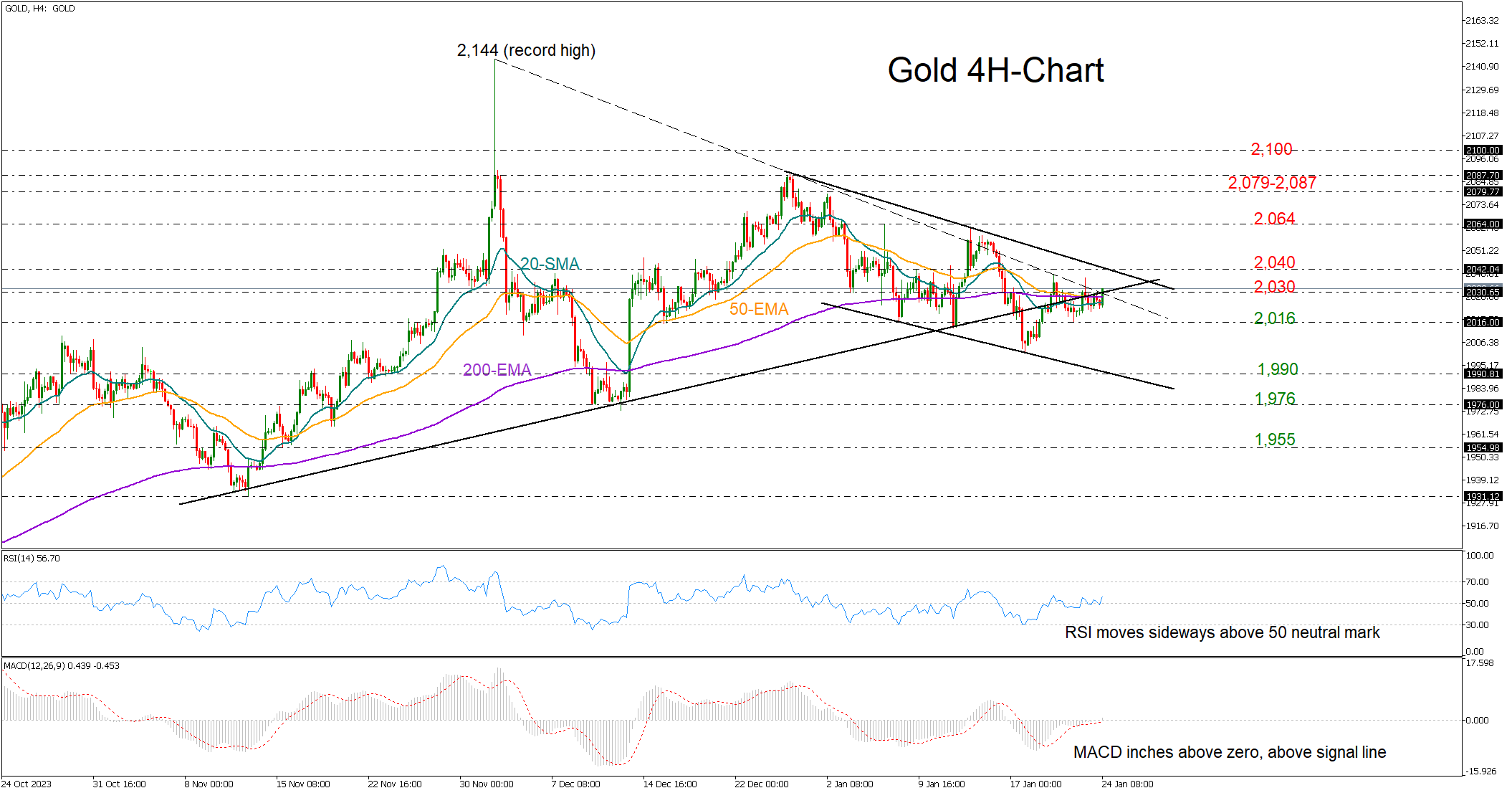

Gold currently finds itself navigating a challenging landscape, marked by its inability to break through critical resistance levels ahead of the forthcoming Federal Open Market Committee (FOMC) policy announcement. Despite some technical indicators suggesting a neutral-to-bullish bias, the precious metal's failure to sustain a meaningful rally underscores a cautious market sentiment. This week, gold prices have oscillated within a narrow range between 2,016 and 2,030, struggling to attract sufficient buying momentum to close convincingly above key technical markers. Notably, gold has been unable to breach its exponential moving averages (EMAs) on the four-hour chart or to reclaim the broken support trendline from November. These technical hurdles paint a picture of a metal caught in a delicate balance, with traders weighing every new development cautiously.

The technical outlook, while displaying some bullish undertones, is far from decisively positive. The Relative Strength Index (RSI) is hovering above its 50 neutral mark, indicating a lack of strong downward momentum, while the Moving Average Convergence Divergence (MACD) is flirting with the positive territory. However, these signals are somewhat muted by the fact that gold's consolidation is occurring within a broader monthly bearish channel. This channel formation could act as a barrier to any significant bullish advancements, potentially capping gains near the 2,040 level.

For gold to embark on a more robust rally, a decisive close above the 2,040 resistance is crucial. Such a breakout could pave the way for a surge towards the 2,065 constriction zone. Beyond this level, the metal might aim to retest the significant range of 2,079-2,087, seen in December, before potentially challenging the psychologically important 2,100 mark. A breach of this threshold would then put gold on a path to reapproach its record high of 2,144.

Conversely, a downturn that sees gold falling below the 2,016 support level could trigger a fresh wave of bearish momentum. This decline might extend towards the lower boundary of the current bearish channel, located around 1,990, with further losses potentially revisiting the December low near 1,976. In summary, while gold shows some potential for upward movement, its path is fraught with technical challenges and market uncertainties. A definitive breakout above the bearish channel and the 2,040 resistance level is necessary to alleviate downside risks and to signal a shift towards a more confidently bullish trajectory.