Bitcoin has slowed to a crawl, adding just over 1% for the week. Meanwhile, Altcoin season has started in the market. Leading altcoins from the top ten are growing at 5-15% per week, with Solana (+26%) showing record growth in the top 30, climbing to seventh place in the capitalisation ranking. Bitcoin has formed a short-term range with a slight upward bias and trades increasingly confident above $35K. The shift in attention to altcoins is not bearish news for the first cryptocurrency. Thawing investor sentiment towards cryptocurrencies brings capital back into the industry after a long "winter". However, high interest rates are unlikely to allow cryptocurrencies to easily repeat the momentum of 2020-2021.

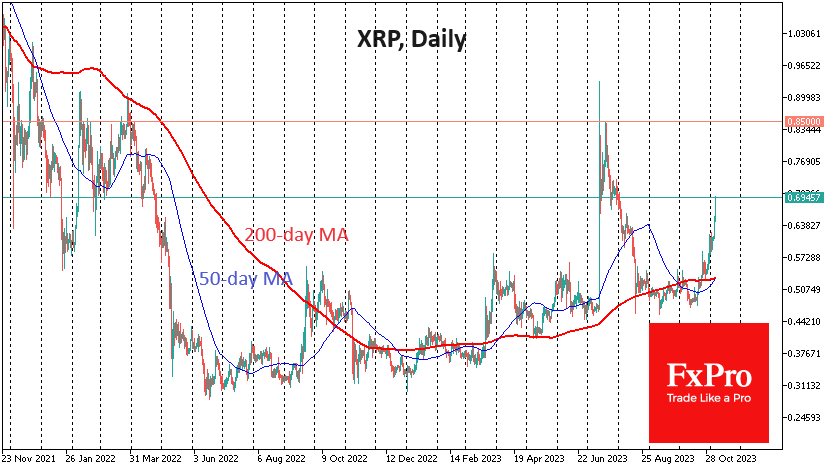

XRP's growth is gaining momentum. Over the past three weeks, the price has risen by a cumulative 30%, but since the beginning of this week, it has increased by over 13%, reaching $0.6340 at the time of writing, back to early August levels. On the daily timeframe, the "golden cross" - a bullish pattern whose appearance often attracts additional buying - has almost formed. The picture remains bullish on the weekly chart, suggesting an essential resistance test at $0.85 at the earliest.

News background

The Central Bank of Georgia has selected Ripple as its partner to develop and launch the country's digital currency. MicroStrategy founder Michael Saylor said that major commercial banks will soon begin acquiring bitcoins and offering customers services to store and exchange such assets. US mining company Marathon Digital announced the launch of a pilot project to mine BTC from landfill sites - using methane from the waste to generate electricity.

Deutsche Bank-owned asset management company DWS will launch cryptocurrency-based ETFs in the coming months. The former CEO of crypto exchange BitMEX, Arthur Hayes, said that although he didn't like Solana, he had bought the coins, which have recently soared in value. The Meme token MEME rose 2100% in 24 hours after being flooded by leading cryptocurrency exchanges Binance, Bybit, OKX and HTX. The project is similar to the popular Meme tokens PEPE or DOGE.