Crypto market investors rush to lock in profits from the recent growth, selling off coins. Capitalisation has rolled back to 1.27 trillion (-2.8% in 24 hours). Such dynamics fit pretty well into the definition of Bitcoin as a safe asset. The demand impulse for shares, in this case, plays against the largest crypto. But we advise not to rely too much on the crypto's defensive nature. On the contrary, we see Bitcoin as the most sensitive to changes in risk demand and often leads to these changes. And its latest turnaround could foreshadow an intensifying sell-off in equities.

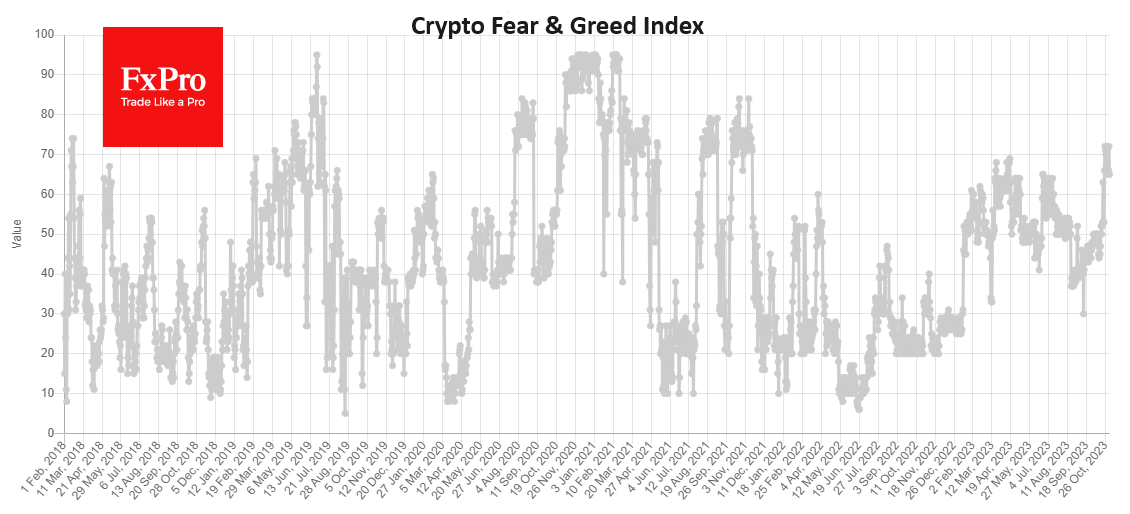

The Crypto Fear and Greed Index posted tops at 72 (Greed zone) several times since late October, a two-year high. The last time we saw such highs in the Index was in November 2021, when Bitcoin hit an all-time high near $69K. Nowadays, Bitcoin has likely entered a correction phase from the upward momentum since mid-October. This scenario remains workable with a price above $32300. A failure below would make the latest rise be considered false.

Ethereum fell back and struggled for support at its 200-day moving average just above $1770. Bulls have room for a decline down to $1740, while a move below would go beyond the regular correction.

News Background

Michael van de Poppe expressed confidence that the US Federal Reserve has completed its policy tightening cycle, which could have a positive impact on risk assets, including the first cryptocurrency. Fidelity Investments called bitcoin "exponential gold" and a "commodity currency" seeking to become a savings vehicle and a defence against the depreciation of money.

MicroStrategy last month increased its bitcoin reserves by 155 BTC to 158,400. Third-quarter purchases totalled 6,067 BTC at an average price of $27,531. CoinShares noted digital asset managers' interest in Ethereum. The second most capitalised cryptocurrency was mentioned in the survey by 44% of respondents. In comparison, 39% of respondents voted for Bitcoin and 7% for Solana. The US SEC has started investigating PayPal’s PYUSD stablecoin, which launched in August. The launch of PYUSD raised concerns in the US Congress due to the lack of a regulatory framework for such assets.