In the bustling corridors of the financial world, short-term trading stands out as a high-octane race, demanding lightning-fast reflexes, unwavering focus, and an adept understanding of market nuances. This trading style, punctuated by quick turnarounds and razor-sharp judgments, requires traders to tap into the pulse of momentary market shifts, all to seize profit-making opportunities that might evaporate in mere minutes.

In this comprehensive guide, we aim to elevate the discourse surrounding short-term trading analysis. From the experienced trader on the quest for deeper insights to the budding enthusiast eager to demystify the fast-paced whirlwind of the markets, we delve into a plethora of strategies, methodologies, and cutting-edge tools tailored to enhance one's proficiency in reading the short-term market winds.

The arena of short-term trading is rife with both unparalleled potential rewards and formidable risks. The double-edged sword of volatility demands respect and readiness. To thrive in this environment, one must master the art of assimilating vast swathes of data on-the-fly, spotting emergent trends, and making pinpointed trade decisions with unwavering confidence. Embark with us on this enlightening expedition as we dissect the pillars of adept short-term trading analysis. Our mission? To arm you with a robust toolkit, ensuring you are well-prepared to traverse the exhilarating yet demanding terrains of short-term trading with finesse and foresight.

A Multifaceted Approach to Chart Time Frames Exploration

In the intricate mosaic of financial markets, the careful dissection of multiple chart time frames stands out as a fundamental pillar of astute analysis. Adopting a tunnel vision approach by focusing merely on a single, constricted time frame can inadvertently shroud potential market avenues from view. Conversely, an exclusive emphasis on protracted time frames might obscure critical nuances and imminent opportunities. Therefore, a harmonized examination of various temporal scales is indispensable, as it furnishes a panoramic vista of market trends and serves as the bedrock for judicious investment decisions.

Take, for instance, the meticulous scrutiny of a stock chart. To truly grasp its narrative, one must unravel its story through disparate lenses: from the immediacy of 30-minute snapshots to the broader tableau of 4-hour intervals.

For those inclined towards the short-term, tools like the Simple Moving Average (SMA) and Relative Strength Index (RSI) become instrumental in discerning the stock's trajectory. These varied time scales, acting as your navigational compass, empower you to pinpoint optimal entry corridors and to adroitly surf the trend wave, alighting gracefully at the first hint of a bearish undertow.

