The US dollar has been facing considerable headwinds lately, with market sentiment increasingly leaning toward the prospect of significant rate cuts by the Federal Reserve. Factors such as disappointing October jobs data and a larger-than-expected inflation slowdown have fueled expectations of monetary policy easing. However, recent remarks from Fed officials have intensified these rate cut bets.

Fed Governor Waller ignited the conversation about potential rate cuts next year when he mentioned that if the decline in inflation continues for several more months, lowering the policy rate could be on the table. This marked a significant shift in Fed rhetoric. Subsequently, Fed Chair Powell's recent comments, though more hawkish than Waller's, suggested that the balance of risks has shifted, with the risks of slowing the economy excessively now seen as equal to the risks of failing to control inflation by not raising interest rates enough.

As a result, Fed funds futures are pricing in a quarter-point rate cut for May, with the probability of a March rate cut approaching 70%. Furthermore, the total expected rate reductions by the end of 2024 have risen to approximately 130 basis points.

Eyes on the US Employment Report for November

With Fed policymakers entering a blackout period ahead of the upcoming policy decision, investors are shifting their focus back to economic data. While Tuesday's non-manufacturing index will be of interest, the highlight of the week is undoubtedly the US employment report for November, scheduled for release on Friday.

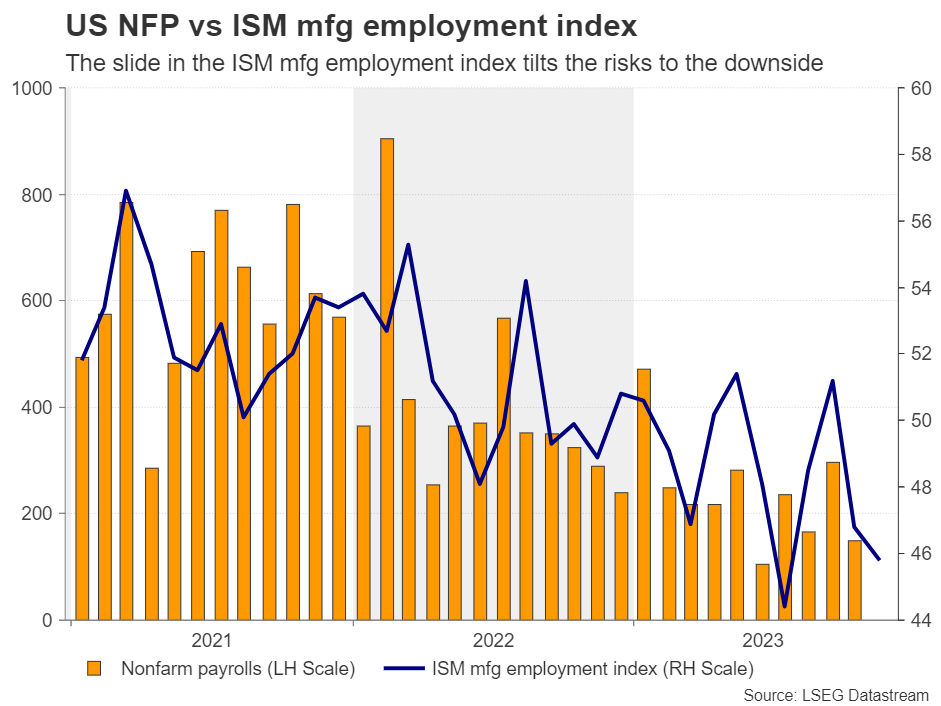

Market expectations for the report include an unchanged unemployment rate at 3.9% and an acceleration in nonfarm payrolls to 180,000 from October's 150,000. However, concerns arise from the fact that the ISM manufacturing PMI indicated a decline in factory employment, suggesting a potential downside risk to the nonfarm payrolls figure if the non-manufacturing survey paints a similar picture.

Even if the forecasts are met, for investors to scale back rate-cut bets, the numbers may need to be accompanied by a reacceleration in wages. This could raise concerns about future inflation and prompt the Fed to maintain higher interest rates for a longer period. However, the forecast for average hourly earnings is for a further slowdown to 4.0% year-on-year from 4.1%, which may solidify rate-cut expectations and weigh on the dollar. Recent market moves suggest that investors are quicker to sell the dollar when data or headlines support their view, rather than buying it on indications supporting the opposite scenario of "higher for longer" rates.

Aussie and Kiwi Shine Amid Rate Expectation Divergence

Anticipations of multiple Fed rate cuts have not only contributed to dollar weakness and lower Treasury yields but also improved risk appetite and boosted stock markets. Lower yields make high-growth firms more attractive, which has benefited risk-linked currencies like the Australian and New Zealand dollars.

Adding to the strength of these currencies is the relatively hawkish stance of the Reserve Bank of New Zealand (RBNZ) at its recent meeting. While the Reserve Bank of Australia (RBA) adopted a softer tone this week, there's still a 20% probability of another hike at the RBA's February meeting. This divergence in policy expectations between the two antipodean central banks and the Fed further supports gains in AUD/USD and NZD/USD.

Technically, after the RBNZ's hawkish hold, NZD/USD extended its recovery against the US dollar, breaching the key level of 0.6130. Although the pair retraced slightly from its recent high around 0.6220, the overall price structure shows higher highs and higher lows above a short-term uptrend line. As long as market sentiment remains bearish on the Fed's future rate path, bulls may target the July 27 peak at 0.6270. A breakout could lead to extensions toward the significant 0.6385 area, which acted as resistance between February and July. To negate the bullish outlook, NZD/USD may need to decline below the confluence of the 200-day exponential moving average and the critical 0.6060 level. Such a move could shift the near-term outlook back to neutral.