The burst of optimism in traditional markets bypassed cryptocurrencies on Tuesday. It seems that some investors shifted some of their assets from coins to shares, reducing the total capitalisation of cryptocurrencies by 1.7% over the last 24 hours. Bitcoin continued its correction on Tuesday, which at one point seemed to get out of control as the price fell below $34.5K due to stop orders triggered. However, prices quickly moved away from the local extreme lows, and by Wednesday morning, there was moderate buying that took BTC back up to $35.6K.

Perhaps the most acute question is whether the cryptocurrency market's counter-trend dynamic indicates risk demand exhaustion or an attempt at a quick correction to continue following equities. We are leaning towards the latter and expect a fresh test of last week's highs soon.

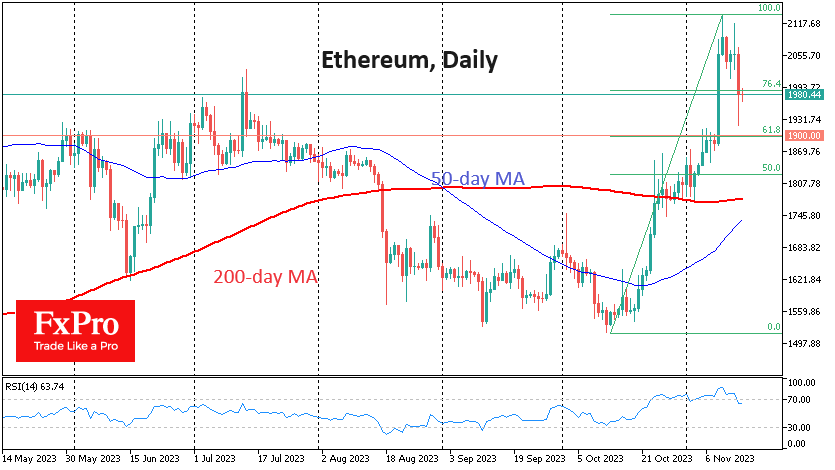

Ethereum pulled back below $2000 on Tuesday but is attempting to move higher again early Wednesday. In addition, there will be two "golden crosses" on the charts in the coming weeks - on the daily and weekly timeframes. The formation of this pattern usually attracts further buying demand.

News background

According to CCData, the Solana token (SOL) has seen the strongest growth among the major cryptocurrencies in recent weeks, and the coin's share of total trading volume in the digital asset market has reached an all-time high (8.85%). The leading meme coin of the Solana ecosystem, the Bonk token (BONK), has also seen rapid growth. In the last 30 days, it has grown by 850%, significantly outperforming popular and larger capitalisation meme coins such as DogeCoin, Pepe and Shiba.

Coinciding with the name of Elon Musk's chatbot, the Grok token rose 13,000% in just one week after its launch, with a market capitalisation of $160 million. The CBOE will launch leveraged futures trading on Bitcoin and Ethereum on 11 January 2024. Morgan Creek founder Anthony Pompliano believes that all applications to launch spot bitcoin ETFs should be approved by the SEC simultaneously to avoid favouritism. He believes this will increase capital inflows into the cryptocurrency market and create a bullish trend.