During the Asian trading session, the price of Bitcoin managed to hold above the $22000 level. During the Asian trading session, the price of Ethereum managed to maintain above the $1700 level and climbed to the $1760 level. The Labor Department said the CPI consumer price index rose 0.1% in August after remaining unchanged in July.

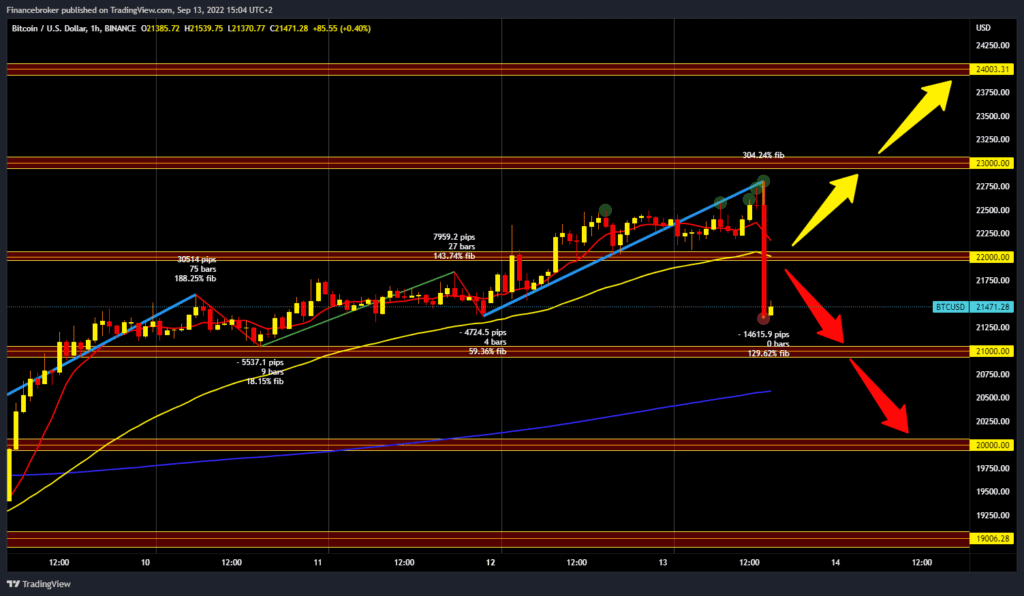

Bitcoin chart analysis

During the Asian trading session, the price of Bitcoin managed to hold above the $22000 level. Today’s maximum was at the $22800 level. The CPI report from the US market showed that inflation weakened, but not as much as expected. The dollar index gained strength because such data will only strengthen the FED’s decision to be decisive in its aggressive monetary policy. Following the release of the inflation data, Bitcoin fell to the $21250 level, losing more than 5.00% of its value. We are now looking at support at the $21000 level. And the bearish option, we need a break below the price and the continuation of this negative consolidation. In the zone around the $20,500 level, we have additional support in the MA200 moving average. Our potential lower target is the $20,000 level.

Ethereum chart analysis

During the Asian trading session, the price of Ethereum managed to maintain above the $1700 level and climbed to the $1760 level. After the US CPI report, the price of Ethereum lost 5.20% of its value and is now at the $1615 level. There is huge pressure on the price, and we could soon see a test of the $1600 level. If the pressure continues, a break below the price is evident. Potential lower targets are $1550 and $1500 levels. For a bullish option, we need a new positive consolidation. Then we must go back up to the $1700 level to try to hold up there. After that, we need a break above and a new bullish impulse to continue towards the $1800 resistance level.

Market Overview

The Labor Department said the CPI consumer price index rose 0.1% in August after remaining unchanged in July. The forecast was a drop in consumer prices by 0.1%. The report showed that core consumer prices, excluding food and energy, rose 0.6% in August after increasing 0.3% in July.