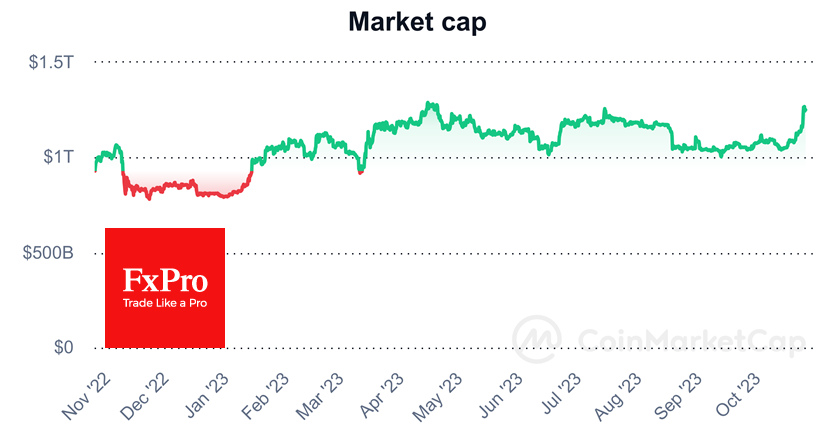

The crypto market is attempting to settle at the previous day's highs. The $1.26tn capitalisation is close to this year's peak, briefly touched in April. Bitcoin is up just under 1% in 24 hours and over 19% in the last seven days, consolidating near $34K after a higher surge. The consolidation forms a triangle with exits often to the upside. However, the RSI on the daily timeframe is highly overbought, suggesting that short-term speculators should be looking for a corrective pullback. Looking at the longer term, the current setup for Bitcoin seems very promising for the bulls.

Bitcoin has rallied on the back of institutional investors' hopes that the SEC will soon decide to approve spot ETFs on BTC.

News Background

BlackRock's proposed spot bitcoin ETF, the iShares Bitcoin Trust, appeared for a while on the asset list of The Depository Trust and Clearing Corporation (DTCC), a Nasdaq clearing house. The instrument was listed under the ticker IBTC, then disappeared, and reportingly reappeared on Wednesday. The US Court of Appeals for the DC Circuit formally approved a ruling that the SEC must review Grayscale Investments' application to convert GBTC into a spot ETF based on the former cryptocurrency.

Another possible reason for BTC's rise is the ongoing tension in the Middle East, causing investors to diversify risk through the first cryptocurrency. Matrixport believes that BTC will reach $45K this year. This is particularly indicated by the 'bullish' figure of the 'ascending triangle' from Chainalysis. Chainalysis argues that the US authorities are losing influence over the stablecoin market as more transactions are conducted through overseas crypto companies.