Pair Trading: Effective Strategies for Earnings in Financial Markets

Pair trading is used by experienced traders as a reliable tool for risk diversification. For the successful implementation of a long-term trading plan on the stock market, it is enough to competently make an investment portfolio by investing in promising ETFs. As an alternative, it is permissible to consider the distribution of capital between shares of companies with high capitalization and government bonds in the ratio of 70/30. This is the kind of tactics that is used by such an investment guru as Warren Buffett, allowing him to minimize trading risks.

The use of such a strategy is possible on the over-the-counter foreign exchange market. The only difficulty is the right choice of financial instruments. The article discusses examples of pair trading on Forex and provides practical recommendations for beginner traders. The author also describes his personal trading strategy with a guaranteed profit of 7 to 12% per month.

Correlation and features of its practical application in trading

Correlation is a statistical interdependence of at least two random values. In the terminology of online trading, correlation should be understood as an interrelation in the pricing of currency pairs.

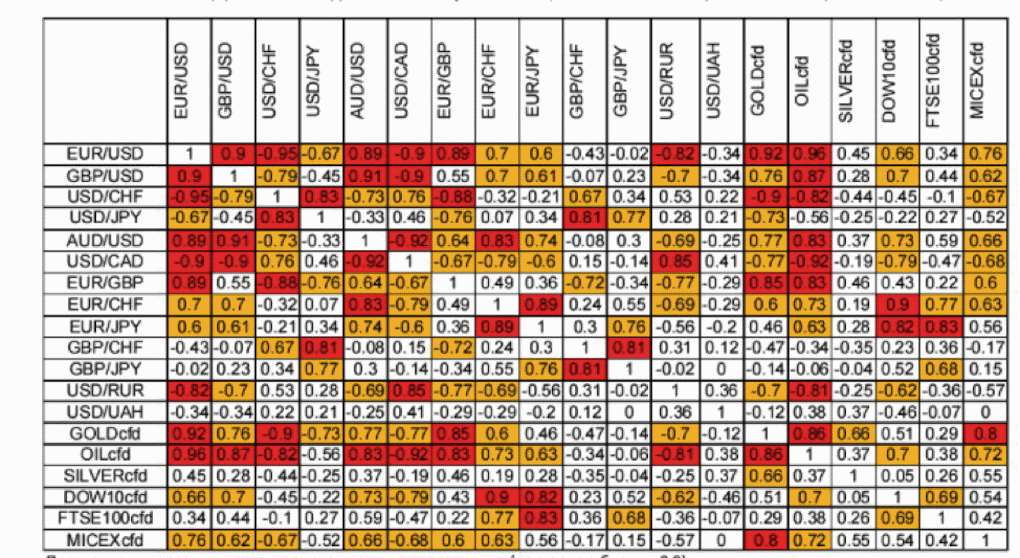

The correlation coefficient can vary in the range from -1 to one, where the minimum value indicates the opposite trend of asset pricing, and the maximum – the identical one. If the coefficient is zero, then this indicates the absence of interdependence between financial instruments. For example, the correlation between the Australian dollar and the value of gold is close to one. This metal is practically the main export commodity of the state, so its market value affects the pricing of the national currency in the medium and long term:

The screenshot shows the AUD / USD and XAG / USD charts. The identical pricing principle is obvious. It is important to pay attention to the intense price impulses that are peculiar to the XAG / USD pair. Smoother movements are characteristic of AUD / USD. This can be successfully used in your own trading. The average daily volatility of the XAG / USD pair is about 170 points. If an impulse from 50% of this range is formed on the chart, then you should open a trade for AUD / USD with a target level of 20-30 points (the volatility of this instrument within the day is very insignificant). Stop loss is recommended to be set at the opposite local level. The number of successful transactions is more than 85%.

Important! The correlation coefficient is a floating value, which depends on the level of liquidity. This indicator is also able to influence macroeconomic factors. This allows traders to make profit by changing the correlation coefficient in the medium term in the foreign exchange and long-term in the stock or commodity markets.

Practical application of correlation in forex trading

The most common way to earn profit with interdependence of Forex currency pairs is trading in assets with a negative correlation coefficient.

The interdependency ratio of the EUR / USD and USD / CHF pairs is -0.95. In practice, this figure ranges from -0.78 to -1. The essence of earnings consists in opening 2 identical trading orders for assets at the moment when the correlation coefficient between them will be minimal. To identify such situations, you will need to use the currency pair relationship indicator. There are a lot of similar analytical tools, but it is recommended to pay attention to the iCorrelationTable. This indicator is not available in the MT4 and MT5 platforms, however it is possible to download it from specialized sites independently and install it in the terminal in accordance with standard instructions. When transferring to a grid, it is not required to make adjustments to the input parameters of the tool.

