The optimism that initially surrounded the anticipation of significant U.S. central bank easing in 2024 has given way to a more pessimistic tone in the gold market. Recent statements from key figures and economic indicators have caused a shift in sentiment and raised questions about the future direction of gold prices. Just a few weeks ago, the prevailing sentiment in the markets suggested that the U.S. central bank would implement a substantial 160 basis points of easing in 2024. However, these expectations have undergone a significant transformation, leading to a bearish reversal in the gold market.

The primary catalyst for this change in outlook has been the statements made by Atlanta Federal Reserve President Raphael Bostic. President Bostic's remarks emphasized that policymakers might not initiate rate cuts until the third quarter of the year, dampening hopes of swift and aggressive monetary easing. This shift in timeline has had a direct impact on gold's support levels and has contributed to a more subdued overall outlook for the precious metal.

Furthermore, the recent report from the Labor Department revealing that initial jobless claims have reached their lowest level since September 2022 suggests a tightening labor market. A robust labor market diminishes the immediate need for rate cuts, further undermining gold's bullish case.

Technical Indicators and Support Levels

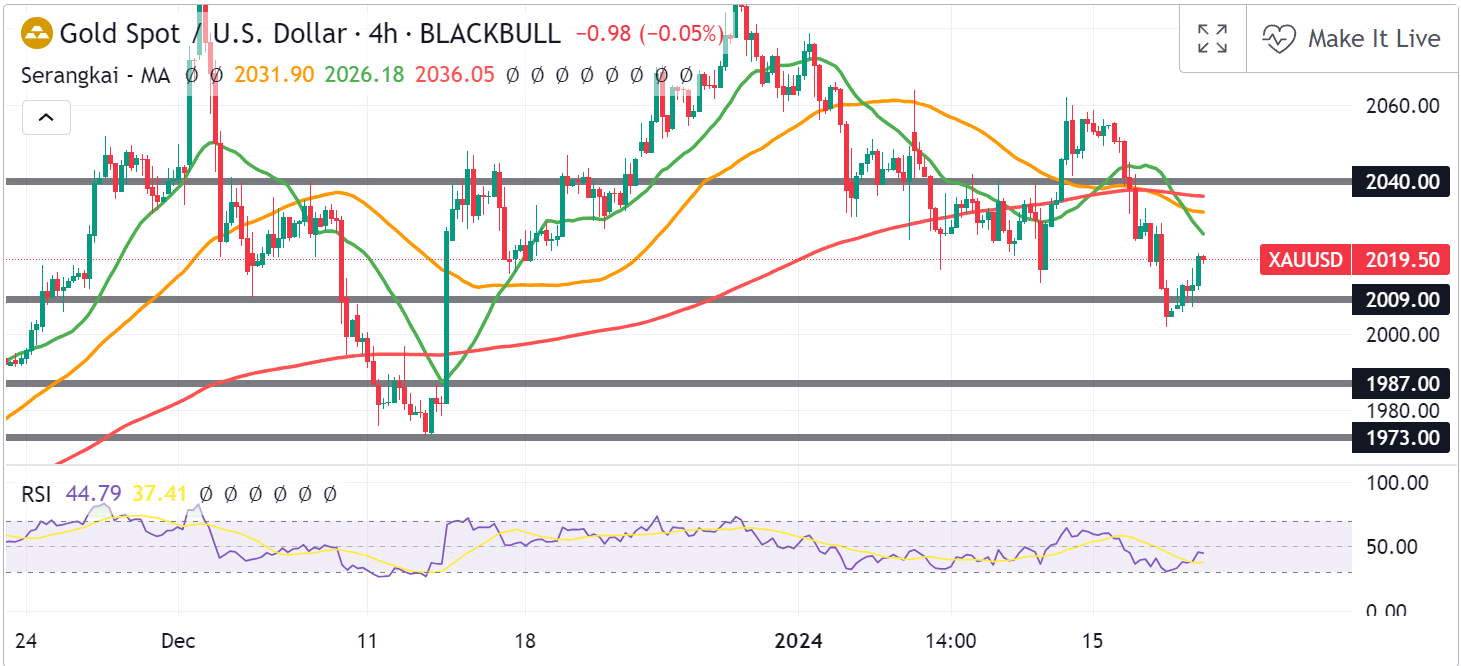

The recent sell-off in gold has had a notable impact on its technical indicators. The spot price has slipped below both the 20-day and 50-day simple moving averages, intensifying the negative sentiment surrounding the precious metal. While technical indicators have weakened in their bearish stance, they have yet to provide a clear signal of a potential bottom, remaining in negative territory.

The next crucial level of support for gold is situated at $2,009 per ounce, with a subsequent support level at $1,987 per ounce. To maintain a cautiously optimistic perspective over the long term, it is essential to monitor whether gold can hold above the last higher low at $1,973 per ounce. A more significant rebound in gold's fortunes would require the metal to surpass the $2,040 per ounce mark. However, as of now, there is no clear catalyst or compelling reason for gold to make a sustained move back to this level, making such an outcome appear somewhat overly optimistic.

Conclusion

The gold market's outlook has shifted from initial optimism to a more pessimistic stance due to changing expectations regarding U.S. central bank actions and positive economic indicators. While technical indicators have weakened, they have yet to signal a clear bottom, leaving the precious metal in a state of uncertainty.

Investors and traders in the gold market should exercise caution and closely monitor key support levels, particularly the $1,973 per ounce threshold. The path forward for gold remains uncertain, and any potential bullish resurgence would likely require a significant change in economic conditions or central bank policies. As such, maintaining a balanced and vigilant approach to gold trading is prudent in the current environment.