Deciphering the Language of Chart Patterns

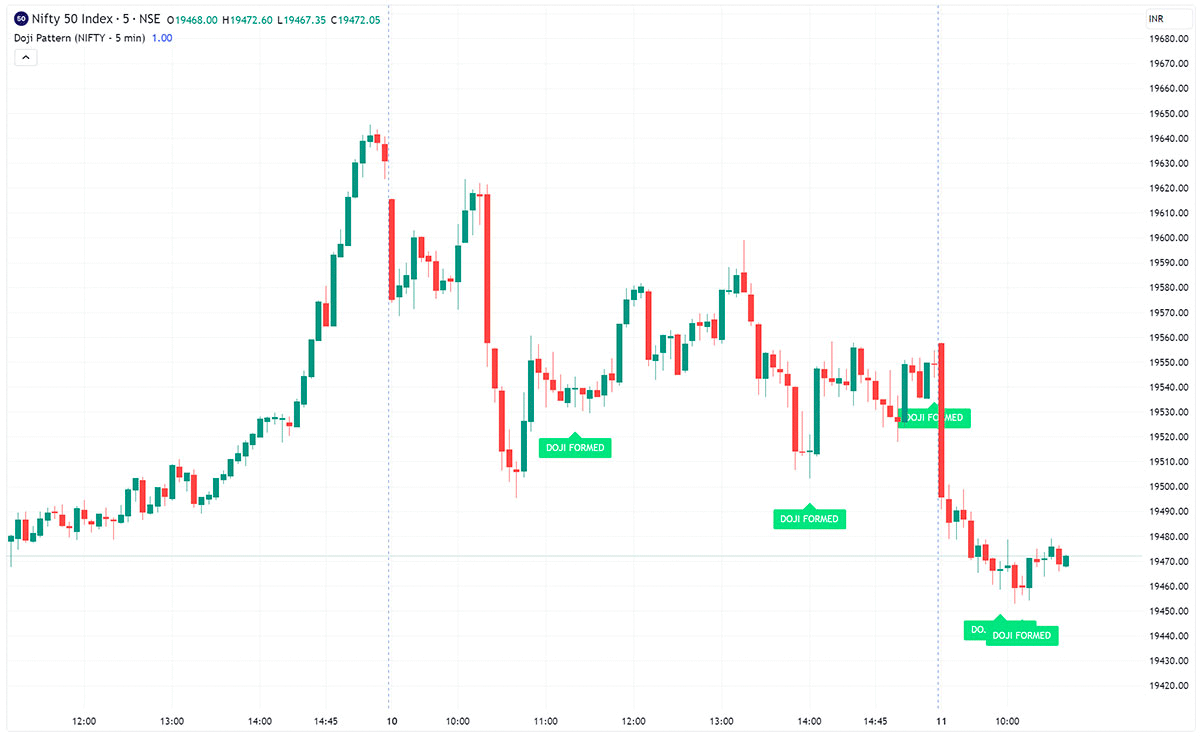

To master the art of technical analysis is to become fluent in the nuanced language of chart patterns. This requires a constant, eagle-eyed vigil over the ebb and flow of market tides, encompassing ascents, descents, and those tranquil phases of lateral drift. These rhythmic patterns, in their unique choreography, hold the key to unlocking market secrets.

A seasoned trader's arsenal is enriched by an intimate familiarity with both reversal and continuation patterns, the hallmarks of candlestick chart topography. And while it remains prudent to cross-verify pattern intimations with supplementary indicators or analytical methodologies, these patterns, in their eloquence, can illuminate the overarching market zeitgeist, guiding traders through the labyrinthine corridors of long-term market prognostications.

Mastering the Art of Tailored Indicator Selection

In the vast landscape of trading, the compass directing your course is often the indicators you employ. The challenge, however, lies in calibrating these instruments according to your unique expedition. A recurrent dilemma among traders is determining the ideal settings for these indicators. While finer settings lend greater sensitivity to the indicator, their broader counterparts trade sensitivity for enhanced precision, offering signals that are more trustworthy, though not without exceptions. Take the RSI (Relative Strength Index) as an exemplar. Though standard benchmarks like 70/30 or 80/20 are frequently employed, it's imperative to remember that expansive settings might be sluggish in reflecting the real-time ebb and flow of the market.

The golden rule in this realm is to mold these indicators, not as per general conventions, but in a way that resonates with your idiosyncratic trading ethos.

The Imperative of Astute Decision-Making

The adrenaline-charged arena of short-term trading, characterized by fleeting contracts, demands not just decisions, but decisions at the speed of light. Paralysis by analysis is a real peril here. Every moment of hesitation or over-deliberation can equate to a missed golden opportunity, and consequently, unrealized gains. The essence of triumphant short-term trading is not just swift action but coupling it with forethought, ensuring each move is neither rash nor tardy.

Differentiating short-term trading from its long-term counterpart is pivotal. The former mandates an eagle-eyed focus on candlestick configurations and an adeptness at customizing indicators. But beyond tools and techniques, the essence lies in mastering rapid, yet well-thought-out decision-making, making it the very cornerstone of successful short-term trading.

Final Thoughts: Navigating the High-Octane World of Short-Term Trading

Embarking on the adventure of short-term trading is akin to navigating a tempestuous sea—full of exhilarating highs and daunting lows. Through the course of this discourse, we've meticulously unpacked a toolkit of strategies and insights, tailored both for the grizzled trading veterans and those taking their initial steps into this dynamic landscape. Short-term trading, with its innate unpredictability, is a tapestry woven from the threads of market volatility. The beacon of success in this realm is not just the acquisition of knowledge but the agility to apply it—sifting through data torrents, discerning emerging patterns, and making resolute decisions with alacrity. Furnished with these insights, you stand poised to traverse the labyrinthine corridors of short-term trading, executing decisions with the precision of a maestro.

As a beacon to guide your journey, always be mindful of the essentials: the importance of diversifying your analytical lens across multiple chart durations, the art of discerning chart narratives, and the finesse of calibrating indicators to echo your unique trading rhythm. In the ephemeral world of short-term trading, where windows of opportunity open and close with mercurial swiftness, decisiveness becomes your most trusted ally.

In conclusion, this exposition serves not merely as a guide but as a compass, orienting you towards success in the electrifying arena of short-term trading. Commit to the craft, hone your skills with unwavering dedication, and set sail on a fulfilling odyssey in the financial seas.