Bitcoin has decreased over the past week by 0.9%, ending it at around $38,700. Yesterday, the decline continued, bringing the price to 38500. Ethereum lost 0.7% in 24 hours and added 1.5% in a week. Other leading altcoins from the top ten show mixed dynamics over 24 hours: from a decline of 3.8% (XRP) to a rise of 3.3% (Terra).

According to CoinMarketCap, the total capitalization of the crypto market decreased by 14% in 24 hours, to $1.72 trillion. The Bitcoin Dominance Index fell 0.1% to 42.4%.

The FxPro Analyst Team emphasized that the Cryptocurrency fear and greed index added 2 points in a day to 23 and remains in "extreme fear" condition.

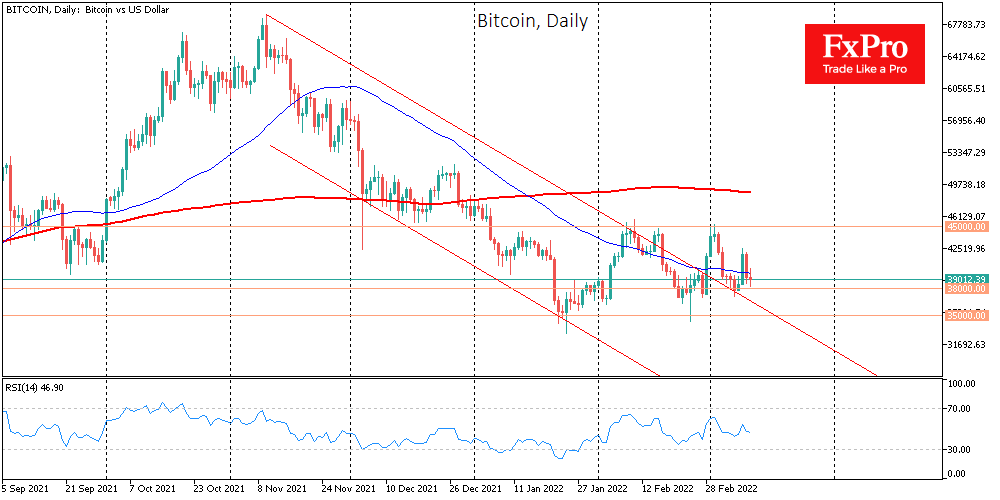

In the first half of the past week, the first cryptocurrency tried to strengthen, testing five-day highs near $42,600. Later, BTC lost all gains, again being thrown back to support near $38,000. Pressure on all risky assets continues to be exerted.

One of the Apple founders, Steve Wozniak, said that bitcoin would reach $100,000, which will be facilitated by the general interest in cryptocurrency. At the same time, he has a negative attitude towards altcoins and non-fungible tokens (NFTs).

The US Securities and Exchange Commission (SEC) has again rejected applications from the NYSE Arca and Cboe BZX Exchanges to create spot bitcoin ETFs due to non-compliance with US exchange law.

El Salvador has announced that it will postpone the issuance of bonds in bitcoins in connection with the events in Eastern Europe. The received funds were planned to be used for the construction of the "Bitcoin City".