The AUDUSD currency pair, a prominent player in the forex market, has exhibited notable price movements that have captured the attention of traders and market analysts alike. Recently, it demonstrated a significant reversal from a pivotal support level, paving the way for potential future trajectories. In recent trading activities, the Australian Dollar (AUD) has showcased a noteworthy uptick, marking gains for two consecutive days against the formidable US Dollar. This bullish movement on Tuesday can largely be traced back to the anticipatory atmosphere surrounding the release of the Reserve Bank of Australia (RBA) minutes from their October 2023 meeting.

Central Bank Deliberations

The decision-making process at the heart of Australia's central bank was intensely focused on a pivotal choice: should they elevate interest rates by a quarter-percentage point (25 basis points) or uphold the status quo? With the myriad of economic indicators at play, the RBA's board members arrived at the consensus that the scales tipped in favor of maintaining the current rate. Their resolution was not arbitrary; it was rooted in key determinants like the imminent inflation metrics, employment statistics, and the forthcoming forecasts slated for the November session.

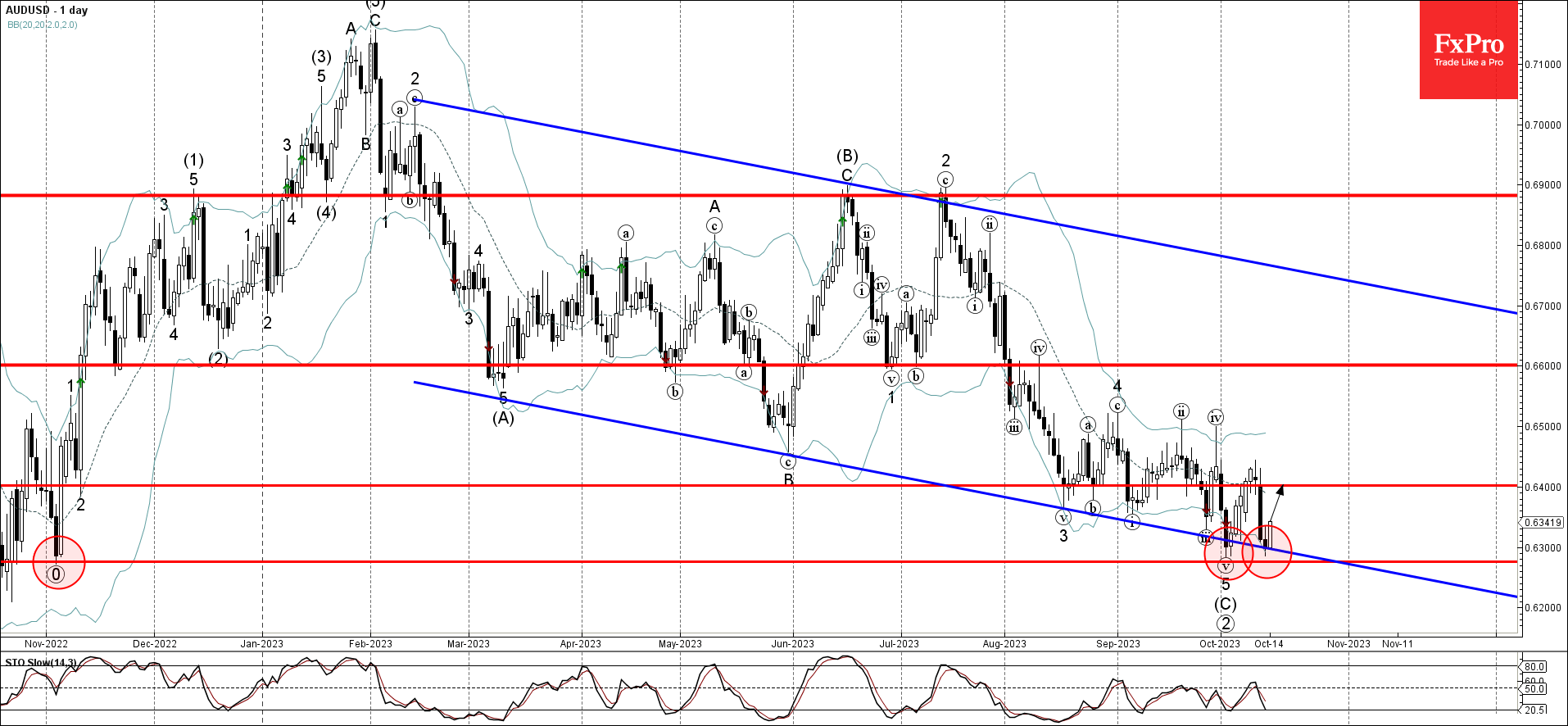

- Historical Context: The AUDUSD found a crucial support at the 0.6300 mark. This wasn't just any ordinary level; it was the same threshold that marked the monthly low in November. Its significance was further underscored by its alignment with the support trendline of the protracted weekly downward channel that's been in play since February. Such confluences often act as strong magnets or repulsion points for price actions, making them focal points for traders.

- Technical Reinforcements: In the realm of technical analysis, the Bollinger Bands are key tools that traders use to gauge volatility and potential overbought or oversold conditions. For AUDUSD, the support level of 0.6300 was further buttressed by the lower daily Bollinger Band. This confluence of support mechanisms often serves as a strong signal for traders, suggesting that the price has a reduced probability of dropping further and may instead look for an upward trajectory.

- Anticipated Movements: Given the robust nature of the 0.6300 support level, and considering the multiple technical factors bolstering it, there's a heightened expectation that AUDUSD might embark on an upward journey. The immediate target on the radar for most traders would be the resistance level at 0.6400. Should the pair garner enough momentum, this resistance might be the next significant pitstop, and potentially even a launching point for further bullish endeavors.

Inflation Concerns in the Spotlight

The minutes from the RBA meeting unveiled a salient point - board members harbored palpable apprehensions regarding the potential upside risks tied to inflation. This nuance is critical, shedding light on the bank's conservative stance. It reveals a preemptive approach, indicating that the board remains vigilant, ever-watchful for variables that might exacerbate inflationary pressures.

The US Dollar and the Fed's Position: Meanwhile, the US Dollar Index (DXY) confronts bearish forces. The downward inclination can be linked to the relatively dovish remarks echoed by a series of Federal Reserve officials. The undercurrent of their statements alludes to a projection where interest rate hikes may not feature on the horizon for the remaining part of 2023. This dovish tilt underscores the Federal Reserve's prudent modus operandi, suggesting a hesitancy to constrict monetary policy amidst the prevailing economic milieu.

Providing further depth to this narrative, Federal Reserve Bank of Philadelphia's President, Patrick Harker, voiced his perspective on Monday. Harker articulated a viewpoint championing economic stability, suggesting that the central bank should steer clear of instigating additional economic strains through augmented borrowing costs. He accentuated that barring a transformative shift in economic indicators, the Federal Reserve's optimal course would be to sustain interest rates at their extant benchmarks.

In conclusion, the AUDUSD's recent activities underscore the significance of key support and resistance levels, and how multiple technical indicators converging at these points can offer traders insights into potential future price movements. As always, while technical analysis provides a roadmap, the market's inherent unpredictability requires traders to proceed with caution and due diligence.