The US dollar continued its upward trajectory last week, with the minutes from the Federal Open Market Committee (FOMC)'s July meeting shedding light on further monetary policy adjustments. The discussions around the central interest rate being pegged at 5.5% quickly evolved into how much it might increase after the minutes' publication. Given the prevalent concerns about potential inflation not decreasing as significantly as hoped, it seems the Fed may be gearing up for another rate increase. Consequently, predictions about a surge to 5.75% or even more in 2023 went up significantly. Adding to the US dollar's strength is the positive landscape of the securities market and a resilient US economy. Encouraging retail sales numbers, promising real estate market metrics, and an overall upbeat economic environment reduce the fear of a recession and bolster the dollar's stance. Furthermore, rising oil prices could be a harbinger for another inflationary wave.

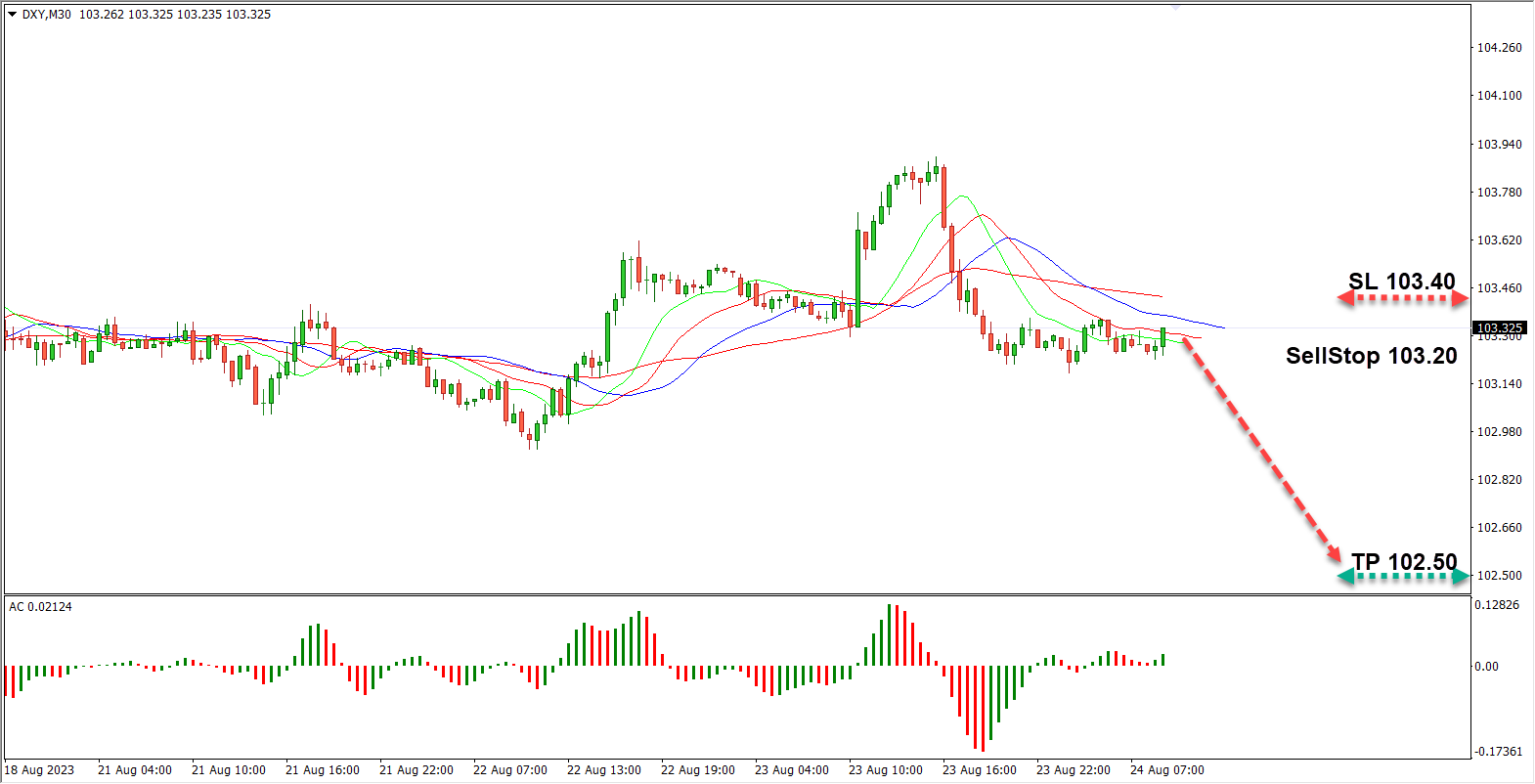

The US dollar index currently stands at 103.30, showing signs of vulnerability amidst a fluctuating economic backdrop

Recent data on business activity, encompassing both the manufacturing and services sectors, left market participants disillusioned. These unfavorable findings have stoked fears that the US economy may be on a trajectory towards a recession by year-end. Such apprehensions are especially potent in the trading community, given that they can recalibrate market strategies and future investment plans. A notable consequence of the disappointing stats was its immediate impact on interest rate hike probabilities. Prior to the data's release, market analysts had gauged a 42% likelihood of a rate augmentation by the year's close. However, this figure saw a post-release dip, settling at 34%. Such shifts underscore the sensitivity of rate hike expectations to incoming data, and the potential policy adjustments that might arise from them.

As the trading day progresses, the focus will shift to two key datasets: durable goods orders and initial jobless claims. These statistics provide a crucial insight into the economy's health. Durable goods orders can indicate business investment trends, while initial jobless claims offer a near real-time glimpse into labor market dynamics.

Given the prevailing air of uncertainty, dollar proponents might brace for another challenging day. Any further reports hinting at economic fragility, especially on the eve of Powell's anticipated address, could exert downward pressure on the dollar, possibly deepening its current plight. For those tactically positioned in the market, a potential strategy might involve a SELL STOP at 103.20, targeting a take-profit (TP) at 102.50, and setting a stop-loss (SL) at 103.40. As always, traders should exercise caution and conduct their own analysis before acting on market signals.

However, the banking sector might present a thorn in the dollar's side. Concerns surrounding the health and operations of several major banks, especially in the wake of potential interest rate hikes, raise alarms. Rating agencies even contemplate downgrading some major bank ratings, including industry heavyweights.

Analysts and strategists are somewhat split on the future rate trajectory. Goldman Sachs strategists believe that any potential rate decrease might only come into play in Q2 2024, given certain conditions. As for the Eurozone, its economy seems to be performing modestly, and the euro faces its challenges.

For the EUR/USD trading pair, the next week promises to be crucial. Any indications from Federal Reserve Chairman, Jerome Powell, regarding rate-hike decisions could significantly affect the Dollar Index (DXY). Additionally, major economic data releases and central bank symposiums will undoubtedly play a role in currency pair dynamics.