The global financial markets never sleep, constantly responding to a barrage of data, news, and economic indicators. In recent times, several key metrics and developments are shaping the behavior of some leading financial instruments. Here's an in-depth look at the current market scenario surrounding the US dollar index (DXY), the USD/JPY currency pair, and Brent crude oil.

DXY – US Dollar Index Holds Its Breath

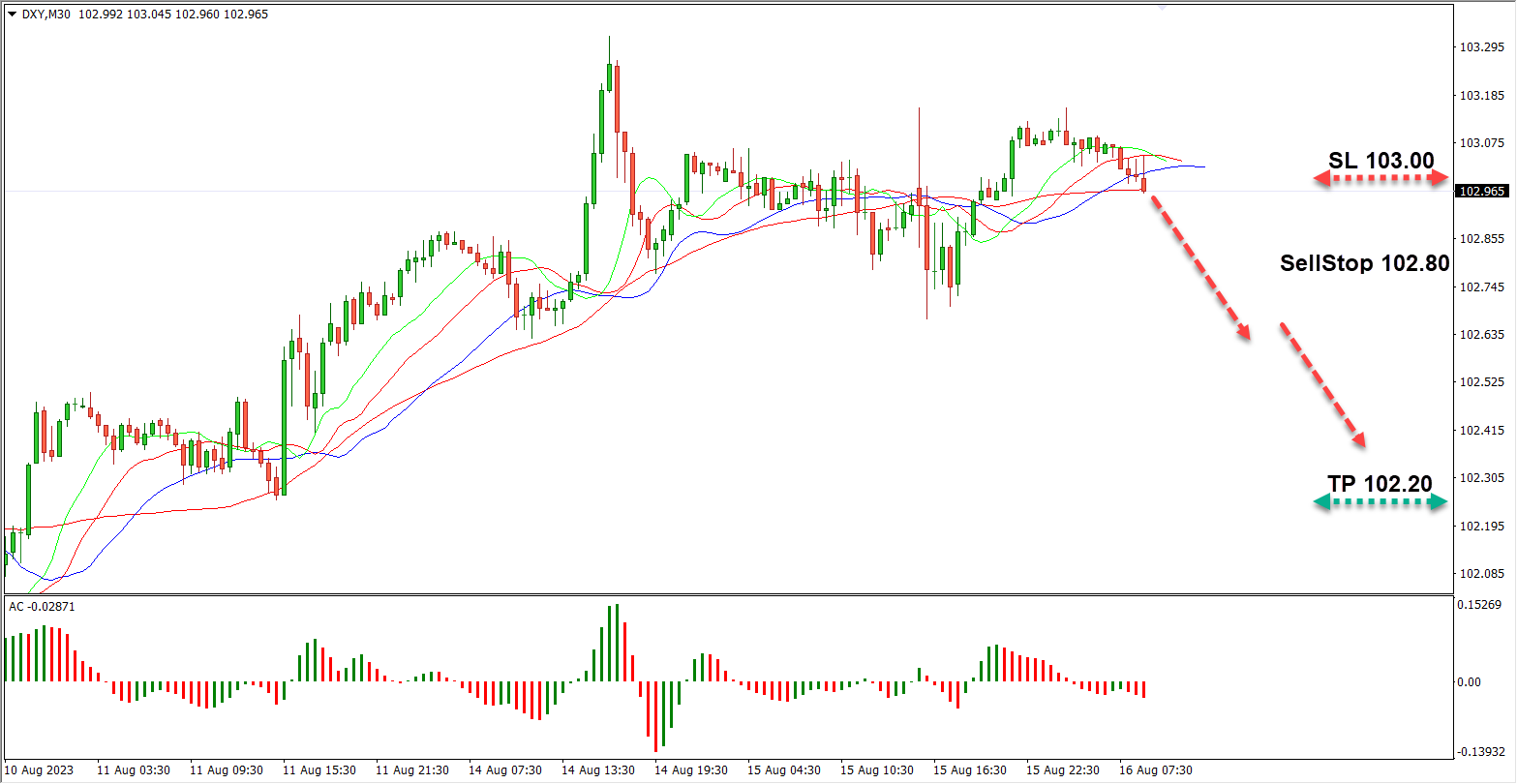

The US dollar index (DXY), a measure of the value of the US dollar relative to a basket of foreign currencies, is currently in a consolidation phase, hovering around the 103.00 mark. The market's attention has been captured by the recently released retail sales data. The numbers painted a positive picture, showing a month-on-month increase of 0.7% - a figure that surpassed the market's expectation of 0.4%. This boost provided the US currency with a necessary lifeline, allowing it to recover from losses sustained during the Asian trading session.

However, the financial world now keenly awaits the minutes from the latest Federal Reserve meeting. Speculation is rife that the voting members of the US central bank could acknowledge the potential end of the ongoing tightening cycle.

Should these minutes corroborate such expectations, the US dollar might once again find itself on shaky ground. Given this looming uncertainty, the prudent recommendation for traders would be to maintain their short positions with a SELL STOP order placed at 102.80, targeting a TP (Take Profit) at 102.20 and an SL (Stop Loss) set firmly at 103.00.

USD/JPY – A Strong Yen Amidst Positive Economic Data

In the currency pair realm, the USD/JPY is presently stationed close to 145.50. Japan's economy, during the second quarter, presented a bullish picture, growing at a rate that left expert forecasts in its wake. On a quarterly scale, we witnessed an expansion of 1.5%, outstripping the predicted 0.8%. This surge results in a staggering 6% growth rate on an annual scale, likely buoyed by a robust 3.2% rebound in Japan’s exports.

Furthermore, Japan's industrial production data for June carried the positive momentum, showing a growth of 2.4%, especially significant when contrasted against the 2.2% decline observed in the previous month.

But there's more; market experts are now bracing for potential foreign exchange interventions from the Bank of Japan, reminiscent of similar actions last year aimed at stabilizing the exchange rate. With these factors in play, the USD/JPY pair seems poised for a potential dip. Recommended action includes a SELL STOP order at 145.20, with a TP at 144.00 and an SL set at 145.60.

BRENT – A Slippery Slope for Oil

Shifting our focus to commodities, Brent crude oil is experiencing a dip, with prices currently pegged at $84.50. Two significant pressures weigh on oil prices. Firstly, the economic data emerging from China, which seems to be losing its steam. Coupled with worries that China's key interest rate cut might not sufficiently boost the national economy's recovery trajectory, oil prices face substantial headwinds. The anticipated US oil inventory report could further dent Brent's position if it shows a rise in crude oil stockpiles.

Another factor providing strength to oil sellers is the rising concern about the global economic climate in the face of soaring worldwide inflation. In light of these factors, a SELL STOP order is recommended at 84.30, targeting a TP at 82.30, and an SL set at 85.00.

In Conclusion

The financial market, with its multifaceted instruments and indices, remains sensitive to global economic indicators, policy decisions, and geopolitical scenarios. As traders and investors, staying informed and interpreting these signals is the key to making informed decisions in an ever-evolving marketplace.