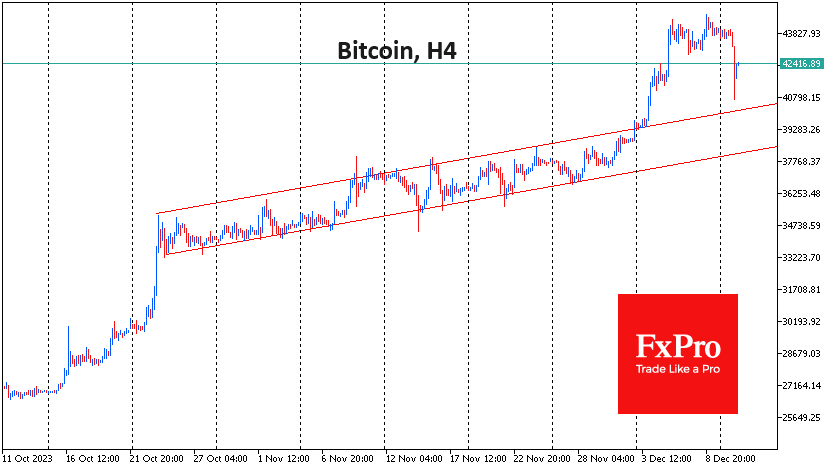

A wave of profit-taking hit the cryptocurrency market on Monday morning. It seems that the failure of cryptocurrencies to rise over the weekend caused players to pull stop orders very close to market prices, and we saw a massive exit from long positions in low liquidity before the regular session in Asia. Strong demand for risk assets in traditional markets suggests that the market will try to get back on its previous growth track.

Bitcoin started the day at $43.8K, soon fell to $40.7K, and then stabilised at $42.1K, losing 4% since the start of the day. This quick reload did not break the bullish trend. In our view, it will remain in force if Bitcoin manages to hold above $40K.

The sudden sell-off proved even harder for altcoins. At one point, Ethereum was losing over 9%, XRP was losing over 10%, Solana collapsed by 13%, and Cardano lost 14%. The largest altcoins have already recovered about half of those losses. The sell-off attracted buyers who were waiting for lower prices to enter the market, and the market gave them that chance.

News Background

Spot bitcoin ETFs could raise more than $2.4bn as early as the first quarter of 2024, according to asset management firm VanEck. Bitcoin is expected to take away a significant market share from gold. The inflow of funds may reach $40.4bn in two years. Bitcoin will hit a new all-time high in the fourth quarter of 2024, potentially driven by ‘political events and regulatory changes following the U.S. presidential election’, VanEck predicts.

A new Glassnode report notes significant fund flows on cryptocurrency exchanges, which could suggest institutional investors are preparing for spot ETFs.

Société Générale, one of France’s largest banks, plans to become the first traditional financial institution to list its stablecoin on a cryptocurrency exchange. CoinGecko estimates that more than half of the world’s countries have already legalised cryptocurrencies in some form. The best example is Europe, where 39 out of 41 countries have already legalised cryptocurrencies.

Authorities in El Salvador announced the launch of an emigration programme that will offer residency permits and a chance to obtain citizenship for crypto investments of $1m in Bitcoin or USDT.