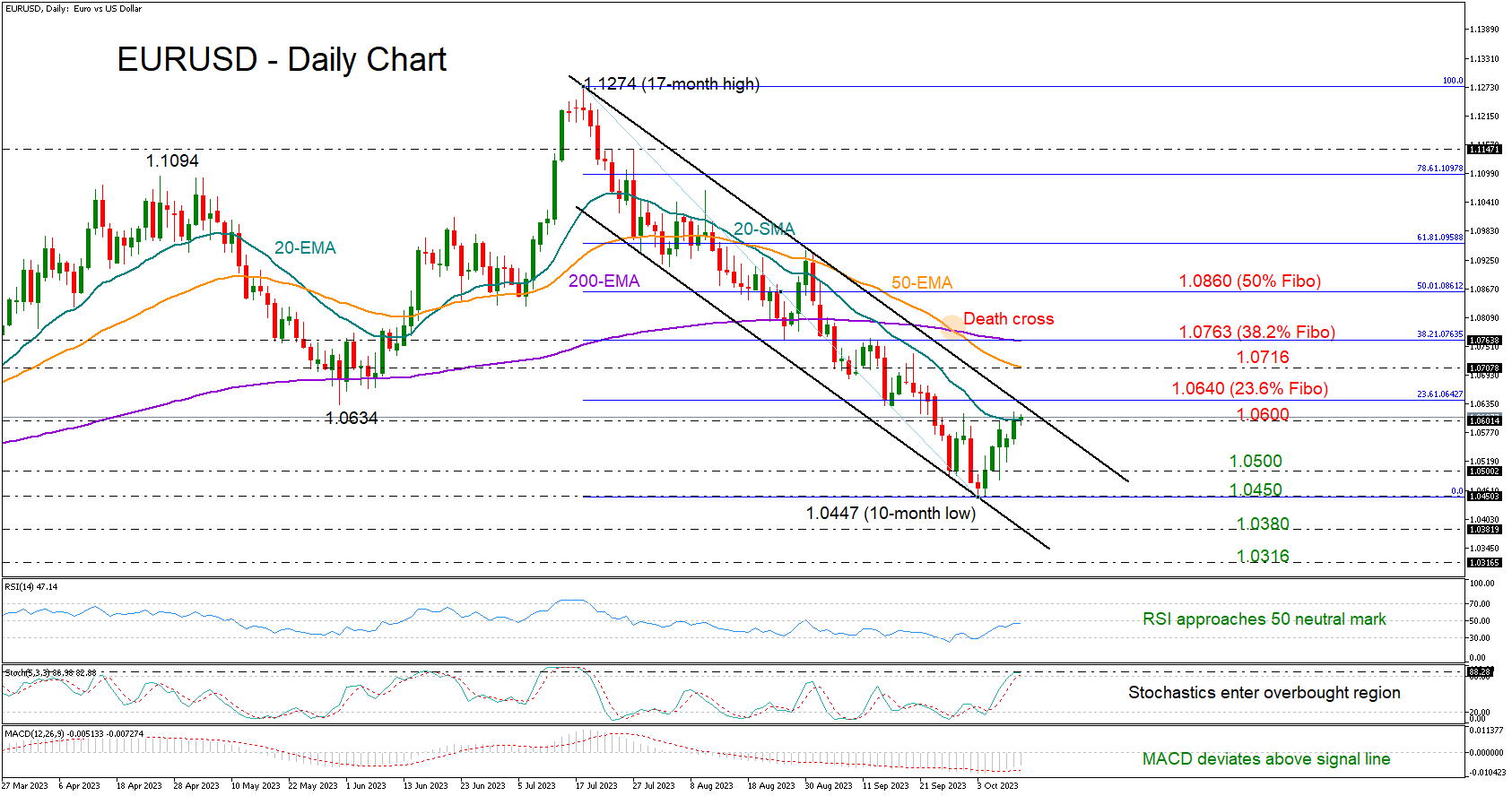

Amid the bustling European trading scene, the EURUSD finds itself hovering tentatively around the 1.0600 mark, after demonstrating bullish tendencies for five successive days. This presents an intriguing situation, where despite the ongoing upward trend, significant technical barriers loom, potentially inhibiting its further advance. The 20-day Simple Moving Average (SMA) has historically been a challenging frontier for the currency pair, and its current trajectory suggests the same. However, looming larger is the upper boundary of the established bearish channel pegged at 1.0640. This level is precariously close to the 23.6% Fibonacci retracement of the significant movement spanning 1.1274 to 1.0447.

Despite the headwinds, the technical indicators emit an aura of mild optimism. The Relative Strength Index (RSI) portrays a gentle upward tilt, a positive sign for potential buyers. Yet, its value remains south of the crucial 50-mark, suggesting potential uncertainty. Concurrently, the stochastic oscillator signals a possible overextension, having already ventured into the overbought territory. Adding complexity to the mix, the recent intersection of the 50-day and 200-day Exponential Moving Averages (EMAs) - often referred to as the 'death cross' - underscores the negative trend the market has been subjected to since mid-July.

For traders bullish on the EURUSD, breaching the bearish channel to the upside could lead to significant landmarks coming into focus. The duo of 50-day and 200-day EMAs, stationed at 1.0700 and 1.0763 respectively, are pivotal. Notably, the latter converges with the 38.2% Fibonacci level. A robust surge past this level could potentially set the stage for a further rally, targeting the 50% Fibonacci retracement at 1.0860.

However, should the EURUSD falter and maintain its alignment within the descending channel, particularly sealing a position below the 20-day EMA, the immediate support might crystallize around 1.0500. This could act as a launchpad for bears to revisit the lows experienced in October at 1.0447, and potentially extend the decline towards the lower boundary of the channel at 1.0380. A breach of this level could further sour market sentiment, pushing the pair towards the 1.0316 region, derived from the data on November 30, 2022.

In conclusion, while the EURUSD has hinted at a positive shift recently, substantial hurdles remain. For the upward momentum to gain genuine traction and appeal to buyers, it is imperative for the currency pair to shatter the 1.0640 resistance, and subsequently establish itself convincingly above its long-term EMAs. Traders should approach the scenario with a blend of caution and acumen, keeping a vigilant eye on the evolving technical landscape.