Today's focus centers on the Federal Reserve's deliberations, featuring the quarterly economic projections, the release of the new dot plot, and Jerome Powell's press conference. Beginning with China, the People's Bank of China (PBoC) has left its benchmark rates unchanged, maintaining the one-year and five-year loan prime rates at 3.45% and 4.2%, respectively. The PBoC emphasized the strength of the national economy and hinted at potential future rate cuts, which analysts are betting on. In Japan, the trade balance for August dropped by 66.7%, reaching 930.5 billion yen compared to a 2.79 trillion yen deficit the previous year. The decrease in imports by 17.8% contributed to this improvement, although it was smaller than expected.

Yesterday, the US dollar (USD) faced significant losses until the US market open, with the USDIndex dropping by -0.4% at one point. The USD was particularly weak against currencies like the Canadian dollar (CAD) before recovering most of its losses and closing flat. The EURUSD dropped below 1.07, and the GBPUSD fell below 1.24. US yields reached new highs across the 2, 5, and 10-year maturities, with the latter two hitting levels not seen since 2007. Stocks and indices closed in the red, led by the US30.

Another notable development was in the oil market. Brent crude came close to $96, while Crude surpassed $92, both reaching strong resistance levels that were tested multiple times last year before experiencing a significant pullback. Currently, the US blend is trading at $90.35.

The Fed Meeting: Focus on Dot Plot and SEP

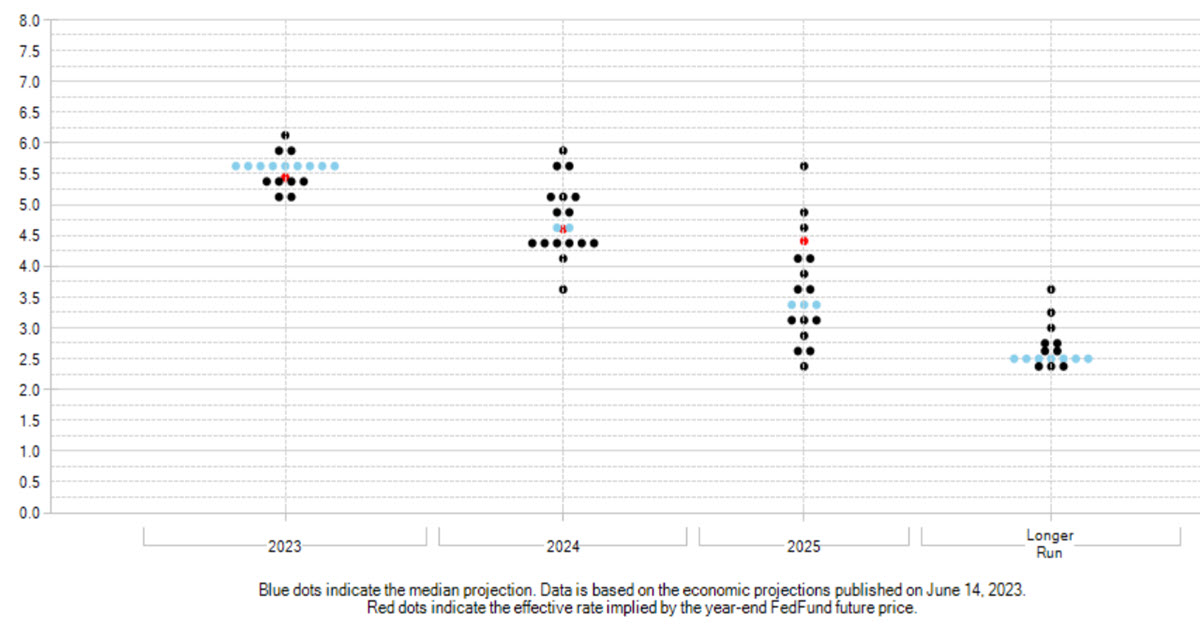

Tonight, the Federal Reserve will hold its meeting, with a 99% probability that the official rate will remain in the 5.25%-5.50% range. This meeting marks the renewal of the Summary of Economic Projections (SEP) and the release of the new Dot Plot, both of which are crucial for understanding future developments. During the conference, Powell may emphasize to the markets that they should not make assumptions about the board members' future actions.

Currency Markets:

- USDIndex is flat at 104.82.

- EURUSD is up +0.05% at 1.0685.

- GBPUSD is down -0.30% at 1.2355.

- USDCAD is up +0.06% at 1.3456.

- USDJPY is flat at 147.88.

- USDCNH is at 7.308.

Stock Markets:

- US Futures are mostly lower (US500 -0.04%, US100 -0.10%, US30 +0.01%).

- GER40 is up +0.10%.

- FRA40 is down -0.09%.

- Electric vehicle maker TIO experienced a -12% decline.

Commodities:

- USOil is down -1.11% at $90.44.

- UKOil is trading at $93.44 after nearing $96 last night.

Precious Metals:

- GOLD is flat at $1931.

Today's Highlights:

- UK CPI, PPI, and Retail Price Index have been released, with the latter exceeding expectations.

- German PPI data is scheduled.

- US Mortgage applications and the EIA Weekly Oil Stocks Change will be reported.

- The Federal Reserve will announce its interest rate decision, release the FOMC Economic Projection, and conduct a press conference.

Interesting Mover:

- USOil is down -1.11% at $90.44, experiencing a pullback after nearing a key resistance level around $92.20. The RSI indicates overbought conditions.