The crypto market cap rose 1.5% over the last 24 hours to $1.091 trillion. Yesterday, the market surged briefly on the false news of Bitcoin spot ETF approval. But interestingly, the ensuing market tide did not derail the short-term upward trend. That said, we continue to see continued elevated trading volumes. We view this as good news, given that the price is not high by historical standards. It is an influx of fresh buyers rather than an active exit from the market.

That said, buyer interest is concentrated around Bitcoin, whose share of total capitalisation is adding in territory above 50%. These are highs since April 2021. This is probably due to the special status of the first cryptocurrency that the SEC is willing to recognise as a commodity while not recognising the rest of the crypto as commodities. But it's also possible that the remaining coins are under pressure due to reduced developer activity as funding has become more complex.

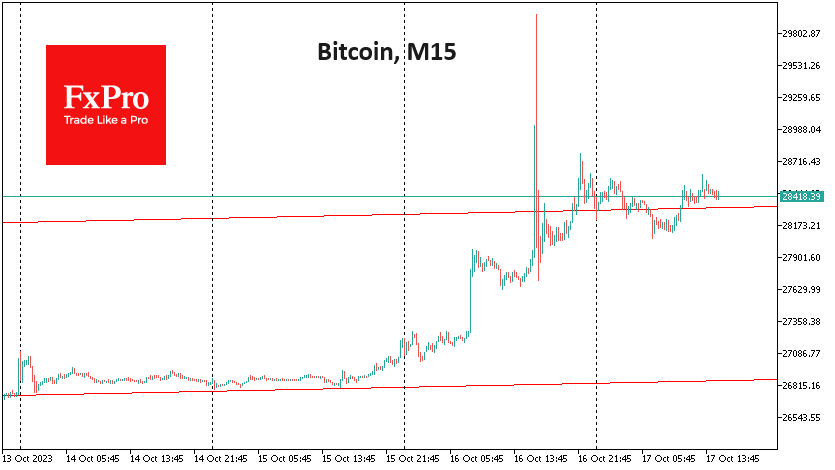

Bitcoin was bouncing towards $30K on Monday, starting at $27.2K. Although we did see a significant pullback, the Bears got busted. BTCUSD closed Monday's trading above the 200-day average, with the intraday trend gaining momentum. Current positions near $28.5K indicate bullish dominance and confirm the existence of an upward channel since early September with a sequence of more than three higher highs and lows. The market could quickly move to the $29.4K level, recovering from the mid-August sell-off.

News background

According to CoinShares, investments in crypto funds increased by $15 million last week; the inflow of funds continues for the third week. Bitcoin investments were up $16 million, while Ethereum investments were down $7 million. Investments in funds allowing bitcoin shorts were up $1.7 million. Investments in Solana were up $3.7 million, again significantly outperforming all altcoins. Grayscale Investments (GBTC) bitcoin trust's discount to net asset value (NAV) narrowed to its lowest since December 2021 at 15.9%. The SEC will not appeal Grayscale's lawsuit, potentially paving the way for spot ETFs to be approved in the country, CoinShares noted.

Ethereum miners (over 1,000 ETH) have reduced positions by 12 million ETH since the beginning of the year, while bitcoin miners (over 1,000 BTC) have accumulated coins, Cryptoslate noted. Since 2020, large investors have emptied their wallets by 20 million ETH. Swan has encountered many customers who want to exchange Ethereum for Bitcoin. U.S. authorities have joined the ranks of the largest holders of Bitcoin. Thanks to several significant asset seizures related to the Bitfinex hack and the Silk Road platform, about 200k BTC has been deposited into US federal accounts.