Bitcoin is down 3% over the past week, ending it at around $38.K. Ethereum lost 4.4%, while other leading altcoins in the top 10 fell from 4% (Binance Coin) to 14.7% (XRP). The total capitalisation of the crypto market, according to CoinGecko, fell 4.6% over the week to $1.75 trillion.

The Bitcoin Dominance Index rose by one percentage point to 42.2% over the same period due to weakness in altcoins. For the week, the cryptocurrency fear and greed index fell by 2 points to 22 ("extreme fear").

The index rose to 28 points on Monday and moved into "fear" status. Bitcoin has declined over the past four weeks amid weakening US stock indices. On Friday, Amazon and Google shares suffered their most significant falls since 2008, dragging down the tech-rich Nasdaq Index. It lost 12.7% in April, its most considerable dip since 2008.

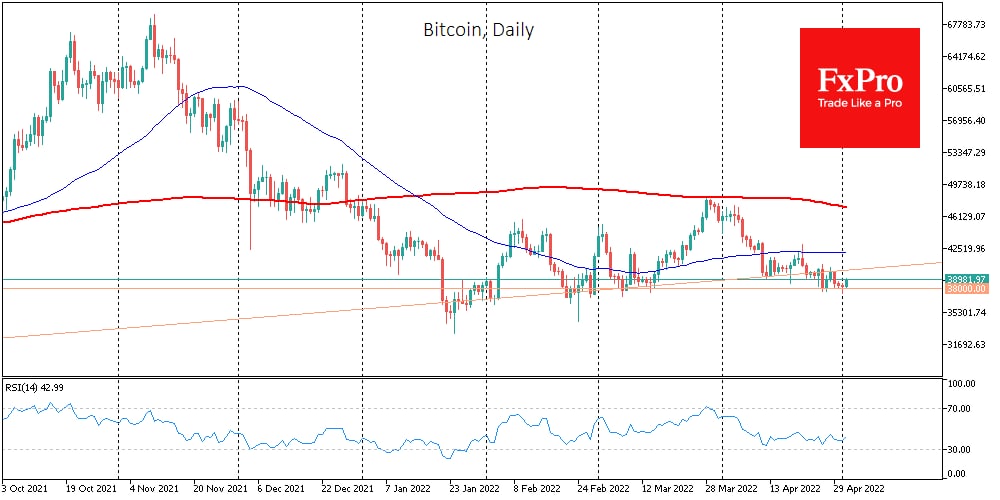

Bitcoin fell 16.2% over April, offsetting the previous two-month rise and falling short of seasonal trends. This is the worst performance in a given month of the year in trading history since 2011. In terms of seasonality, May is considered a relative success for BTC.

Over the past 11 years, bitcoin has ended the month up seven times and down four times. The average rise was 27%, and the average decline was 16%. Under these scenarios, the estimated average range for BTC at the end of May is between $32K and $48K.

A more local view of the dynamics of the first cryptocurrency indicates an ongoing struggle around the $38K mark. This struggle will decide which of the above levels the price will be closer to at the end of the month. The Swiss National Bank's (SNB) management believes it is inadvisable to invest in bitcoin and hold it as reserves for the regulator. The US Department of Labor has raised concerns about an initiative by US investment firm Fidelity to allow its customers to put a portion of retirement accounts in bitcoin.