Bitcoin was down 3% on Thursday, ended the day at $45.7K. On Friday morning, the pressure has continued, taking the price down 4.6% to $44.8K. BTC ended last month lower amid falling US stock indices. In total, BTC added 10% and demonstrated strength for the second month in a row.

Historically, April is considered to be one of the best months for the benchmark crypto: during the past 11 years, Bitcoin gained in April eight times and declined only three times respectively. If Bitcoin shows the same growth this time, it could end the month around $576K.

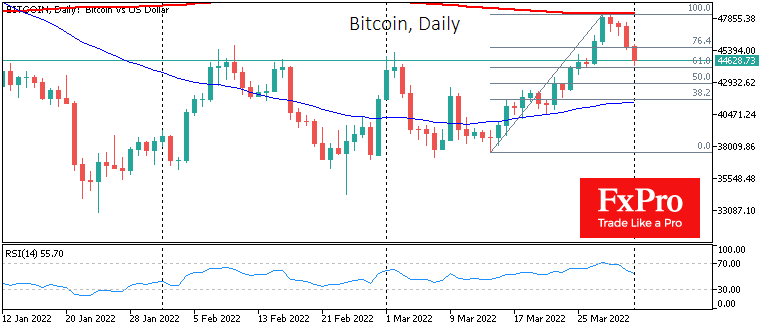

The FxPro Analyst Team emphasised that the local picture on the chart shows the advantage of bears, who managed to keep BTCUSD above the 200-day moving average. It will be possible to talk about the final breakdown of the growth momentum if BTCUSD finally falls below $44K.

It should be mentioned that April is also a strong month for stock markets. Puttiung all together, the new month begins with optimism and the mood to look for a moment to buy on a decline, especially given the dense influence of institutional sentiment on the dynamics of the first cryptocurrency.

Kiyosaki predicted the dollar collapse

According to CoinMarketCap, the total capitalization of the crypto market decreased by 4.5% to $2.05 trillion. The Bitcoin dominance index fell 0.1 points to 41.4%. The fear and greed indicator rolled back exactly to the middle of the scale and stopped at 50 points.

Ethereum lost 4% during last 24 hours. Other leading altcoins from the top ten sank from 4.4% (XRP) to 7% (Polkadot). The exception was Solana (+0.5%), which continued to grow as the OpenSea NFT platform had added support for tokens on the SOL blockchain.

Amongst the news, a legendary writer and investor Robert Kiyosaki warned of a "sky-high" US national debt and predicted collapse of the dollar. Keeping that in mind, he urged to invest in alternative assets: gold, Bitcoin, Ethereum, and Solana. It should be noted that Kiyosaki has repeatedly predicted the collapse of the dollar, but his predictions have not yet come true.