Thursday's sell-off in the US stock market forced cryptocurrencies to bounce back from the previous day. As a result, the crypto market capitalisation is back at $1.05 trillion (-1.8% in 24 hours). Solana (-5.2%) and XRP (-3.3%) led the decline among the top altcoins, while Ethereum held up relatively well, losing 1.3%. The Cryptocurrency Fear and Greed Index is in "Fear" territory for the latest week, with a current reading of 39. By this measure, the market is far from oversold and not yet attractive to bargain hunters.

Alex Kuptsikevich, the FxPro analyst, said Bitcoin has entered another long horizontal consolidation and is going down another ladder. The previous two ladders were from late June to mid-July (around $30.5K) and from late July to mid-August (around $29.3K).

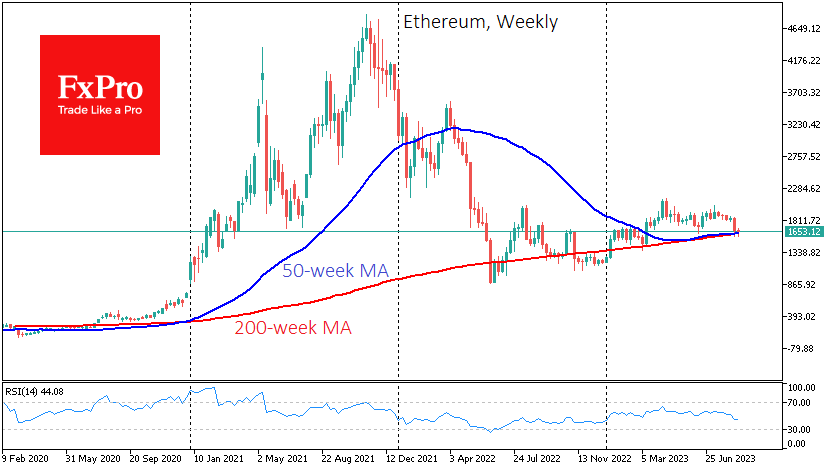

Ethereum is consolidating around $1650, a significant pivot level of the last 12 months. A failure below this level could start a capitulation that could take the price to $1200 within a week or two. The ability to hold here would indicate buyer support, potentially kick-starting a rally. However, we still see a higher probability of a continued downturn in the crypto market in the coming months.

News background

Social media-famous crypto analyst Justin Bennett warned that Bitcoin could fall as low as $14K. According to him, BTC has fallen out of the bullish channel it has been in for about a decade. A likely global economic recession and falling stock markets compound the risks. Bitcoin will halve to $35K by April next year and rise to a new record high of $148K by July 2025, Pantera Capital predicts, based on historical data from past growth cycles.

Donald Trump's NFTs surged in value following his interview with US TV host Tucker Carlson. The trading volume of the politician's NFT collection increased by nearly 1,000% overnight. Binance stopped supporting cryptocurrency cards in Latin America and the Middle East. Binance launched the first bank cards with cryptocurrency support in 2020. The decentralised payment protocol Solana Pay has integrated its plugin with the e-commerce platform Shopify. In the first phase, only USDC stablecoin is available for payment.