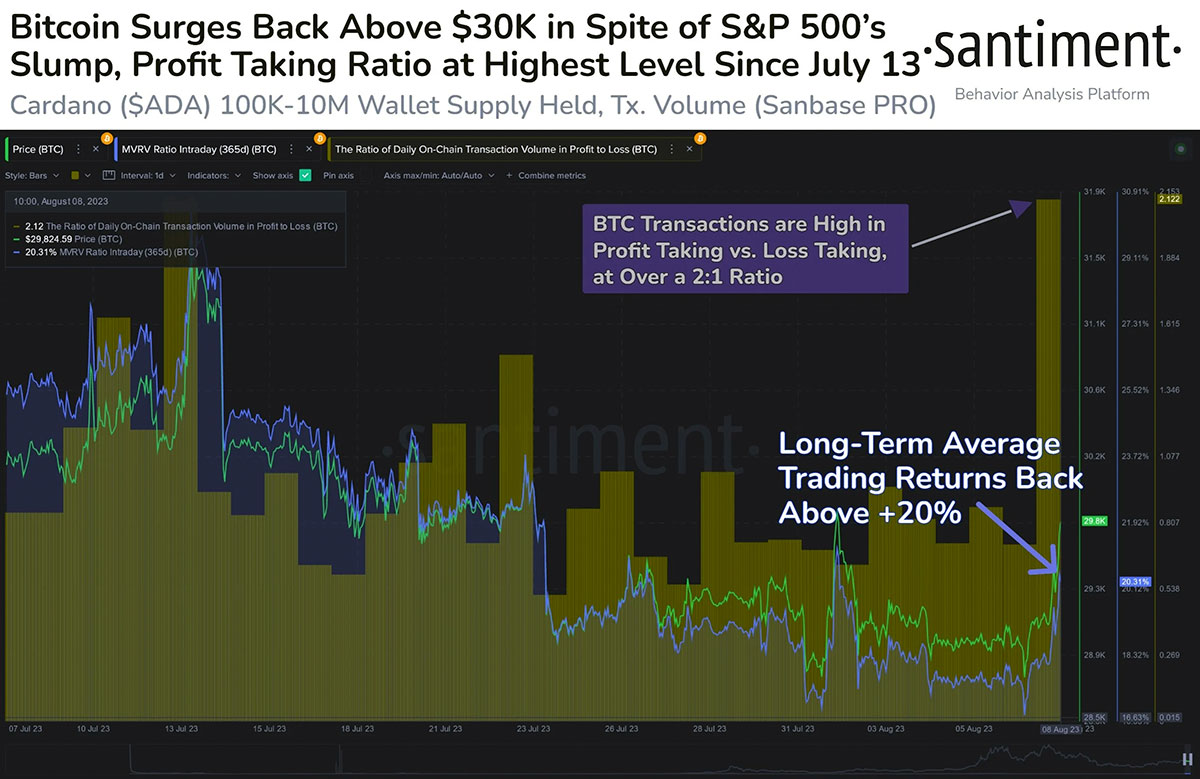

As anticipated, the crypto market saw a resurgence last week, fueled by a credit rating downgrade on US banks by Moody's. This boost led to BTC briefly surpassing the $30,000 mark on Tuesday, coinciding with a downturn in US stocks. However, the ascent was met with profit-taking, causing BTC to revisit the $30,000 level. An interesting trend emerged as more transactions were sold in profit than at a loss, indicating a cautious approach among BTC holders. This sensitivity to higher prices could cap short-term growth while also suggesting resilience against significant price drops due to limited selling at lower levels.

The corporate adoption of BTC as a reserve asset saw a modest uptick, exemplified by Hong Kong-listed company Boyaa Interactive's decision to allocate $5 million towards BTC and ETH purchases. This move reflects the trend that fueled the 2021 bull market—companies investing in crypto as a store of value. The Hong Kong market becomes particularly intriguing as the government recently legalized crypto investment for all investor classes starting from June 2023. While this is a single instance, it indicates a positive direction just two months after Hong Kong officially embraced crypto investment.

BTC's persistent stagnation around the $29,000 level has highlighted the prominence of altcoins, notably meme coins. SHIB, in particular, has provided substantial trading opportunities, experiencing a 20% increase after a brief consolidation phase, reaching a new local high. The SHIB community's speculation about the upcoming launch of Shibarium on August 16th has propelled this surge. Other meme coins like DOGE and APE have also registered commendable gains compared to BTC.

Nonetheless, SHIB traders should exercise caution, as Voyager Digital, a distressed crypto firm, transferred a significant quantity of SHIB tokens to Coinbase. Although Voyager's actions could have an impact, it is unlikely to exert substantial influence given the rising interest in various altcoins. For instance, RUNE witnessed over 50% growth as its team introduced a new burn feature to make its supply deflationary.

As altcoins decouple from BTC due to unique growth narratives, several interesting developments are worth noting:

- LINK and ADA Whales: LINK's recent token movements sparked interest as it reached $8. Despite a subsequent price decline, new buyers absorbed these tokens, indicating a shift from old to new holders. ADA has also gained attention with a surge in the accumulation of whales and sharks holding 100,000 to 10 million ADA. Additionally, ADA's onchain transaction volume has consistently risen, historically foreshadowing price increases.

- DeFi Platforms Gaining Momentum: Total Value Locked (TVL) in major chains is on an upward trajectory. After a period of decline, TVL on ETH-based protocols saw a 3.8% increase, suggesting demand for ETH might rise. SOL also experienced a 15% TVL surge over two weeks, surpassing ETH's growth rate.

Amidst these developments, precious metals faced a challenge due to the strengthening dollar. The credit rating downgrade of US banks and China's economic concerns led to a stock market retreat. However, the dollar continued to gain, impacting precious metals—Gold declined by 1.6%, and Silver lost nearly 4%. In contrast, Oil remained resilient, recording a seventh consecutive week of gains. Cryptocurrencies, while not strongly correlated to the dollar, managed to hold steady despite the dollar's rise.

The new week commenced with China's property sector woes affecting overall sentiment, impacting both equity and crypto markets. As attention shifts to the US, the release of FED meeting minutes and retail sales data will likely influence stocks and the dollar. The evolving situation highlights the crypto sector's potential to attract capital flows as traditional assets face uncertainty. Amidst this, the crypto market remains in flux, ready to respond to global developments and shifts in investor sentiment.