The Australian dollar has faced a notable depreciation, exceeding a 1% loss in a single trading session. The selloff marks a moment of realization for traders who have been weighing the implications of the latest monetary policy adjustments. The Reserve Bank of Australia's (RBA) decision to hike the key interest rate by 25 basis points to 4.35%—the highest in over a decade—was expectedly received by the market. Such a move traditionally boosts a currency's appeal, reflecting a robust anti-inflationary stance. However, the AUDUSD pair's reaction was counterintuitive; the currency faltered, descending to critical levels that underscore the market's discomfort.

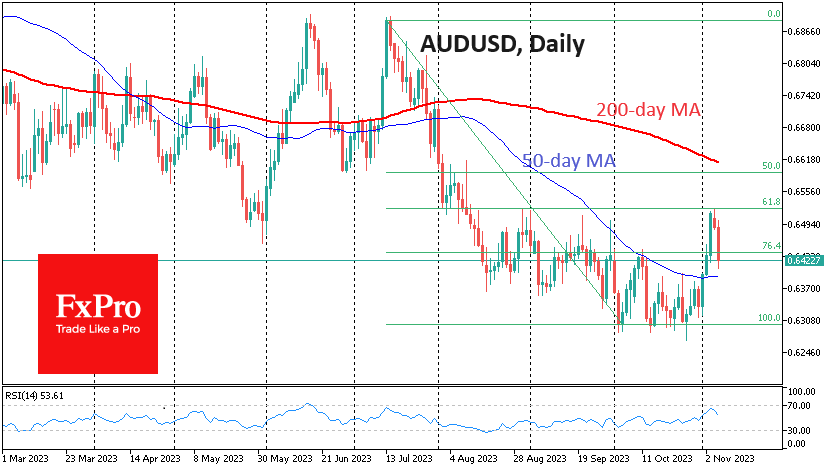

Despite the interest rate reaching a 12-year pinnacle, AUDUSD's brush with the 0.6500 threshold triggered a sharp reversal. The downturn was swift, with the pair tumbling below the 0.64 mark temporarily.

Central Bank's Caution Triggers Market Jitters

The RBA's policy statement revealed an essential tone of caution. Acknowledging the need for a tightened policy to rein in inflation, the authority stopped short of signaling a steadfast commitment to continued rate increases. This ambiguity likely served as a catalyst for the Australian dollar's retreat, as investors priced in the uncertainty of future monetary policy direction.

Technical Perspective: Critical Levels to Watch

From a technical analysis standpoint, AUDUSD's performance in November had been positive, posting a 2.8% gain, which translates to approximately 180 pips from its October base. However, the recent downturn seems to carry more weight than a mere pullback from these gains. The focus is now on the 0.6390 price area, where the 50-day moving average lies—a pivotal indicator for short-term trend direction. A sustained move below this level could invalidate the recent bullish rally, painting it as a "false dawn" and setting the stage for a deeper plunge towards the 0.6300 region.

Furthermore, should the Aussie capitulate beneath this support, there looms a potential slide under the psychologically significant 0.60 level. This bearish scenario gains traction considering the 0.65 level intersects with the 61.8% Fibonacci retracement of the downward journey from the August high to the October nadir—a commonly watched retracement level that often acts as a key battleground between bulls and bears.

Market Sentiment and External Factors

While technical levels provide a map for potential price movements, the Australian dollar's trajectory is also heavily influenced by external factors, such as commodity prices, global risk sentiment, China's economic outlook (as Australia's major trading partner), and international trade dynamics. Hence, while the AUDUSD's current path seems inclined downwards, a shift in these external variables could swiftly change the currency pair's course.

In Conclusion

The Australian dollar's response to the RBA's rate decision highlights the complexity of currency market reactions to central bank policies. Investors and traders must remain vigilant, not just to the central bank's current policy moves but also to its forward guidance—or lack thereof—as well as to a broader array of economic indicators and geopolitical events that can influence currency valuations.

The immediate future of the AUDUSD appears to hinge on its interaction with key technical levels. The 0.6390 support level is of particular interest, and its breach could signal a continuation of the downward trend with significant implications for traders and analysts alike.