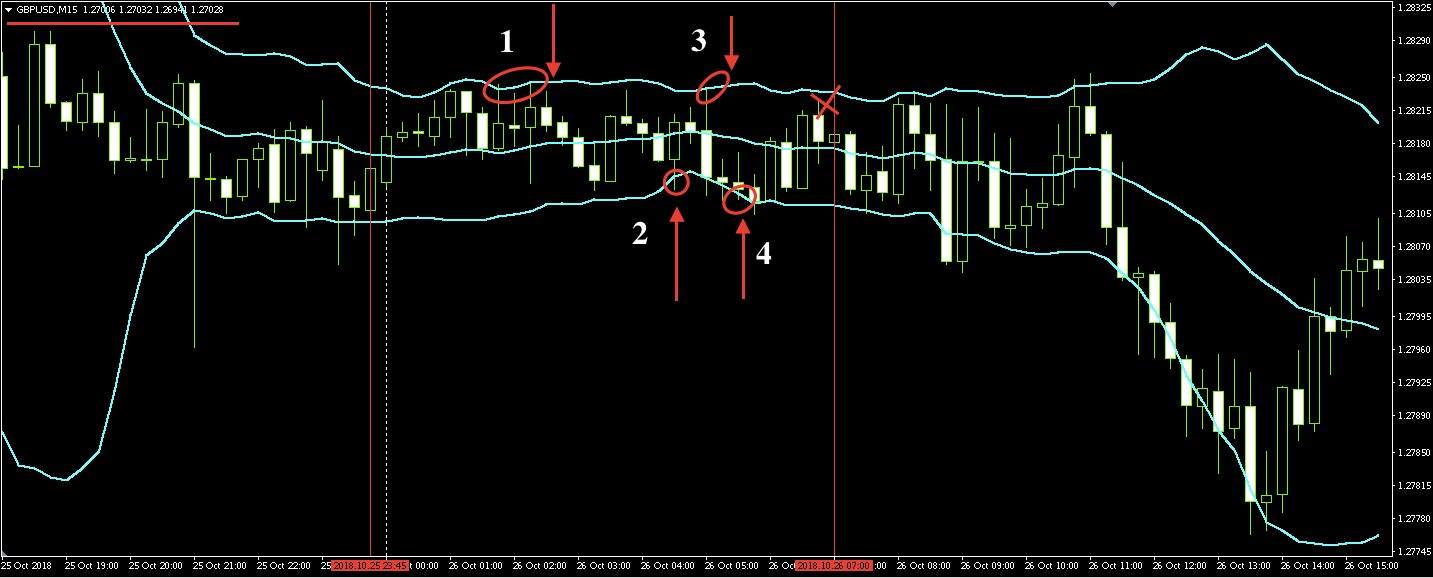

The screenshot shows a segment of the chart of the pair GBP/USD with a period of M15. Red vertical lines mark the border of the Asian session, during which 2 trading signals were formed. Each of them closed with a fixed profit of 10 points, that is, in total, it is possible to increase the deposit by 4% during the Asian session. It is worth saying that orders are extremely rarely closed with fixation of losses.

To optimize losses, it is permissible to use the Martingale method. In this case, the risk per transaction should not exceed 1% of the capital.

This screenshot shows another segment of the GBP/USD graph with a period of M15. As you can see, during this Asian session 4 trading signals were formed, each of which was successfully implemented. The total profit was 35 points or 7% of the deposit. This justifies the expediency of using the Bollinger envelope for trading during the Asian session.

The trading method no one will tell you about

Another promising earnings strategy in the Asian session is related to the gap – the price gap on the chart. Such a phenomenon can be observed during the opening of the market on the night from Sunday to Monday.

Central banks do not work on weekends, which is not the case with macroeconomic processes affecting the value of national currencies. It is because of this that such discontinuities form.

Important! The gap always tends to close. In accordance with the rules of simple trading strategy on gaps, the trader should, at the moment of opening the market, simply open a deal in the opposite direction to the gap and not place safety orders. According to statistics, in 80% of cases within 2 days the transaction will be closed with a fixed profit.

