The year 2023 has emerged as a landmark period in global financial markets, marked by a series of critical events that have significantly altered the economic landscape. From groundbreaking technological advancements to seismic shifts in the geopolitical arena, this year has been a testament to the dynamic and interconnected nature of the world's financial systems. This article aims to provide a detailed analysis of the five key events of 2023 that have had a profound impact on the markets, offering insights into their implications for traders and investors.

The Artificial Intelligence Revolution

In 2023, the field of artificial intelligence (AI) reached new heights, profoundly influencing various industries. The year was particularly notable for the launch of OpenAI’s ChatGPT-4, a landmark in AI technology, which raised pivotal questions about the future of work and labor market dynamics.

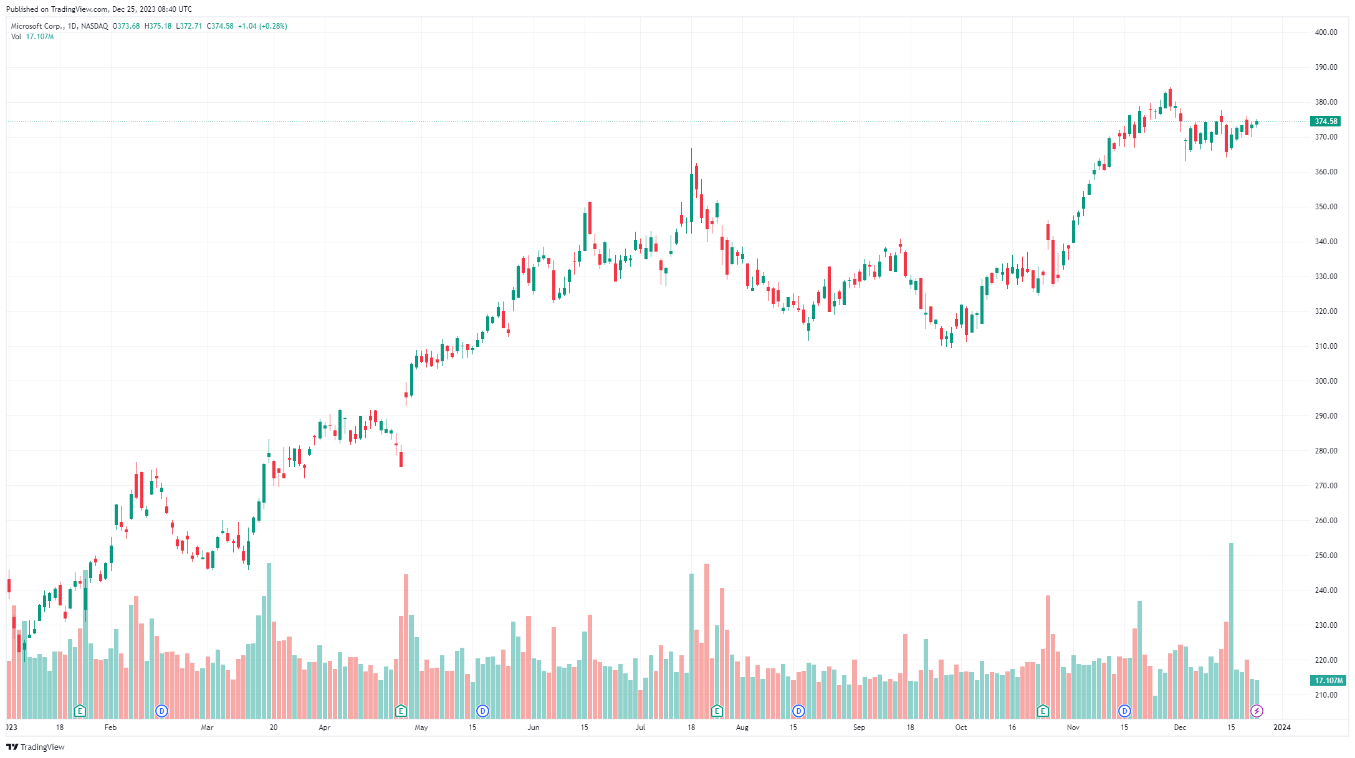

Microsoft Price Chart 2023

Microsoft, a significant investor in OpenAI, experienced a notable increase in its stock value following the launch, highlighting the market's enthusiasm for this technological advancement. Additionally, the ongoing semiconductor shortage, a legacy of the pandemic era, continued to challenge global production and supply chains, affecting costs and causing disruptions. Nvidia, a key player in AI chip production, benefited from these market conditions, seeing substantial revenue growth, particularly in its data center business, which significantly boosted its stock value.

Global Banking Crises

The financial sector faced turbulence in 2023, starting with the collapse of Silicon Valley Bank (SVB) and followed by the closure of Signature Bank. These events triggered a domino effect in the banking industry, leading to a significant drop in the shares of First Republic Bank and the eventual closure and acquisition of the bank by JPMorgan Chase.

Internationally, the crisis extended to Switzerland, where Credit Suisse experienced a downfall and subsequent acquisition by Union Bank of Switzerland (UBS). These events not only shook the global financial markets but also brought into focus concerns about employment stability in the banking sector.

OPEC's Strategic Production Cuts

OPEC and its allies made significant decisions to manage oil production throughout the year, influencing global oil prices. These cuts, aimed at stabilizing the market, led to increased inflationary pressures and heightened concerns about a potential global recession. The decisions by OPEC underscored its critical role in the global energy market and its influence on economic stability.

US Federal Reserve Interest Rate Hikes

In response to inflation, the US Federal Reserve implemented several interest rate hikes throughout 2023, affecting bond yields and making borrowing more expensive. These hikes had a considerable impact on the stock market, particularly affecting growth stocks and technology companies. The Federal Reserve's decisions reflected a cautious approach to managing inflation and economic growth.

Geopolitical Developments

The year also witnessed significant geopolitical events, such as the conflict between Israel and Hamas. This unexpected escalation of hostilities led to increased market volatility, with investors turning towards safe-haven assets like gold, US Treasury bonds, and stable currencies like the Japanese yen, US dollar, and Swiss Franc. Oil prices also saw an upswing, while stock markets initially faced a decline.

Conclusion

The year 2023 stands as a pivotal chapter in the history of global markets, shaped by transformative events in technology, finance, energy, and geopolitics. These developments have underscored the complex interplay between various global economic systems and the need for adaptive strategies in an ever-evolving market landscape. As we move forward, the lessons learned from these events will be crucial in navigating future market challenges and opportunities.