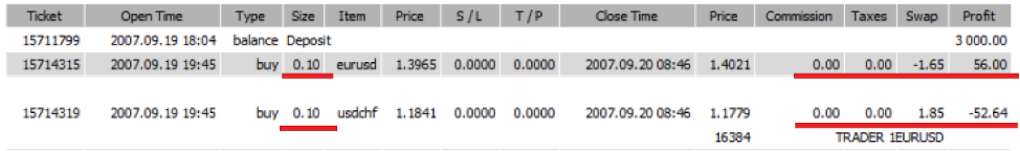

The indicator is built in the additional window below the price chart and displays changes in the correlation coefficient of currency pairs. To place orders on EUR / USD and USD / CHF, it is desirable to wait until the value of their interdependence is about -0.95. Transactions must be opened at market value in one direction and with identical trading volume. Orders will need to be closed after changing the correlation coefficient with fixing the minimum profit:

Two orders are opened with a volume of 0.1 lot. After 3 days, the profit was about 3 USD. To issue these trade orders with a leverage of 1: 100, a deposit of 200 USD will be quite enough. Thus, the minimum potential profitability of the strategy will be 12% per month. However, it is important to pay attention to the obvious disadvantages of this vehicle:

The correlation coefficient does not change often.

Not to many brokers have a positive swap on the mentioned pairs in the contract conditions.

The main advantages of the strategy are stable income, availability of analysis and practically passive participation of the trader in trading.

Attention! For trading, it is possible to consider currency pairs not only with a negative, but also with a positive correlation coefficient. In the latter case, orders should be opened in opposite directions.

There is another way to earn with correlations when trading Forex. The principle of trade is almost completely similar to that described earlier. The trader will need to find 2 pairs with a negative value of the correlation coefficient and a positive swap. At the same time, the conditions specified in the broker’s user agreement should not limit the user in choosing a trading strategy. To exclude non-trade risks when choosing an intermediary company, banking organizations should be given preference, for example:

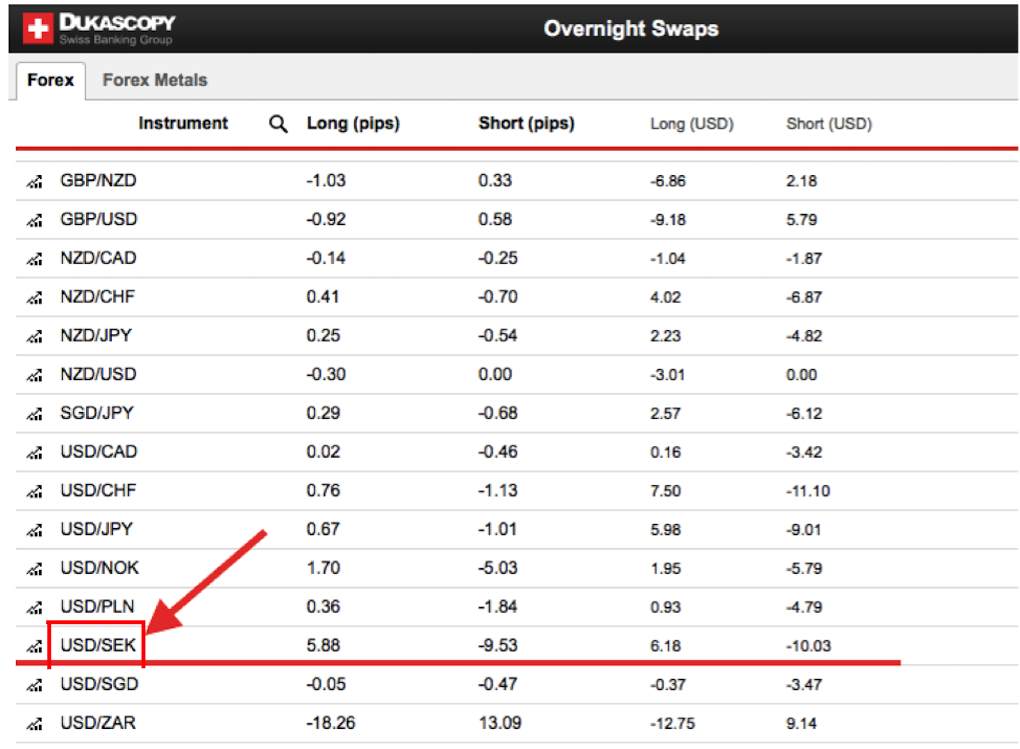

- Dukascopy Bank SA is a large Swiss bank, regulated by FINMA. It provides services in the binary and classic over-the-counter trading industry. The minimum deposit is 1000 USD. The bank has a subsidiary of Dukascopy Europe, registered in Latvia. Cooperation with the Swiss branch of the bank is recommended.

