Bitcoin, the pioneer cryptocurrency, has been a topic of intense debate and fascination since its inception in 2009. As we stand in late 2023, the question of whether Bitcoin is a good investment remains as relevant as ever. This article aims to provide a comprehensive overview of Bitcoin's investment potential, examining its historical performance, technological foundation, market dynamics, and future outlook.

Understanding Bitcoin's Unique Appeal

Bitcoin emerged as a groundbreaking financial instrument, offering a decentralized and secure digital currency. Its underlying blockchain technology ensures transparent and tamper-proof transactions, setting it apart from traditional fiat currencies. The limited supply of 21 million bitcoins introduces scarcity, a key factor driving its value. As of December 18, 2023, Bitcoin's market cap stands at a staggering $804.66 billion, with a circulating supply of approximately 19.57 million BTC.

Investing in Bitcoin: A Historical Perspective

Bitcoin's journey has been characterized by extreme volatility and remarkable resilience. From its humble beginnings, when the first recorded price was a mere $0.003, Bitcoin reached an all-time high of $67,567 in 2021. This dramatic growth trajectory, however, has been punctuated by significant price corrections, underscoring the asset's volatile nature.

The year 2020 marked a turning point for Bitcoin as global economic uncertainties and inflation fears propelled investors towards this digital gold. Bitcoin's appeal as a hedge against inflation was further solidified in this period. Its deflationary nature, juxtaposed against massive fiat currency printing, made it an attractive store of value.

2024 Outlook: Is Bitcoin a Viable Investment?

Looking ahead to 2024, Bitcoin's investment potential is influenced by several key factors:

- Historical Growth Patterns: Despite past volatility, Bitcoin's long-term growth trajectory suggests potential for future appreciation. However, predicting its exact path remains challenging due to the dynamic nature of the crypto market.

- Technological Advancements: Bitcoin's network is continually evolving, with developments like the Lightning Network enhancing its scalability and usability. These improvements could bolster investor confidence and adoption.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies is still uncertain. Positive developments in this arena could boost investor sentiment, while adverse regulatory actions could hamper Bitcoin's growth.

- Market Sentiment: Investor sentiment plays a crucial role in Bitcoin's price movements. Factors like institutional adoption, media coverage, and overall market dynamics will continue to influence its investment viability.

Bitcoin Halving and Price Implications

The upcoming Bitcoin halving in May 2024 is a critical event to watch. Historically, halving events, which reduce the rate of new Bitcoin creation, have led to significant price increases. While past performance is not indicative of future results, this event could potentially trigger another bullish cycle for Bitcoin.

Investment Strategies for Bitcoin

Investors considering Bitcoin have multiple approaches:

- Long-Term Holding: Buying and holding Bitcoin for the long term has been a popular strategy, given its potential as a digital store of value.

