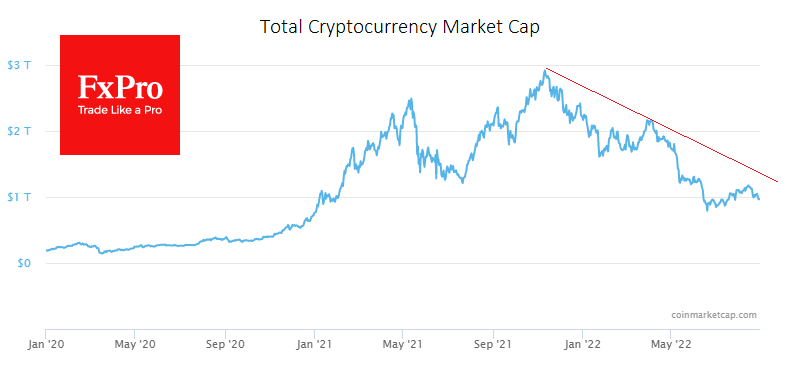

Bitcoin is down 7.3% over the past week, falling below $20,000 at the start of the day on Monday. Ethereum lost 9.2% to $1450, while top altcoins fell from 5% (Cardano) to 15.7% (Solana). Total crypto market capitalisation, according to CoinMarketCap, is down 6.6% for the week, to $952bn. The total capitalisation graph suggests that the bear market is not yet over. The Crypto market will finally confirm this hypothesis if the crypto market falls below the lows of June, meaning it is worth less than $800bn. Until then, we can only talk about the ongoing battle for a trillion.

The Cryptocurrency Fear and Greed Index was down to 24 points by Monday, down from 29 a week earlier. It is back in extreme fear territory.

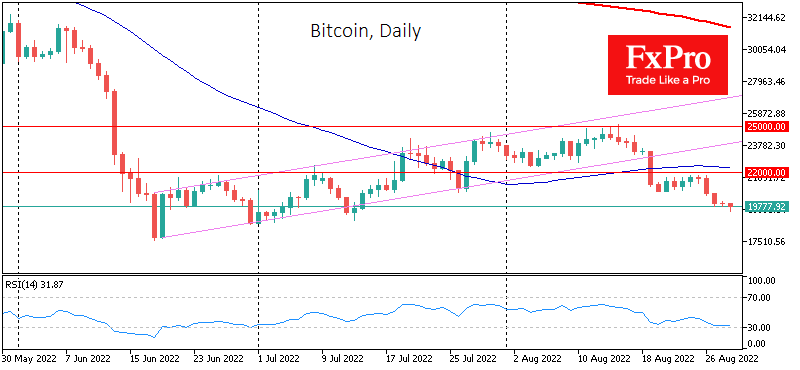

The end of last week asserted Bitcoin's leading role as a risk demand indicator when stock indices dropped sharply on Friday. It is worth noting that since the second half of August, Bitcoin has been "going down the ladder" roughly as it did in April and May, albeit in less broad steps.

News background

The Central Bank of India (RBI) has warned citizens against investing in digital assets, pointing to the risks of a crypto market crash that could leave private investors at risk of losing money. Authorities in India raided the offices of bitcoin exchange CoinSwitch, accused of violating currency regulations.

Another algorithmic stablecoin has lost its peg to the US dollar - it is Neutrino USD (USDN) on the Waves blockchain. The US Securities and Exchange Commission (SEC) has postponed its decision on VanEck's spot bitcoin ETF until October. The regulator was originally due to finalise its review on 27 August.

51% of bitcoin trading volume on centralised cryptocurrency exchanges is bogus and doesn't have economic sense, Forbes analysts have found after examining the trading activity of 157 crypto platforms. Contrary to rumours, Mt. Gox trustee Nobuyuki Kobayashi has not proceeded with the distribution of funds, one of the bankrupt crypto-exchanges creditors said. Some have cited potential payments to creditors as one of the reasons for BTC's recent decline.

Triple-A says the number of cryptocurrency users worldwide has reached 320 million, or 4.2% of the total population. The US remains the leader in cryptocurrency users, with 46 million (13.74%).