- SAXO BANK is an international investment bank with headquarters in Denmark. Classic trading and options trading are available with a minimum expiration period of 24 hours. Domestic traders avoid cooperation with a broker due to high requirements for start-up capital - from 10,000 USD.

- Alfa-Forex is a subsidiary of Alfa-Bank with a license of the Central Bank of the Russian Federation and an authorized capital of more than 60 million RUR. Registration is available only to users from Russia. Opening an account and verifying a client is carried out in a bank branch. Requirements for deposit traders are not specified. The disadvantages of this organization include only low leverage – up to 1:40.

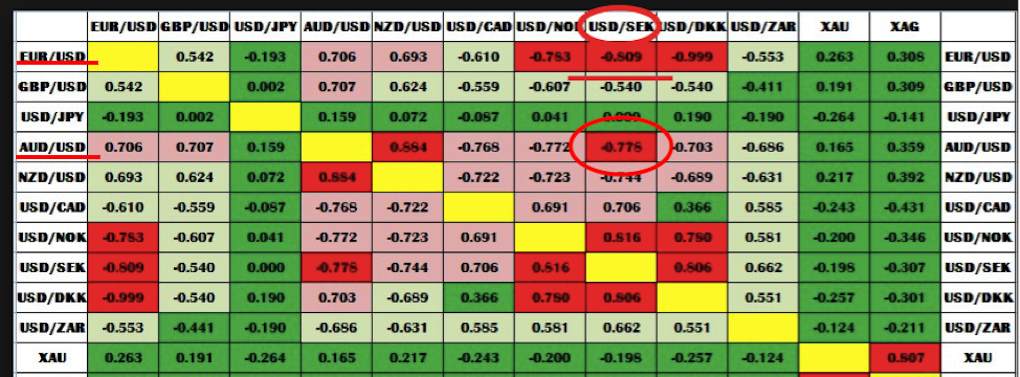

Attention should be paid to the negative correlation coefficient of USD / SEK in relation to EUR / USD and AUD / USD. The companies mentioned earlier offer a positive commission for transferring the transaction to the next day only for USD / SEK and AUD / USD. This combination should be considered for practical use.

The screenshots show the specification of the contracts of the broker Dukascopy Bank SA. As can be seen, when opening a Buy order, the USD / SEK swap pair is 6.18 USD per day. For AUD / USD, this value is negative and amounts to -3.71 USD. Thus, when opening 2 identical orders, the net profit of a trader for transferring transactions will be 2.47 USD per day. When calculating, you should not forget that on the night from Thursday to Friday the swap is credited in triple size. Thus, the net profit per month will be 74.1 USD or 7.4% per month (88.8% per annum) from 1000 USD. This is a pretty impressive profit, given the almost complete absence of trading risks.

Important! There is a high spread for the mentioned currency pairs, so it is important to understand that to compensate for losses, it will be necessary to keep orders open for at least 1 week. Therefore, to maximize profits, it is strongly recommended to consider the application of this strategy exclusively for long-term investment.

- To obtain a stable profit in the long term through the application of the considered strategy will require:

- Choose financial instruments with a negative correlation coefficient and a total positive swap.

- Decide on the choice of a reliable intermediary company to eliminate non-trading risks.

- Open orders of one type with identical volume at market price.

- Profit from a positive swap.

Compared with classical trading strategies, the correlation earnings method has several advantages:

- No risks.

- The possibility of obtaining passive profits from investments in financial markets without using questionable PAMM services, copying signals, and trust management.

- The use of compound interest will double the potential profit.

- Unlike investing in mutual funds or bank depositary programs, the trader has the opportunity to close orders at any time and withdraw the profit.

- The possibility of complex use of other, including short-term trading methods.

The only drawback is the relatively low profitability compared with the profit potential of short-term trading methods.

Conclusion

The considered strategies of earning on the correlation of Forex currency pairs is the possibility of obtaining a stable profit from passive investment in the foreign exchange market. Income potential significantly exceeds similar indicators when investing in a bank deposit, real estate, in foreign ETFs or in Russian mutual funds. The level of risk is quite comparable.

Attention! Beginner traders are recommended to accumulate practical skills on a demo account within 1-2 months before investing their own funds.