In the world of commodities, few assets garner as much attention as West Texas Intermediate (WTI) oil futures. These futures contracts are instrumental in determining oil prices, impacting global markets, economies, and even geopolitical landscapes. In recent weeks, WTI oil futures have experienced a significant sell-off, leading many to wonder whether this downturn is excessive or if it might be signaling an impending turnaround.

Testing Critical Support in 2023

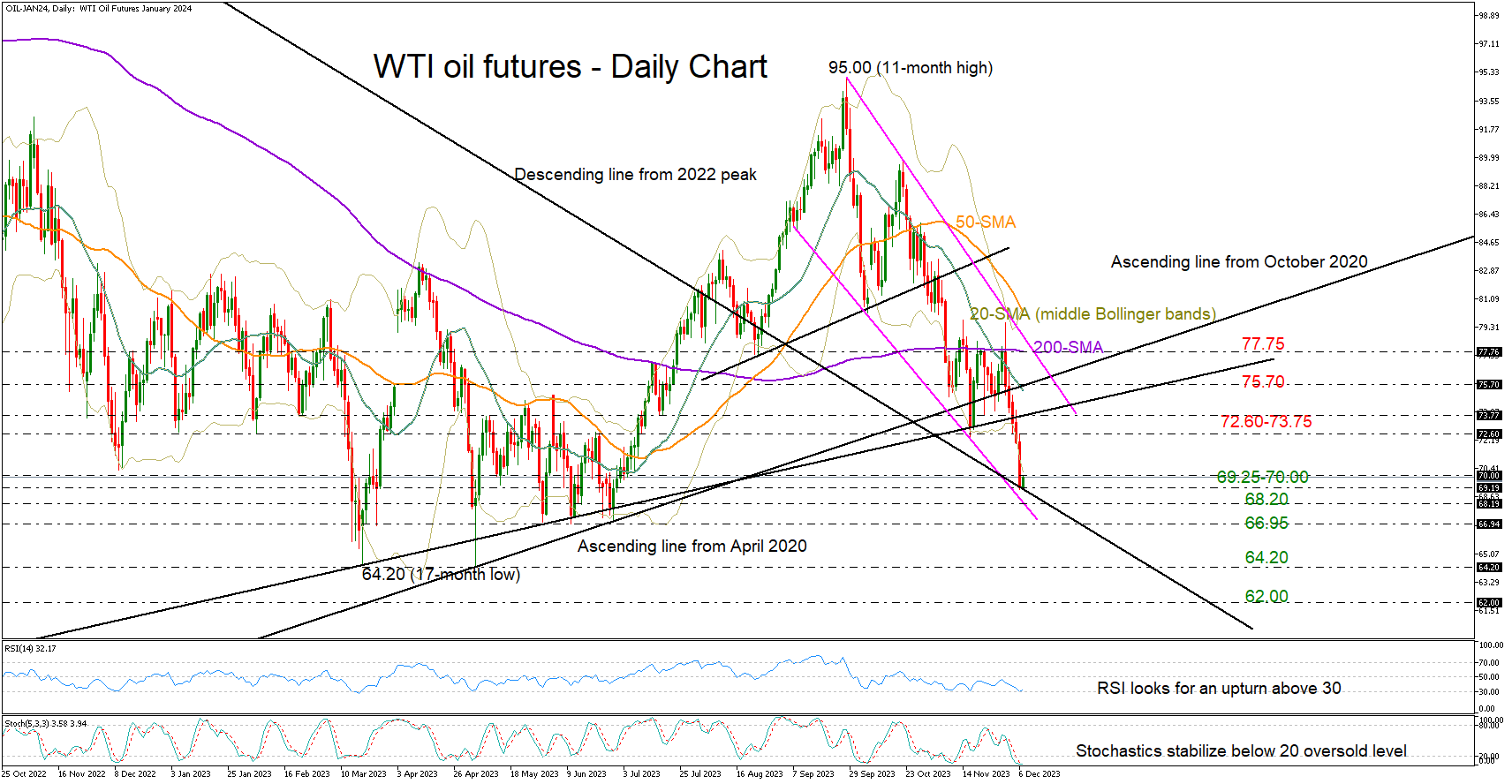

As of Wednesday, WTI oil futures extended their downward spiral to reach a more than four-month low, dipping to $69.10 per barrel. This decline marks the seventh consecutive week of bearish momentum, prompting discussions about the possibility of a bullish correction. Key technical indicators, such as the Relative Strength Index (RSI) and stochastic oscillators, are inching closer to oversold territory, potentially indicating that a reversal to the upside is on the horizon. Additionally, the market has been trading beneath the lower Bollinger band, suggesting that the recent sell-off might have been overdone.

One critical factor to observe is that the market is presently testing the vital 200-period simple moving average (SMA) on the weekly chart, situated at the $70 mark. This moving average had previously halted the downtrend that began after reaching 14-year highs in March. Its ability to prevent a negative outlook revision in 2023 underscores its significance. Consequently, sellers may choose to exercise patience, waiting for a clear weekly close below this crucial threshold before committing further to the bearish side.

Daily Challenges and Potential Support Levels

On the daily timeframe, the price of WTI oil is struggling to climb back above the $70 mark. In the event that downward pressures persist, a potential halt in the decline could occur around the descending trendline originating from September, approximately at $68.20. Further reinforcing this support, the extension of the descending trendline from the 2022 peak could impede the bears around the significant March-June 2023 floor of $66.95. If the bearish trend remains dominant, all eyes will shift towards the 2023 base of $64.20, with the 2021 floor of $62.00 representing a subsequent level of interest.

Exploring a Bullish Scenario

In a more optimistic scenario where the market recovers and extends above $70.00, buyers may drive the price towards the $72.60-$73.75 range. This particular region is significant due to the presence of the ascending trendline originating from the October 2020 low. Slightly higher, the bulls will face the challenge of surpassing the 20-day SMA and the upward-sloping trendline from April 2020, situated around $75.70, to gain direct access to the 200-day SMA at $77.75.

Summing Up

In summary, the WTI oil futures market finds itself in an oversold condition, testing a major support area following a sharp decline. The potential for a continued drop below $70 could exacerbate the current bearish sentiment. On the flip side, a successful recovery above $70.00 could pave the way for a bullish resurgence, though challenges remain on the path to higher prices. As traders and investors navigate these uncertain waters, it's crucial to remain vigilant and consider various scenarios that may shape the future of WTI oil futures.