Current State of the Crypto Market The crypto market's capitalization has maintained relative stability, hovering around the 1.045 trillion mark over the past week. Notably, the recent flux in Bitcoin's value - a classic pump and dump scenario - can be directly correlated with events revolving around the Grayscale Bitcoin ETF fund.

For more than a fortnight, Bitcoin has shown consistency, with its value oscillating around $26K. Although there was a tentative effort to climb beyond the 200-day average, substantial selling pressure was evident. This not only underscores the dominance of bearish sentiments but also raises concerns regarding a possible decline, which could bottom out at $25K or even slide further to $24K.

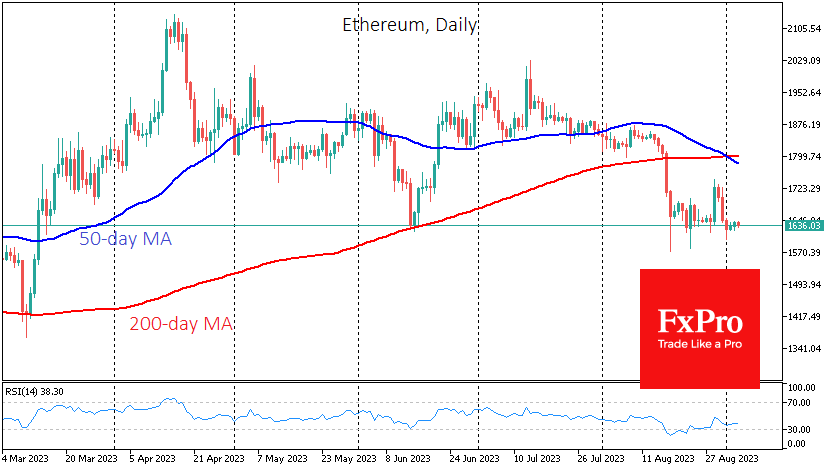

Ethereum's Looming Concerns On analyzing Ethereum's daily charts, the emergence of a "death cross" is unmistakable. This phenomenon, marked by the 50-day moving average descending below the 200-day MA, is historically an ominous sign. This suggests that Ethereum might be headed for further devaluation, reinforcing the bearish trend. However, it's crucial to recognize that Ethereum already appears locally oversold, which might provide some relief to investors. Bitcoin, while still resilient, might be on the brink of witnessing a similar pattern in the coming week, further intensifying market anxieties.

Toncoin's Remarkable Ascent In a stark contrast to the bearish tendencies, Toncoin (TON) showcased a commendable 26% surge within a week. This uptrend catapulted the cryptocurrency to 11th place in CoinMarketCap's capitalization rankings. Adding to its accolades, by August's end, the project network boasted over 3.2 million registered addresses.

Broader Developments in the Cryptosphere August also observed a minor yet consistent deviation in the USDT exchange rate vis-à-vis the US dollar. Such fluctuations have raised eyebrows, with market analytics firm Kaiko expressing concerns. On the flip side, the quotations from USDT's competitors remained largely undeterred.

Bitwise, a notable investment entity, retracted its proposal for launching an ETF rooted in a blend of bitcoin and Ethereum. This decision followed closely on the heels of the SEC's choice to defer its scrutiny of proposals for introducing spot bitcoin ETFs. Adding a glimmer of optimism, Jay Clayton, the erstwhile head of the SEC, voiced his confidence in the inevitable approval of a spot bitcoin-ETF by the regulator, highlighting that the current disparity between futures and spot products is unsustainable.

Intriguingly, despite China's stringent stance on crypto trading since 2017, a recent judicial verdict acknowledged cryptocurrency as a legally safeguarded asset. This is particularly significant given that a fifth of Binance's trading volume reportedly originates from China. Lastly, a study by the crypto exchange KuCoin revealed a surge in crypto investments among the Turkish populace. Amidst soaring inflation rates, an impressive 52% of Turkish residents between 18 to 60 years are now dabbling in cryptocurrencies, marking a 12% rise in the past 18 months. In conclusion, the crypto landscape remains dynamic, oscillating between bullish spurts and bearish undertones. As always, meticulous analysis and staying updated with global trends are imperative for potential investors.