According to CoinMarketCap, the total capitalisation of the crypto market fell 7.6% over the week to $1.06 trillion, close to lows not seen since almost mid-March. Adding to the market's nervousness was a sharp sell-off in altcoins in light of the SEC's ongoing crusade against the crypto business. The biggest demand in such a market is for USDT, as issuer Tether decided to print an additional 1 billion stablecoins.

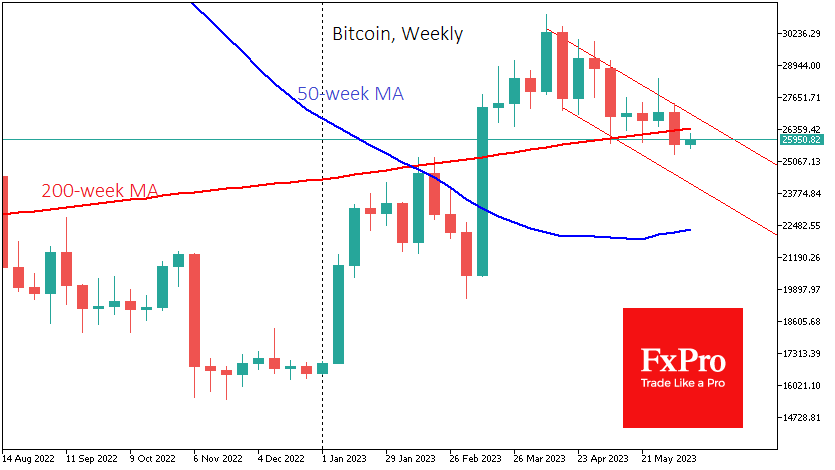

Bitcoin once again briefly acted as a safe haven, temporarily enjoying an influx of buyers as one of the most liquid assets in the sector. At the same time, the technical picture remains bearish.

Bitcoin closed the week below its 200-week moving average, which last time out resulted in a 20-week downtrend. On the daily timeframe, there is little to cheer about as the decline remains within the bearish corridor. However, the final victory of the bears can only be seen in the case of a fix below $25,000, from which BTCUSD bounced over the weekend. Ethereum lost 6.5% to $1750. Other leading altcoins from the top 10 changed from 3% (XRP) to -28% (Solana) and 22% (BNB).

News background

The US authority's crackdown on the Binance and Coinbase exchanges has hit the entire crypto industry. Altcoins, which the SEC classifies as securities, have been particularly hard hit. Former SEC official John Reed Stark believes that owners of cryptocurrency assets should abandon their investments because the storm in the US crypto industry has only just begun. Crypto exchanges have no reason to comply with laws and regulations prohibiting manipulation, insider trading and other fraudulent activities. According to a former SEC official, they operate without oversight and offer poor customer protection and risk identification.

Binance is prepared to spend $1 billion to fight the SEC, Bitboy Crypto's YouTube blogger reported, citing the company's lawyer. According to Bloomberg strategist Mike McGlone, the likelihood of a negative stock market recession in the US, as well as a gold hoarding trend coupled with Fed policy tightening, could harm crypto investor sentiment. As a result of the pressure, the riskiest assets could be pushed out of investment portfolios.

During a conference call, Ethereum developers approved details of a future update to the network, called Dencun (Cancun-Deneb), expected later this year. Ethereum co-founder Vitalik Buterin published a roadmap outlining key areas for the sustainable development of the world's second-largest cryptocurrency.