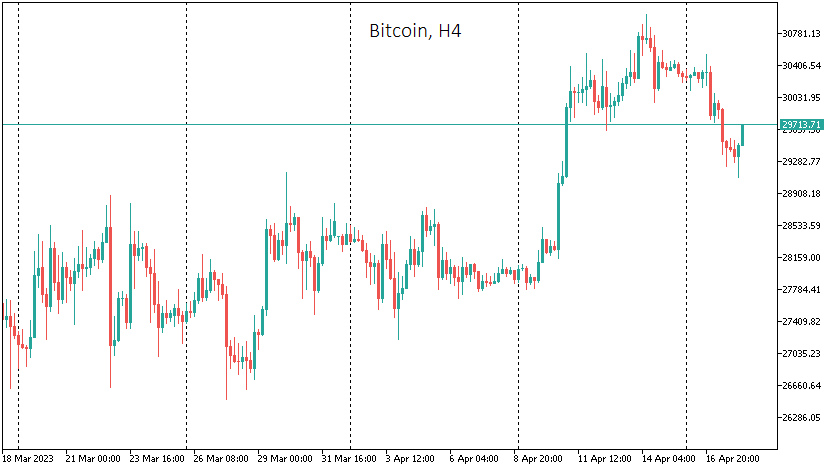

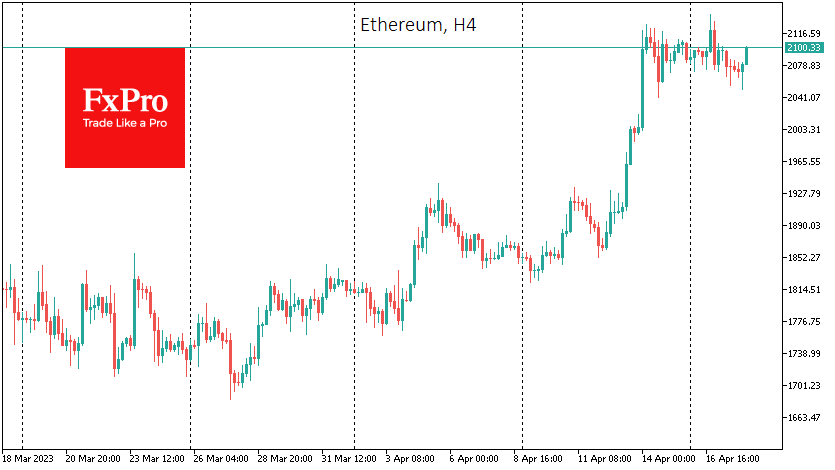

Bitcoin has been correcting its previous rally, falling back to $29K early Tuesday. From this level, it has been on a buying spree and has now risen to $29.6K and begun correcting lower, falling below the $30,000 level amid negative equity indices and a rising US dollar. Similarly, total crypto market capitalisation is now 0.8% lower than 24 hours ago but 1.2% higher than today’s low. Further positive momentum during the day cannot be ruled out. Still, doubts remain whether the market will consolidate above 30k for Bitcoin, $2100 for Ether, and $1.28 trillion capitalisations for the entire crypto.

According to CoinShares, investments in crypto funds doubled last week to $114 million, the fourth consecutive week of growth. Investments in Bitcoin rose by $104 million, while Ethereum saw just $0.3 million. Among altcoins, Solana saw the largest outflow ($2.1 million).

News background

Ark Investment’s Katie Wood said that Bitcoin and Ethereum became defensive assets on par with gold during the recent US banking crisis. She said this suggests a much greater acceptance of BTC and ETH and, therefore, a rosier outlook for them. Ethereum’s rise in recent days is a sign that altcoin season has arrived, said former BitMEX exchange CEO Arthur Hayes. Solana, Cardano and Dogecoin have also seen significant gains over the past week.

The Digital Currency Monetary Authority (DCMA) of the International Monetary Fund (IMF) announced the launch of the Unicoin Universal Currency Unit (UMU), which will be a legal tender for cross-border payments. According to the Wall Street Journal, the US Securities and Exchange Commission (SEC) has notified cryptocurrency exchange Bittrex of a possible forced termination for failing to register with the agency. The Kingdom of Bhutan has been diverting some of its reserves to buy cryptocurrency. Forbes writes that Bhutan’s sovereign wealth fund was a customer of the bankrupt BlockFi and Celsius. This is the first public investment in cryptocurrencies by such entities.