Now it is recommended to pay attention to the NYSE index chart:

The gap is formed almost daily. This is explained quite simply. Forex is a decentralized trading platform, the turnover on which is carried out around the clock, and the New York Stock Exchange is working only in a strictly allotted time - from 13:00 to 21:00 GMT. Because of this, a gap can be observed almost daily on the NYSE chart.

During the Asian trading session at Forex, the central banks of the EU and the USA do not work, so this period is practically no different from the gap. It is recommended to pay attention to one simple pattern: 3-4 hours before the opening of the European trading session, the chart tends to the initial value, that is, to the price that was relevant at the close of trading in the US. This is confirmed by statistics:

The graph shown in the screenshot covers 7 trading days. It can be noted that each morning, before the opening of the Asian session, the value of the asset sought to be relevant at the time of the closing of the American session. Moreover, such forecasts are justified by fixing profits in 95% of cases. The yield potential ranges from 6 to 17 points per day. It is not recommended to trade on Mondays. As practice shows, most of the loss-making orders fall on Monday.

This strategy is not perfect and has its positive and negative features, which will be discussed later. First you should pay attention to the simple trading rules:

- The order should be opened at 02-00 GMT in the direction opposite to the local trend.

- It is recommended to work with the schedule M15, since in this case the calculation of target levels will be more accurate.

- Regardless of the financial result of the transaction will need to close no later than 07-00 GMT.

- The value of stop loss should not exceed the potential profit of more than 2 times.

- The maximum permissible risk per transaction is 2% of the deposit.

- The Take Profit value should correspond to the opening point of the candle at 19:45 according to M15 according to GMT (the screenshots show the MT4 terminal from Nord FX).

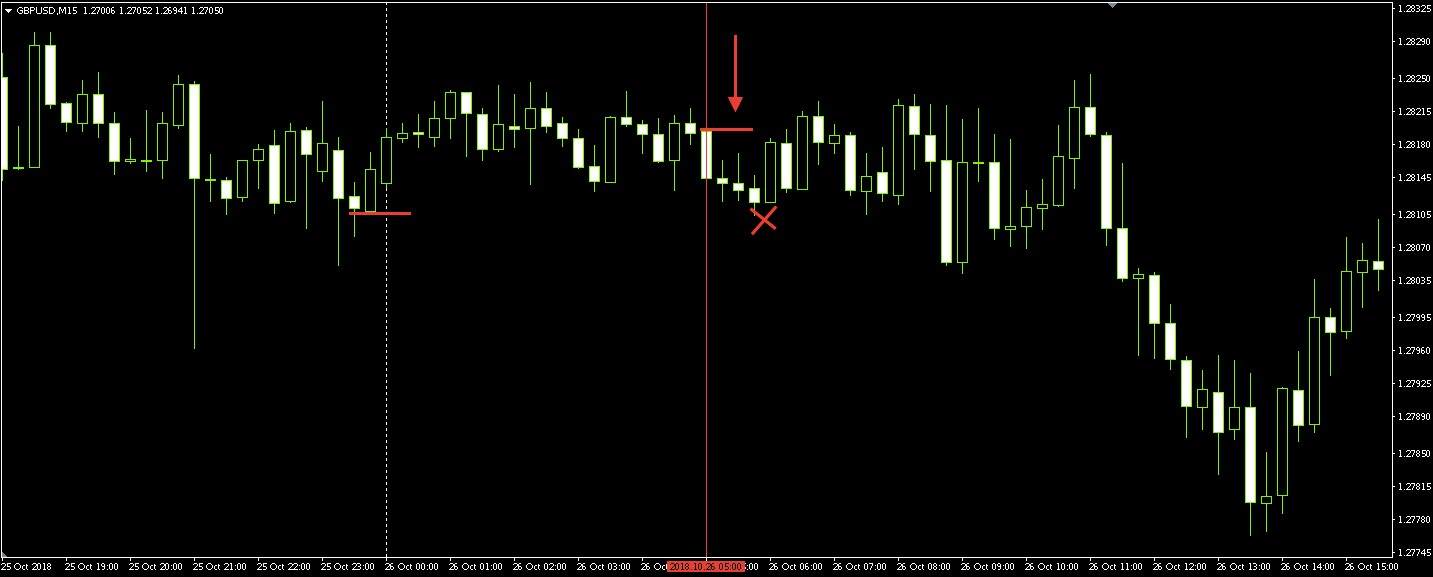

The image is marked with a red vertical signal candle, when opened, you will need to place an order in the appropriate direction. In this case, the profit was 12 points. The cross marks the closing point of the transaction.

