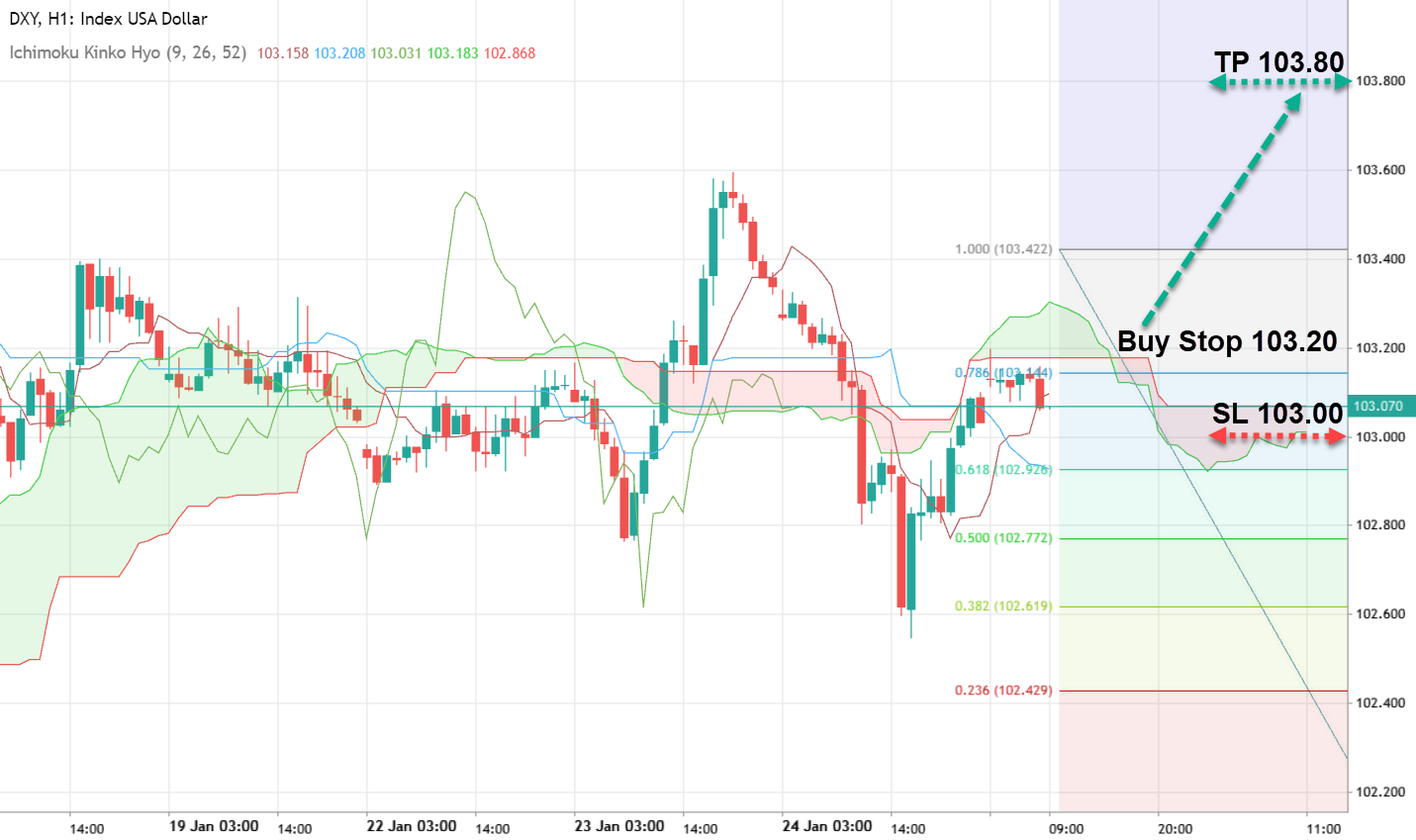

The dollar index is maintaining its position near the 103.00 mark, and market sentiment surrounding the US currency remains a topic of keen interest among traders and analysts. A recent Reuters poll has shed light on expectations regarding the Federal Reserve's potential interest rate actions. The prevailing consensus among respondents suggests that the Federal Reserve may initiate interest rate cuts from the current level of 5.50% in the next quarter, possibly as early as June. However, this move could be postponed to the latter half of the year should consumer prices continue their upward trajectory.

Today, traders are closely monitoring a barrage of economic data, including initial jobless claims, durable goods orders, and GDP figures. Forecasts indicate that this data may not disappoint, potentially lending additional support to the US dollar.

Dollar Index Buy Stop: 103.20 / Take Profit: 103.80 / Stop Loss: 103.00

GBP/USD: Pound Shows Strength Amid Positive Macroeconomic Data

The GBP/USD currency pair has recently surged, updating its local high and trading at the 1.2710 level. This resurgence in the pound's value can be attributed to encouraging macroeconomic data. Notably, the services sector's Business Activity Index has risen to 53.8 points, surpassing the previous reading of 53.4. Additionally, the manufacturing Purchasing Managers' Index (PMI) has increased to 47.3, while the composite index has reached 52.5 points. This upturn in business activity suggests that the British economy may be able to steer clear of a recession. Consequently, the Bank of England now has the opportunity to focus on addressing the issue of high inflation and maintaining a high-interest rate stance over an extended period. Given these circumstances, the GBP/USD pair's upward trajectory is poised to continue.

GBP/USD Buy Stop: 1.2740 / Take Profit: 1.2800 / Stop Loss: 1.2710

USD/CAD: Bank of Canada Holds Rates Steady, Eyes on Economic Recovery

The USD/CAD currency pair is currently trading at 1.3520. As widely anticipated, the Bank of Canada has opted to keep interest rates unchanged at 5%. Bank of Canada Governor Macklem emphasized the central bank's substantial progress in curbing inflation, reassuring that additional rate hikes are not currently under consideration. Instead, the focus has shifted towards bolstering economic recovery. This hint at a potential shift in monetary policy has caught the attention of traders, who are interpreting it as a possible precursor to easing measures. Additionally, the USD/CAD pair continues to benefit from a robust US dollar, bolstered by positive macroeconomic reports. In light of these factors, the USD/CAD pair could aim for the 1.3600 level.

USD/CAD Buy Stop: 1.3530 / Take Profit: 1.3600 / Stop Loss: 1.3500

In conclusion, the dollar's trajectory remains a subject of intense scrutiny, with potential interest rate cuts on the horizon. The GBP/USD pair is enjoying renewed strength, thanks to promising macroeconomic data and the possibility of an extended high-interest rate environment in the UK. Meanwhile, the USD/CAD pair is benefiting from the Bank of Canada's focus on economic recovery and the overall strength of the US dollar. Traders and investors will continue to closely monitor these dynamics to gauge the dollar's outlook as the day unfolds