The crypto market has added 1.4% in the past 24 hours to $1.18 trillion. The positive momentum can be tied to a new wave of concerns about banks following Moody's downgrade of ten mid-sized US banks and an unexpected Italian windfall tax. Investors are piling into the largest cryptocurrencies to preserve large amounts of capital to stay far from the banks, where deposit guarantees apply to not-so-large sums.

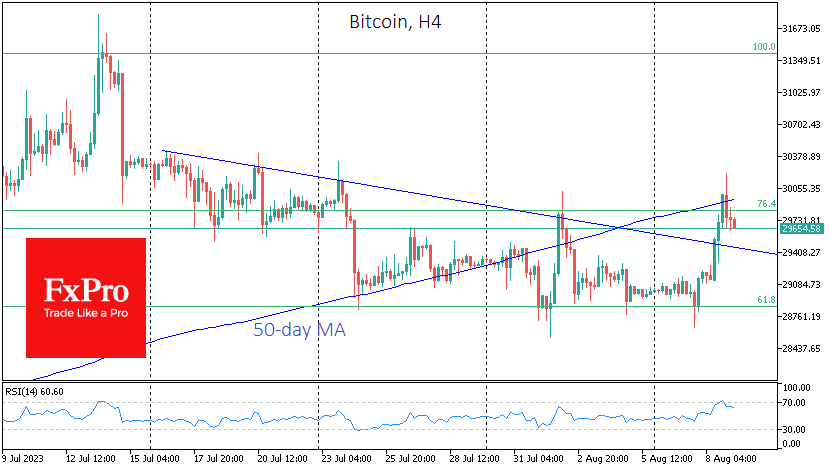

Bitcoin added over 3% throughout Tuesday with a mini short-squeeze in low-liquidity morning trading briefly taking the price above $30K before pulling back to $29.7K by the time of writing.

Bitcoin could maintain a negative correlation with bank stocks' performance, benefiting from their downturn. However, without actual industry bankruptcies, this is akin to a knee-jerk reflex with a short-lived impact. Technically, the market made its second failed attempt this month to get back above the 50-day average. The ability to consolidate above $30K will be a milestone, cementing the breaking of the downtrend of the last four weeks.

News Background

Kaiko is talking about the return of the "Stablecoin Wars" amid massive USDT selling. Consequently, the USDT exchange rate has fallen below its target peg to the dollar for the past few days. According to DEXTools, at least 66 fake PayPal USD (PYUSD) stablecoins have appeared online, launched on Monday by the payment system PayPal. Some crypto enthusiasts have taken a negative view of PayPal's initiative. Others are positive about the new coin's impact on the Ethereum blockchain in the context of its wider adoption.

So far this year, 97 out of 700 cryptocurrency funds have closed, according to a report by 21e6 Capital. In the first half of the year, the average return of such organisations was just 15.2%, while Bitcoin rose 83.3% over the same period.

According to CoinGecko, MetaMask was the most popular non-custodial wallet, with over 22.66 million installations in 2023. This is followed by Coinbase Wallet, Trust Wallet and Blockchain.com Wallet, with at least 10 million installations each.