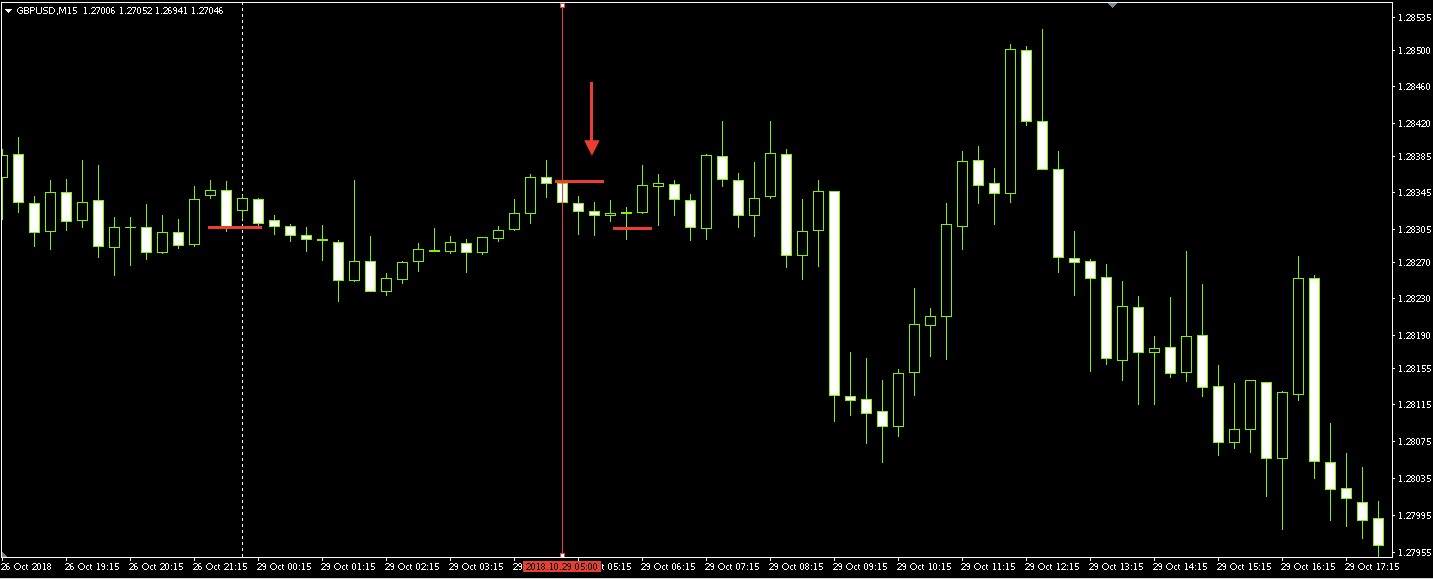

Another example of trading within the considered strategy.

Important! If the range covered by the GBP/USD chart is more than 30 points, then the Take profit value should be 50% of this value. This happens only with a significant increase in trading volume by Japanese traders, which is quite rare. For greater peace of mind these days, you can refrain from trading.

Advantages and disadvantages of the strategy:

Pros

- Stable financial result

- It is easy to convince yourself of the effectiveness of a trading strategy by analyzing the quotes history.

- Simple rules of work

- No need to use indicators

Cons

- A losing trade "eats" the profit received at the close of 2-3 successful orders

- If the range covered is less than 5 points at the time of opening a trade, it is necessary to refrain from trading, since about 80% of the profit will go to compensate for the spread, which makes the risk not justified

The strategies considered in the material are permissible to be considered for practical use by both novice and confident traders. It is important to observe the rules of money management and the rules of a trading strategy.