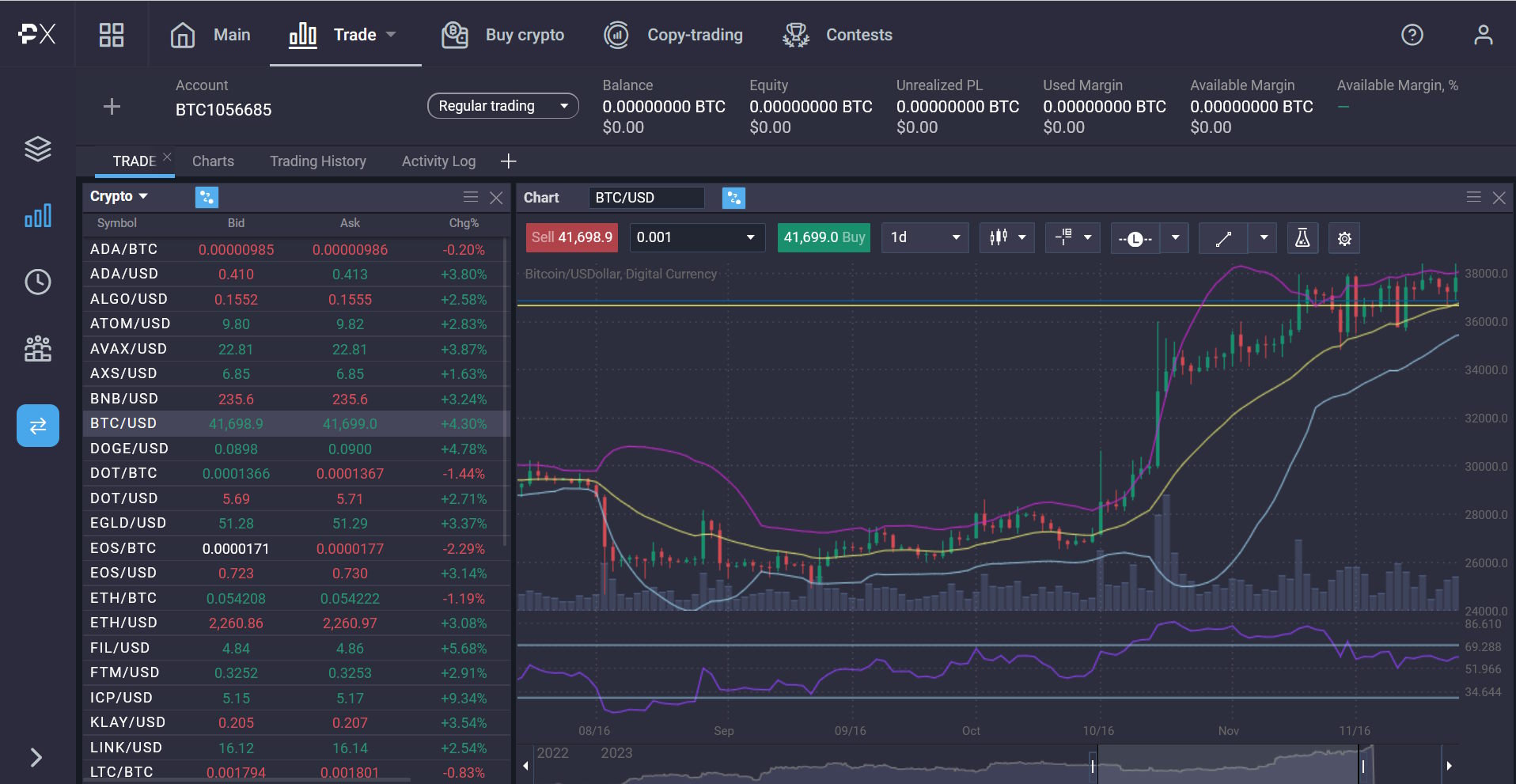

- Active Trading: Given Bitcoin's volatility, active trading can offer opportunities for short-term gains. Technical analysis can provide insights into market trends and potential entry/exit points.

Weighing the Pros and Cons

Investing in Bitcoin comes with its set of advantages and risks:

Pros:

- High Potential Returns: Bitcoin has demonstrated the capacity for substantial returns, outperforming traditional assets in certain periods.

- Inflation Hedge: Bitcoin's capped supply makes it an attractive hedge against inflation and currency devaluation.

Cons:

- Volatility: Bitcoin's price can experience sharp fluctuations, posing risks for investors.

- Regulatory Uncertainty: The evolving regulatory landscape can impact Bitcoin's market dynamics and investor sentiment.

Determining Investment Size

Deciding how much to invest in Bitcoin depends on individual risk tolerance and financial goals. As with any investment, it's prudent not to invest more than one can afford to lose. Diversifying one's portfolio to include Bitcoin can be a strategy to mitigate risk while tapping into its potential growth.

Conclusion: Bitcoin's Place in Your Investment Portfolio

In conclusion, Bitcoin presents a unique investment opportunity with the potential for high returns. However, its volatile nature and regulatory uncertainties necessitate a cautious approach. Investors should conduct thorough research, stay informed about market trends, and consider Bitcoin as part of a diversified investment strategy. As the cryptocurrency landscape continues to evolve, Bitcoin's role as a pioneering digital asset will undoubtedly remain a topic of keen interest among investors.