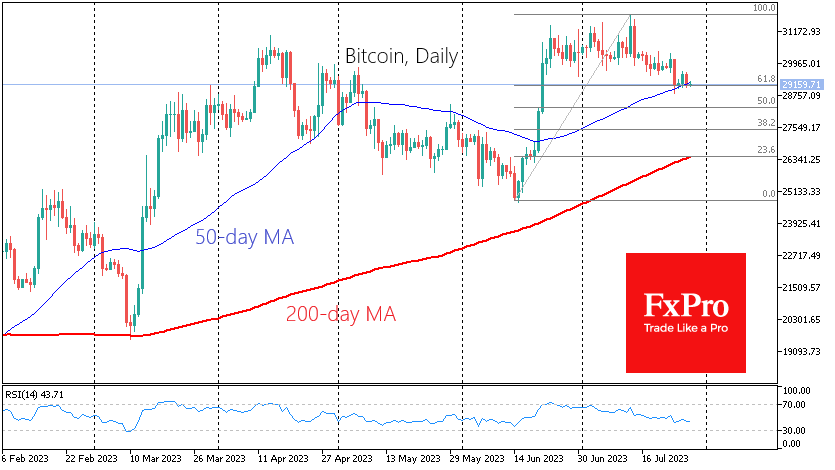

Crypto market capitalisation has fallen 0.9% to $1.176 trillion in the past 24 hours, staying away from the lows at the start of the week but sticking to the downtrend since mid-July. Bitcoin tried to gain height from its 50-day moving average on Wednesday, but pulled back to just above $29.1K on Thursday. That's where the 61.8% Fibonacci line from the momentum from the June lows is located.

A drop below current support opens a direct route to $27K to the 200-week moving average or even lower, $26.4K to the 200-day average.

News Background

The third quarter will be a disappointing one for bitcoin, according to an analyst at Fieru Trading. Historically, the cryptocurrency has experienced declines, sometimes exceeding 20%, during this period of time before halving. Fieru Trading does not rule out a decline in BTC to $25,000.

Tim Draper, a well-known venture capitalist, suggested that in the future bitcoin will become a strong competitor to traditional banking systems and government-controlled fiat currencies. He compared BTC to the emergence of the Internet, which is now used everywhere.

Spain has launched its first crypto fund. A&G, a Spanish banking organisation, has launched a hedge fund that will be available to professional investors. The Securitize platform has issued security tokens for shares in Spanish property fund Mancipi Partners on the Avalanche blockchain. This is Securitize's first issuance of instruments in Europe. It has previously worked with companies in the US and Japan.

Meta's meta-universe-focused division lost $3.7bn in the second quarter. Meta CEO Mark Zuckerberg said the company has no intention of abandoning the development of meta-universes, despite the losses and the public's focus shifting to artificial intelligence (AI).

South Korean authorities have introduced measures to combat crimes involving cryptocurrencies. Regulators will introduce monitoring of crypto exchanges and a joint initiative with the US against North Korean hackers.