The crypto market has been selling off since Tuesday morning, losing 1.7% to 1.17 trillion in 24h. Bitcoin is down 1.6%, Ethereum is down 1.75%, while the top altcoins are losing between 0.9% for BNB and 3.7% for Solana. The reason for the pressure is the collapse of Curve (CRV) amid a possible liquidation of the position of the company's founder, who pledged CRV to buy USDT. However, the story impacts the broader altcoin market and reduces confidence in the sector.

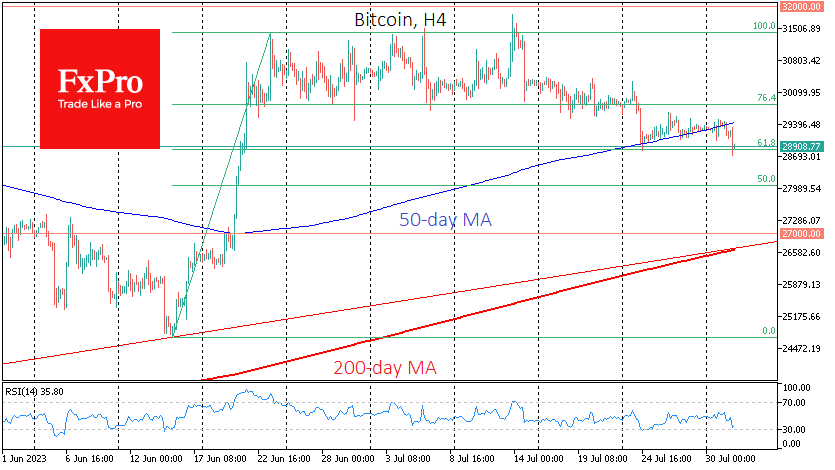

The risk-off pull mode has further clouded Bitcoin's technical picture. After bouncing back to $28.8K, BTCUSD took a step back from the 50-day moving average, which has been acting as support since last Monday. Without any sudden positive news, the main scenario is a decline to $28K (50% of June's upside amplitude). However, it is more likely that no significant demand will emerge at this level and that the price will retreat to $27,000, the lower boundary of the rising channel from November, where the 200-day average is passing.

In terms of seasonality, August is considered unfavourable for BTC. Over the past 11 years, bitcoin has only ended the month higher five times and lower seven times. The average gain was 26%, and the average loss was 16%.

News background

According to CoinShares, investments in crypto funds fell by $21 million last week, the second week of outflows after four weeks of active investment. Bitcoin investments decreased by $19 million, and Ethereum investments by $2 million. George Milling-Stanley, chief gold investment strategist at State Street Global Advisors, says Bitcoin cannot be called a substitute for gold because of the risk of significant losses.

The US Securities and Exchange Commission (SEC) has sued Richard Hart, founder of HEX, PulseChain and PulseX, for allegedly selling unregistered securities. According to the SEC, the businessman has raised over $1 billion through token sales of the three projects since 2019.

CoinGecko published a study showing the banking sector's growing interest in the crypto market. Over half of the top 50 banks already use exchanges to buy Bitcoin and other crypto assets. Bendigo Bank, one of Australia's largest banks, has banned its customers from transferring funds to crypto exchanges to protect them from the risks of fraud and scams.