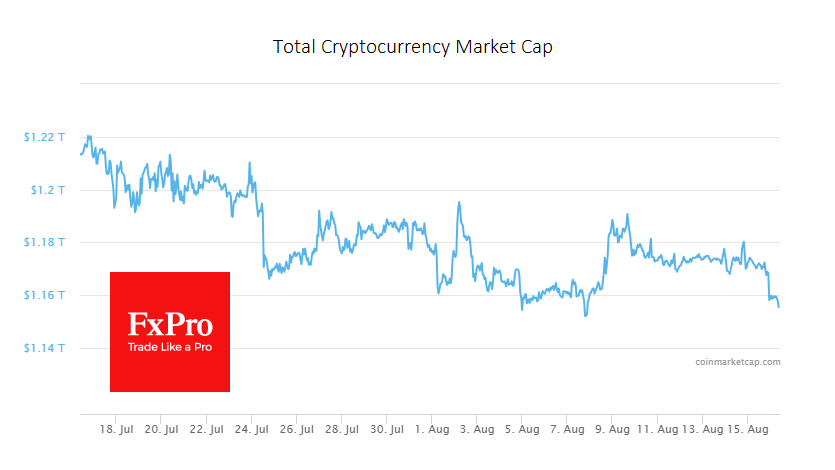

The cryptocurrency world experienced a mild shake today, with the total market cap dipping by 1.2% in a 24-hour period, settling at $1.156 trillion. After a long period of consolidation, this drop, though minor, ruffled a few feathers, especially among holders of smaller altcoins. While today's dip in the crypto market may cause a hint of worry among enthusiasts, it's vital to remember that the cryptocurrency world is known for its volatility.

Ablend of external pressures, from rising US Treasury yields to global economic factors, constantly shape its trajectory. Investors, both new and seasoned, should keep a keen eye on technical indicators and global financial cues to navigate these choppy waters.

Larger Currencies Weather the Storm

While the entire market faced downward pressure, the major players in the crypto arena, notably Bitcoin (BTC) and Ethereum (ETH), held relatively firm. Bitcoin, often viewed as the flagship currency in the crypto world, saw a decrease of 0.7%. Meanwhile, Ethereum, the second-largest cryptocurrency by market cap, faced a 1% drop.

On the other hand, smaller altcoins had a rougher day, with Solana leading the pack, plummeting 6.3%, and Tron experiencing a 1.1% drop.

US Treasury Yields Play Their Part

One of the key external factors affecting the crypto realm today was the rise in US Treasury yields. When these yields climb, it often sends a signal to investors that there's a safer and more predictable return available outside of riskier assets like cryptocurrencies. Today was no exception, as the increasing yields seemed to pull capital away from the volatile crypto market, especially the smaller, more susceptible altcoins.

Record Low Volatility for Bitcoin

In a report by The Block, Bitcoin's volatility has hit a historic low. The 30-day volatility rate, on an annualized basis, nosedived to 15.5% from a staggering 61.4% the previous year. This drastic reduction is indicative of the overall stability and maturity that Bitcoin, and by extension, the wider crypto market, is slowly moving towards.

Glassnode's research also highlighted a prevailing sentiment of apathy and exhaustion among investors and traders due to the fall in volatility. This sentiment is reinforced by Bitcoin's price movement; after meandering around the $29.4K mark for a considerable period, it's currently flirting with the $29.0K boundary.

Technical Outlook

On the technical analysis front, there's a growing concern that if Bitcoin breaks below the critical support level of $28.9K, we might witness an accelerated selling pressure. If this happens, it wouldn't be surprising to see Bitcoin's price plunge rapidly to levels like $28.0K or even as low as $27.2K.